Here's How Much Taxes Will You Pay Under President "..."

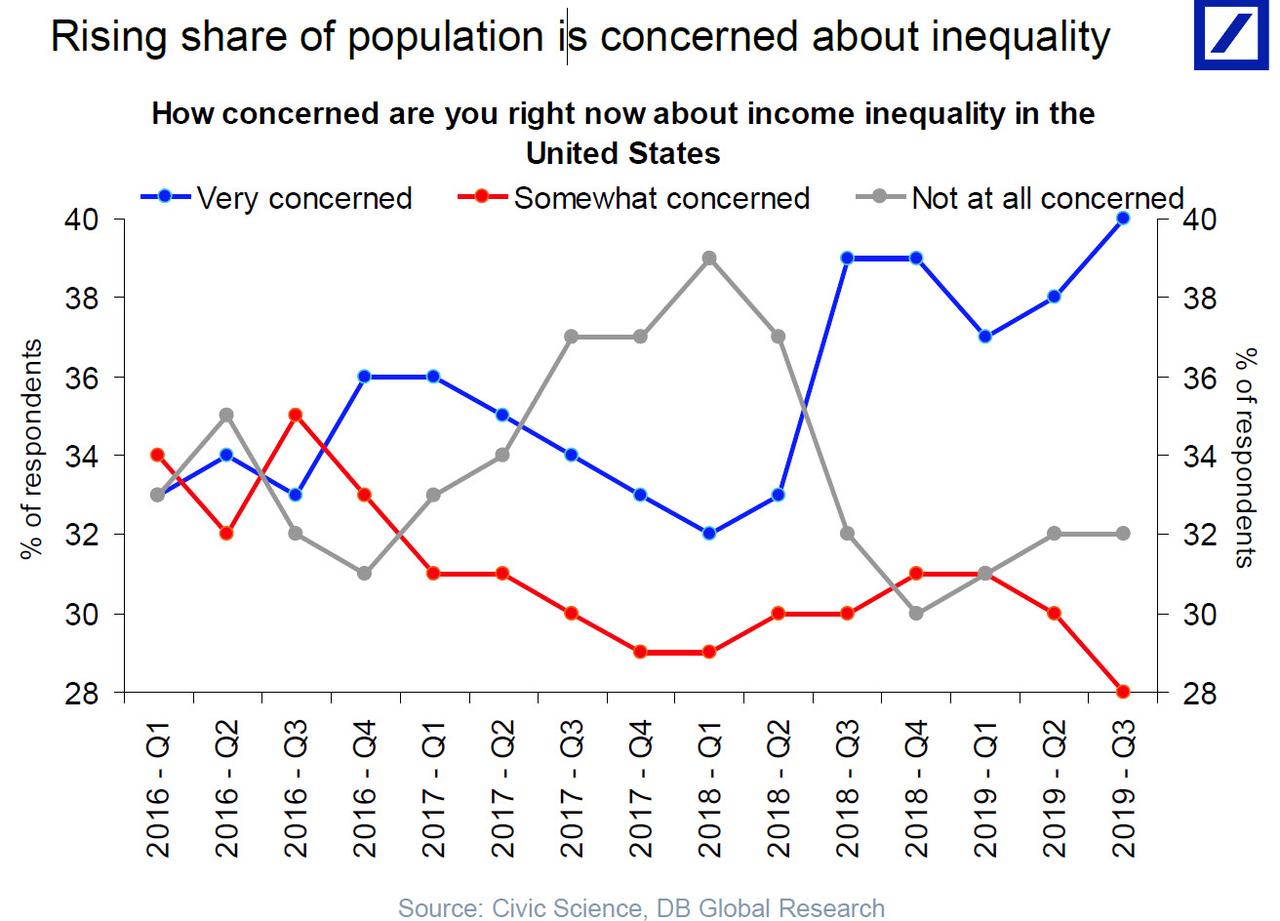

With the chasm between the world's rich and poor wider than ever before, the topic of wealth redistribution and income inequality...

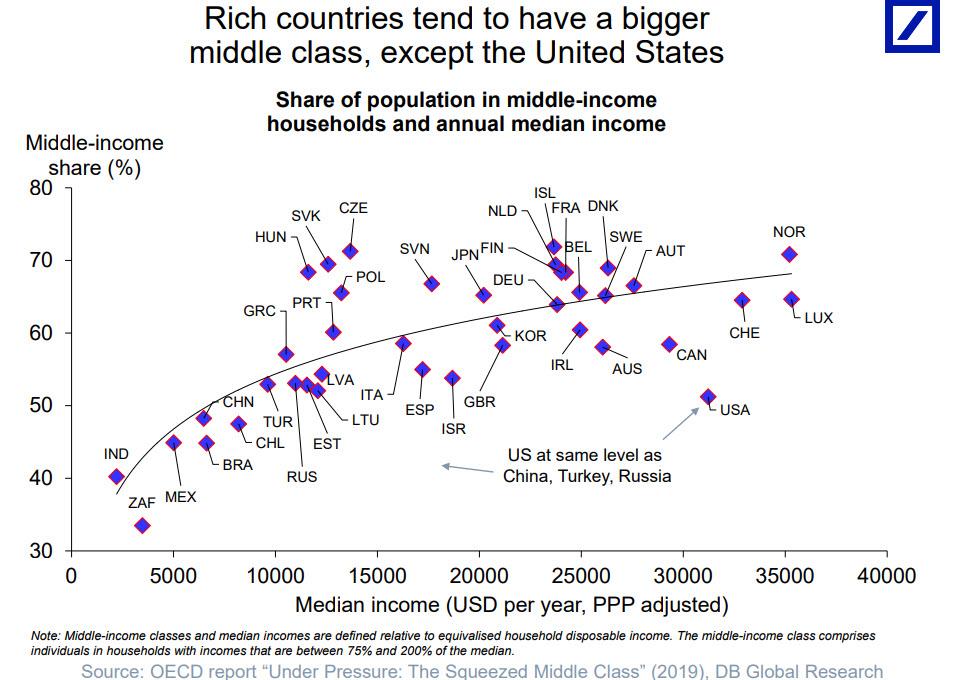

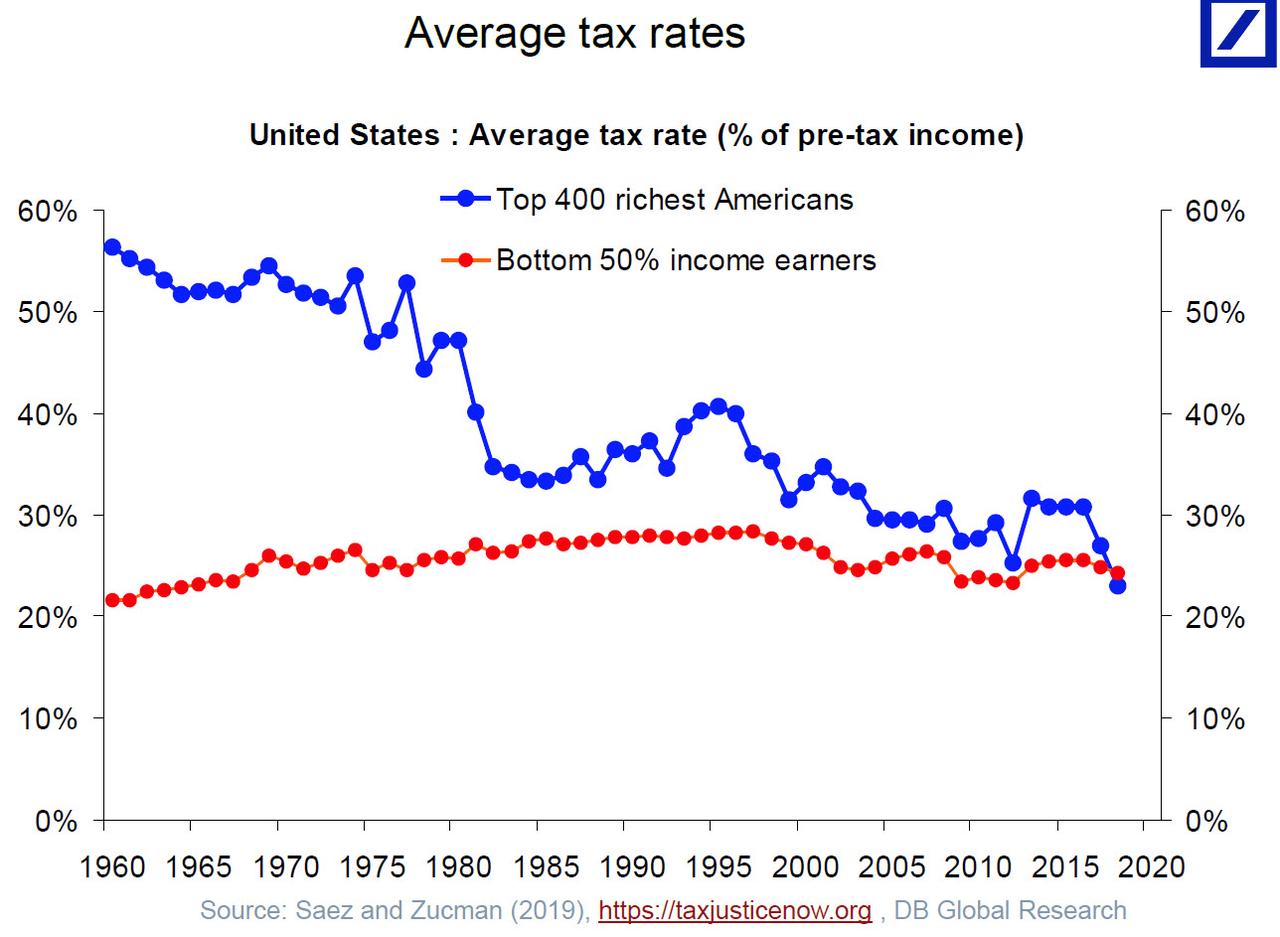

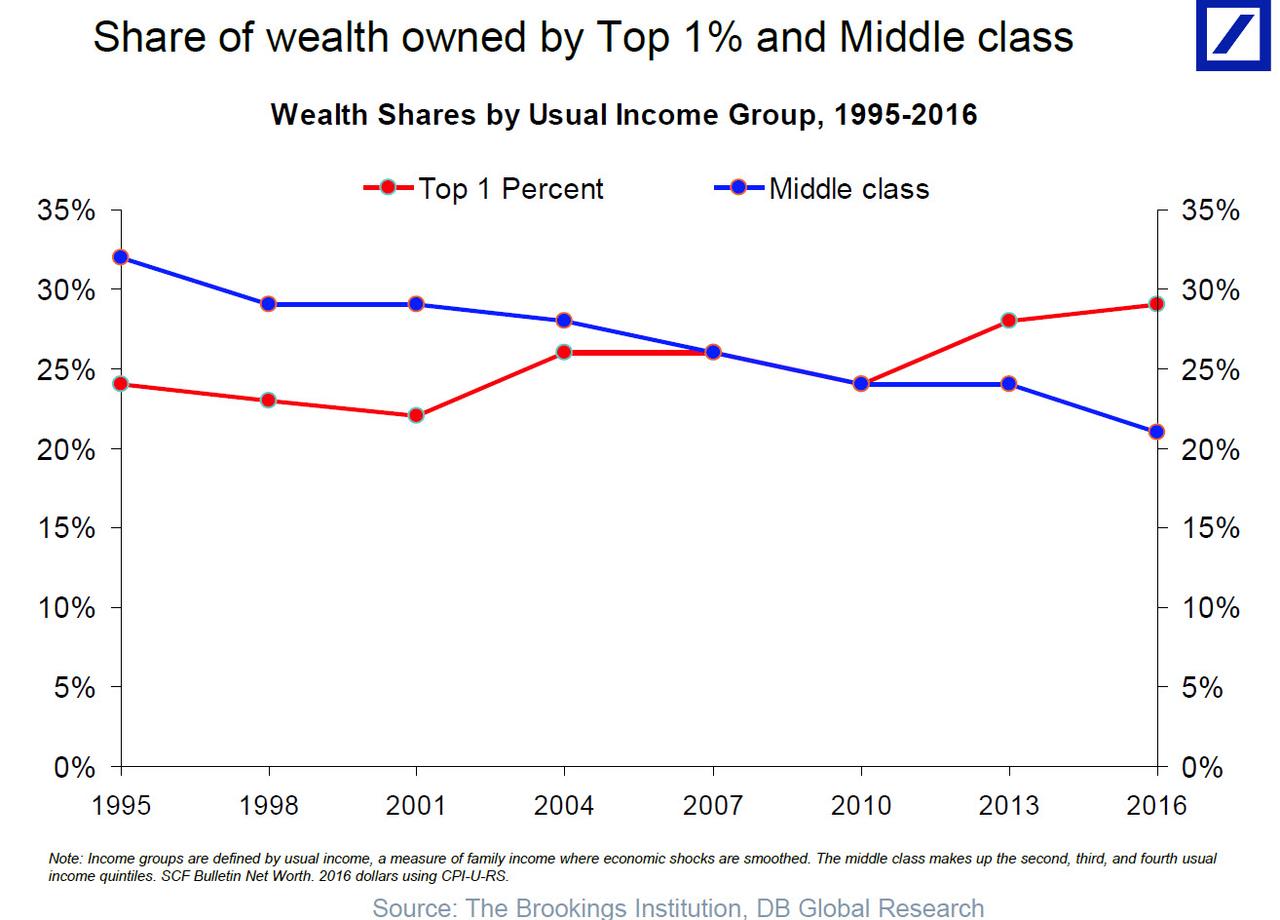

... is understandably at the forefront of not just the 2020 presidential campaign but is daily cooler talk across America if not the world. Furthermore, in a stunning turn of events, on Sunday we reported that none other than Fed president Kashkari recently came out with a "jaw-dropping" policy proposal, seeking to add wealth redistribution to the Fed's official mandates , which only made it clear that the Minneapolis Fed president is unaware that redistributing wealth is precisely why the Fed was created in 1913 and why over the past 10 years the rich have gotten richer than ever before as the middle class has shrank to banana republic levels.

Confirming that fears about wealth redistribution are indeed real, and not just the emotional side-effect of highly charged political theater, the Organization for Economic Cooperation and Development is now spearheading an initiative for a new global tax system for consumer-facing businesses: the WSJ reported that the OECD is scheduled to meet Thursday and Friday in Paris "to discuss a proposal that would set a standard tax rate for a company’s global operations and allow individual governments to tax profits above that based on sales accounted for by each country."

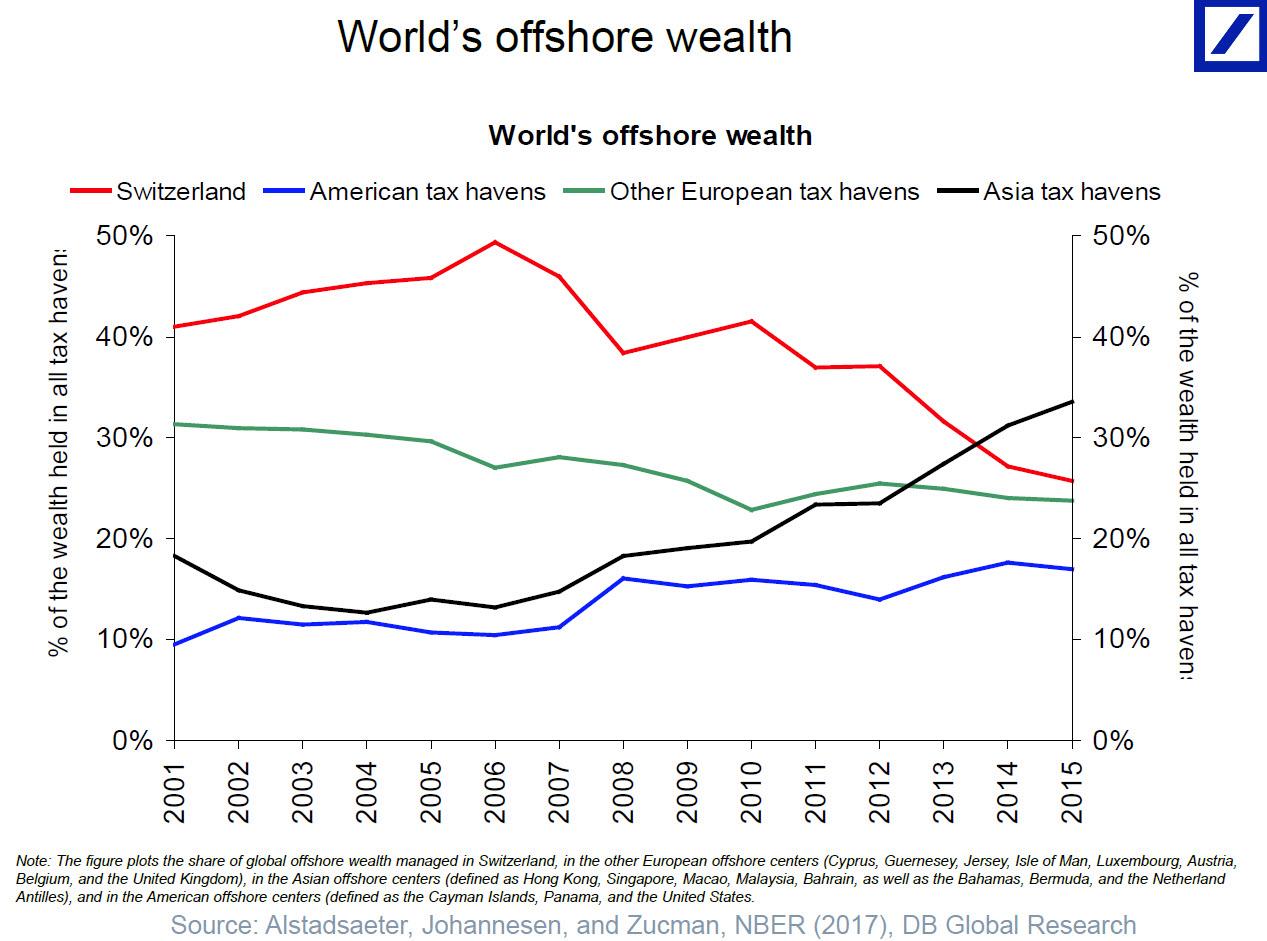

In short, officials at the very highest levels are now coordinating the formation of a global taxation system, one which will affect not only corporations but also very wealthy individuals, whose ability to arbitrage (read flee) highly taxed jurisdiction and redomicile in tax havens such as Monaco has long been seen as a hurdle to any truly punitive tax redistribution initiatives.

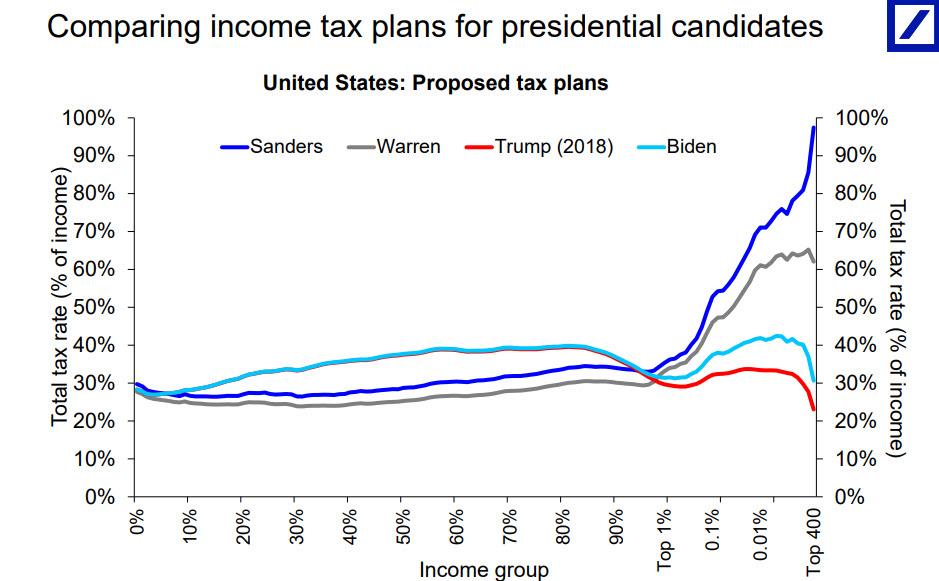

Yet while the world is gradually seeking to impose a uniform system, all eyes will be on the US, especially after November 2020 when America's next president will either be Donald Trump for another 4 years, or one of his far more progressive challengers.

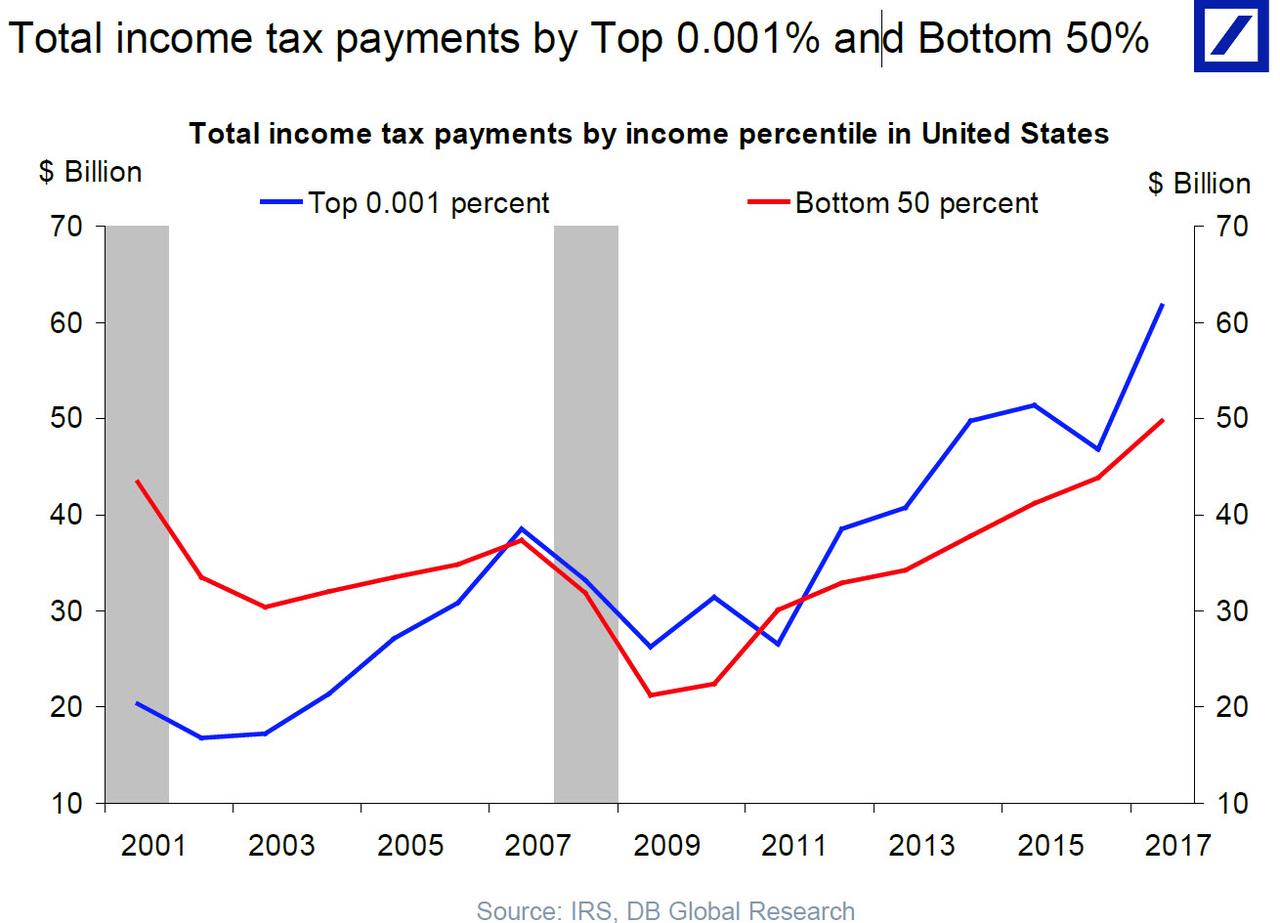

So instead of debating the pros and cons of any one given tax platform - there are plenty of other venues that do that every day - here is a chart comparing what total tax rate any given US president will impose on US taxpayers, broken out by income group. Clearly where there is the greatest variation is in the treatment of the Top 1% - traditionally the group that has paid the bulk of US income tax and especially the "Forbes 400."

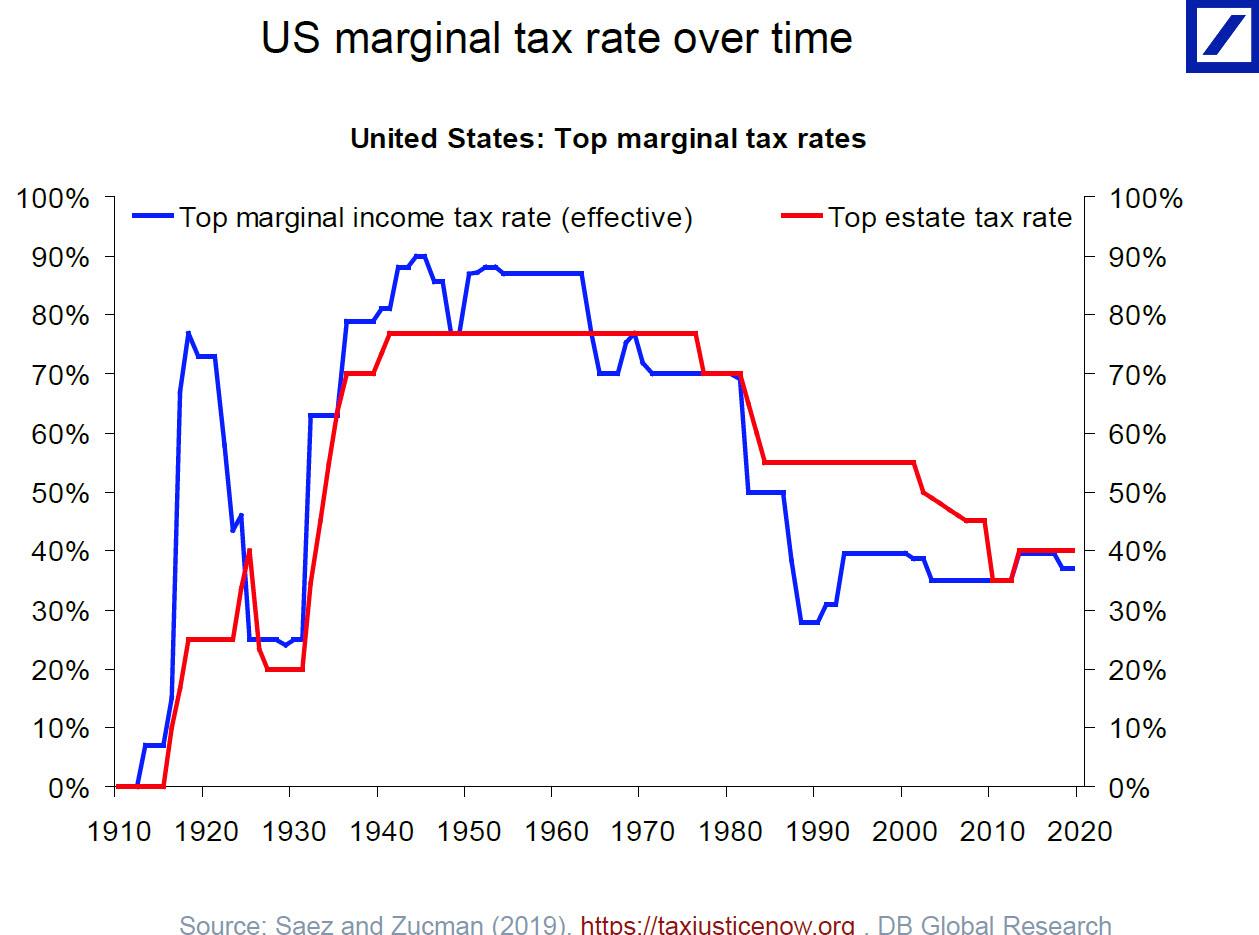

And, courtesy of Deutsche Bank, here are a few bonus taxation charts:

https://ift.tt/2pVZ3zK

from ZeroHedge News https://ift.tt/2pVZ3zK

via IFTTT

0 comments

Post a Comment