Stocks, Bond Yields, & Bullion Puke After Powell Pummels Dovish Dreamers, Assails AI

'Soft' survey data continued its trend weaker...

Source: Bloomberg

And NYCB shit the bed...

Source: Bloomberg

Which is probably why The Fed culled the sentence: "The U.S. banking system is sound and resilient" from its statement!

Not a good look.

BUT... The FOMC statement was a total hawkgasm...

And the market's initial reaction followed that guidance. Then the idiot algos bid stocks back to the highs of the day after Powell said he had "confidence" in inflation coming down (but missed the bit about him saying he needed more confidence).

Powell appeared subliminally aware of that and curb-stomped any dovish hope with the following triple-whammy:

-

*POWELL: DON'T THINK IT'S LIKELY FED WILL CUT IN MARCH

-

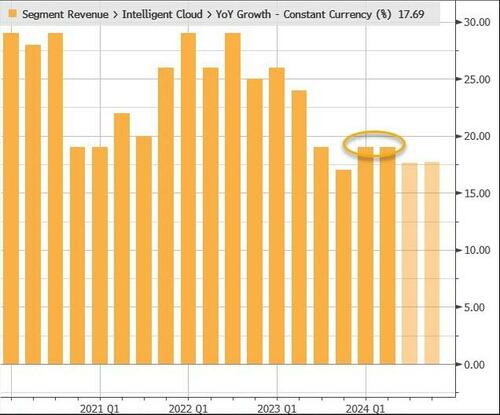

*POWELL: MY GUESS IS PRODUCTIVITY MAY GO BACK TO WHERE WE WERE

-

*POWELL: PLANNING TO START IN-DEPTH BALANCE SHEET TALKS IN MARCH

So, no March cut, AI gains are temporary, and QT ain't coming by March.

The doves cried...

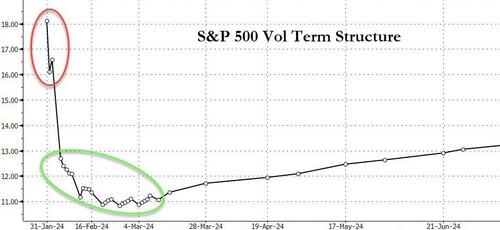

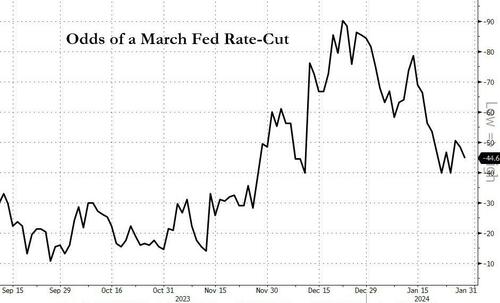

March rate-cut odds tumbled and expectations for 2024 total cuts declined notably...

Source: Bloomberg

And the stock market went wild (as evidenced by the swings in TICK). Initial jerk lower (as selling hit in the statement) held until the presser and algos went crazy with a massive buy program... which was then crushed by a just as massive sell program...

Source: Bloomberg

Small Caps were the day's biggest loser (down 2.5%!), with The Dow the least ugly horse in the glue factory. The S&P and Nasdaq were ugly...

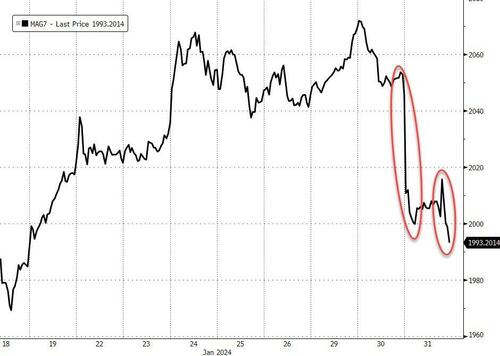

As 'most shorted' stocks were clubbed like a baby seal. A close up on the day's actions shows the algos doing their best to ignite a squeeze... then failing dismally...

Source: Bloomberg

And MAG7 stocks were monkeyhammered (MAG7 basket's worst day since Dec 2022)...

Source: Bloomberg

Interestingly, 0-DTE traders fought The Fed all afternoon, with positive delta flow unable to lift stocks..

Treasury yields were down on the day with the short-end outperforming. The early gains on flight-to-safety bids on NYCB (and weak ADP) were largely erased by the hawkish Fed...

Source: Bloomberg

The 10Y Yield pushed back up to 4.00% towards the close but then yields puked to the lows of the day in the last few mins...

Source: Bloomberg

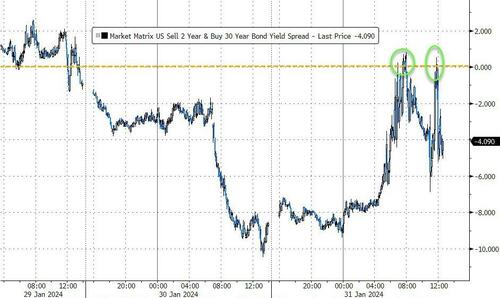

The yield curve (2s30s) bull-steepened on the day, back up near dis-inversion...

Source: Bloomberg

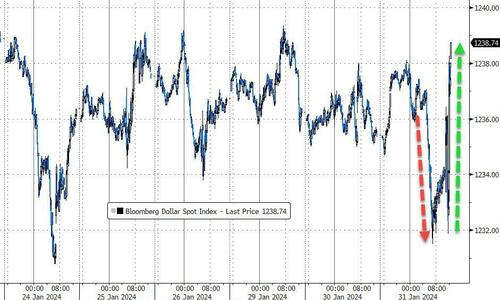

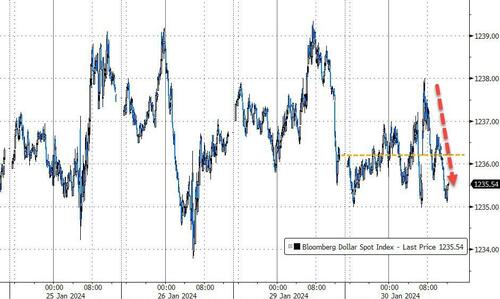

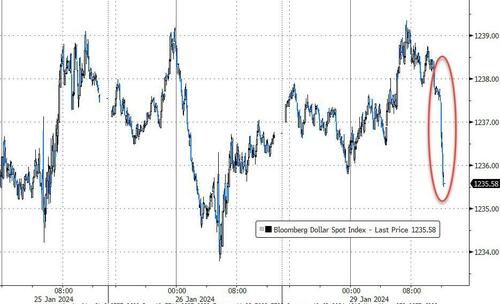

The dollar had quite a day with a plunge early on weak ADP and NYCB's collapse. But then screamed up to the highs of the day

Source: Bloomberg

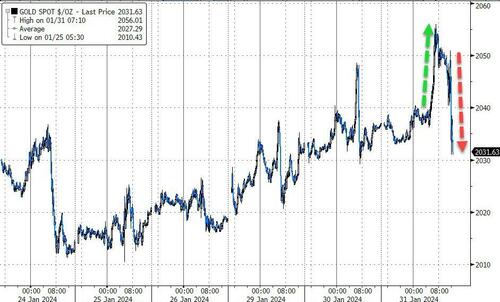

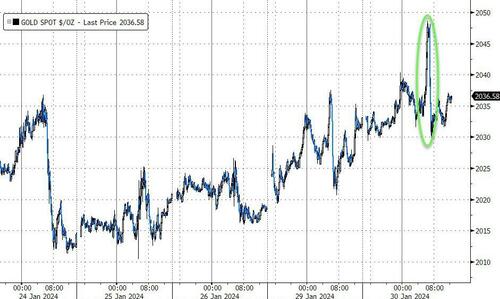

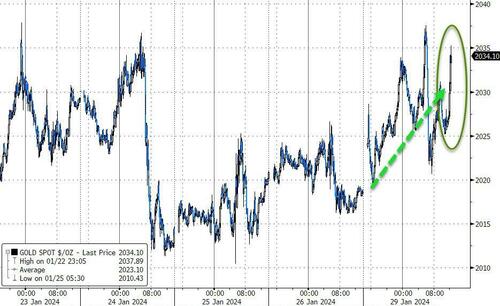

Gold was the mirror image of the dollar, ripping higher on flight-to-safety demand as NYCB imploded, then dumping back as a hawkish Fed spoiled the party...

Source: Bloomberg

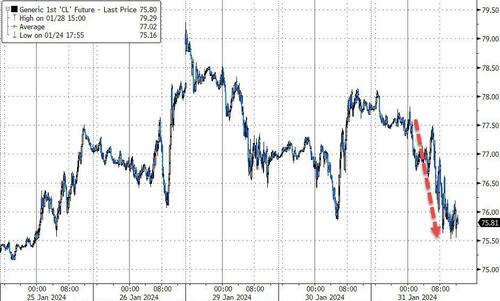

Oil prices accelerated lower today on weak data, a crude build, and hawkish Fed with WTI back below $76..

Source: Bloomberg

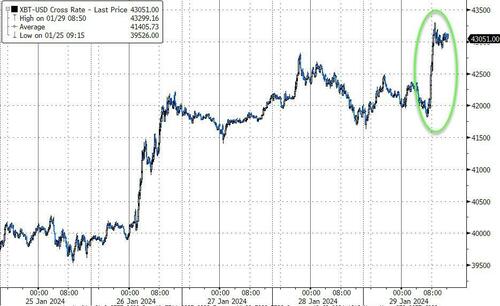

Bitcoin ended lower - following the same kind of chaotic swings in the FX and gold...

Source: Bloomberg

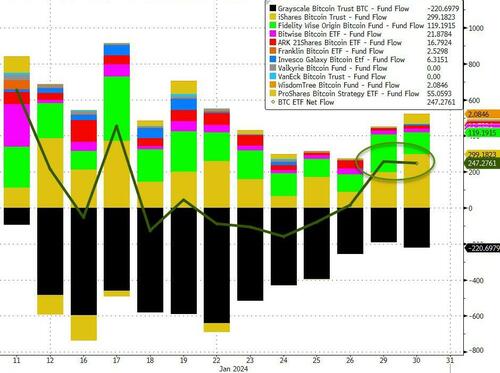

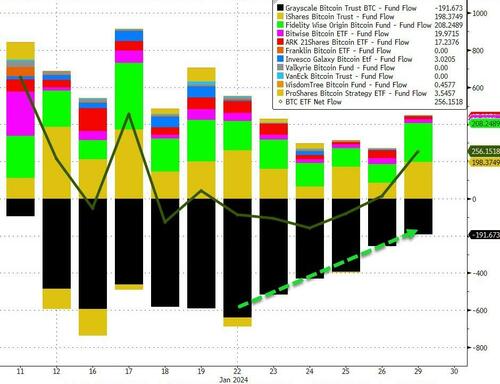

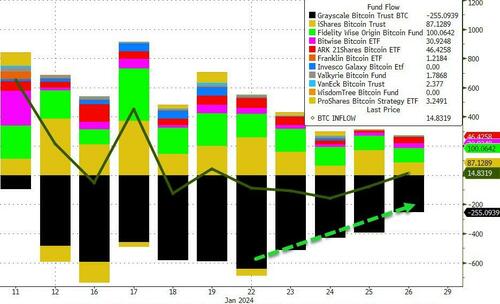

And finally, we are seeing a return to notable net inflows into Bitcoin ETFs...

Source: Bloomberg

...as GBTC outflows appear to be dwindling.

https://ift.tt/5LgsxBp

from ZeroHedge News https://ift.tt/5LgsxBp

via IFTTT