Why The European Recovery Plan Will Likely Fail Tyler Durden Mon, 06/01/2020 - 02:00

The 750 billion euro stimulus plan announced by the European Commission has been greeted by many macroeconomic analysts and investment banks with euphoria. However, we must be cautious. Why? Many would argue that a swift and decisive response to the crisis with an injection of liquidity that avoids a financial collapse and a strong fiscal impulse that cements the recovery are overwhelmingly positive measures. History and experience tell us that, indeed, the risk of disappointment regarding the positive impact on the real economy is not small.

The history of stimulus plans in the eurozone should alert us against excessive optimism.

As you may remember, the European Union launched in July 2009 an ambitious project for growth and employment called the “European Economic Recovery Plan”. A stimulus of 1.5% of GDP to create “millions of jobs in infrastructure, civil works, interconnections, and strategic sectors”. Europe was going to emerge from the crisis stronger than the United States thanks to the Keynesian impulse of public spending. However, 4.5 million jobs were destroyed and the deficit almost doubled while the economy stagnated. This was after the balance sheet of the European Central Bank had doubled between 2001 and 2008. That enormous plan not only did not help the eurozone get out of the crisis stronger, but we can debate whether it prolonged it, as by 2019 there were still signs of evident weakness. The tax rises and obstacles to private activity that accompanied this large package of expenses delayed the recovery, which in any case was slower than comparable economies.

We must also dismantle the idea that the European Central Bank did not support the economy in the 2008 crisis. Two huge sovereign bond buyback programs with Trichet as president of the ECB, rate cuts from 4.25% to 1% since 2008, and purchases of more than 115 billion euros in sovereign bonds. At the end of 2011, the ECB was the largest holder of Spanish debt, while it was accused of inaction.

During all this time, the balance of the ECB was greater than that of the Federal Reserve with respect to GDP, and in May 2020 it stands at 44% of GDP compared to 30% in the US.

Stimuli have never stopped in the eurozone. An additional ECB buyback plan in addition to the TLTRO liquidity programs with Draghi brought sovereign bonds to the lowest yields in history and to the ECB buying almost 20% of the total debt of the main states. This was such an excessive balance sheet expansion plan that, at the end of May 2020, excessive liquidity in the ECB was 2.1 trillion euros. Excessive liquidity was barely 125 billion euro when the so-called 2014 stimulus plan was launched.

No one can deny that the impact on growth, productivity, and employment of these enormous plans has been more than disappointing. Except for a brief period of euphoria in 2017, downward revisions to eurozone growth have been constant, culminating in the fourth quarter of 2019 with France and Italy in stagnation, Germany on the brink of recession, and a significant slowdown in Spain. The use of the excuses of Brexit and the trade war did not disguise that the economic result of the stimulus was already more than poor.

We have another important example for caution. The so-called “Juncker Plan” or “Investment Plan for Europe”, considered as the solution to the lack of growth of the European Union, also had an extremely poor result. It mobilized 360 billion euros, many for projects with no real economic return or real effect on growth. Estimates of growth in the euro zone fell sharply, productivity growth stagnated and industrial production fell in December 2019 to the lowest level in years.

We must also be cautious with the green plans. All of us are in favor of a serious and competitive energy transition, but we cannot forget that a very important part of the European Union’s “green” plan attacks demand via tax increases and protectionist measures such as a border tax on countries that have not signed the Paris Agreement (but not to those who do not comply, those have no risk). This limits the potential for recovery and increases the possibility of an additional trade war.

We cannot ignore the negative impact on industry and employment of the massive “green” policy plans of the euro area of 2004-2018, which caused the countries of the European Union to suffer electricity and natural gas bills for households that are twice as those in the USA, while growth stalled.

What is the problem with European stimulus plans compared to those of the United States? The first and most important is they come from directed economy central planning. These are plans with a very strong component of political decisions about where and how they are invested. Political planning is an essential part of the largest parts of these stimuli, and as such, they generate poor growth and weak results. Thus, one of the big problems is that sectors that are already suffering from overcapacity are being “stimulated”, or a false demand signal is generated via subsidies, which then generates working capital problems and an alarming increase in the number of zombie companies. According to the Bank of International Settlements, the number of zombie companies in Europe has exploded amid stimulus plans. The past is bailed out and the economy is zombified.

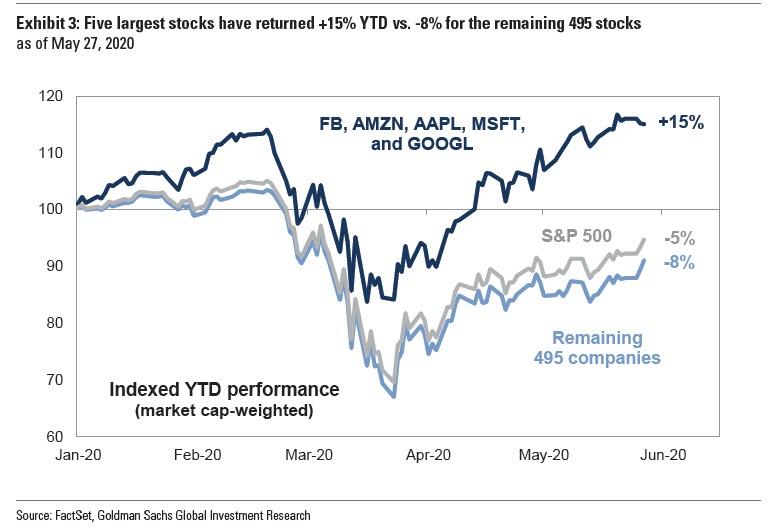

Another big problem is that the wrong sectors are stimulated while thousands of small companies that have no access to credit or political favour die. It is not a coincidence that the eurozone destroys more innovative companies or prevents them from growing when regulation forces 80% of the real economy to be financed through the banking channel while in the US it does not reach 30%. Can you imagine an Apple or Netflix growing via bank loans? Impossible.

Another big problem is the obsession with redistribution. By fiscally penalizing merit and success and sustaining public spending above 40% of GDP at any cost with higher taxes while subsidizing low-productivity sectors, the European Union incurs in a huge malinvestment risk when it rewards the subsidized sectors, or those close to political power while those with high productivity are penalized. It is no coincidence that Europe does not have technological champions. It scares them off by perpetuating the obsolete national champions and penalizing merit remuneration and alternative investment via taxation.

Nothing we just discussed changes in the newly announced plan package. It is the same, but much larger. And we cannot believe that this time will be different. While they tell us about green plans, the vast majority of the bailouts will go to aluminum and steel, autos, airlines, and refineries. Meanwhile, a huge tax increase in savings and investment may further drown start-ups, investment in research and development, and innovative companies.

The problem of the European Union has never been a lack of stimuli, but rather an excess of these. The European Union has chained one state stimulus plan after another since its inception. This crisis needed a strong boost to merit, innovation, private capital, and entrepreneurship with supply measures. I am afraid that, again, it has been decided to bail-out everything from the past and let the future die.

https://ift.tt/2MiOU7O

from ZeroHedge News https://ift.tt/2MiOU7O

via IFTTT