Stocks Dancing On Deck For Titanic U.S.-China Clash Tyler Durden Sun, 05/31/2020 - 22:00

Authored by Bloomberg macro commentator Garfield Reynolds

Complexity is causing global investors to underprice the danger from U.S.-China confrontations over Hong Kong. Far from being just a regional issue, the world’s two largest economies are sliding toward a more markets-negative showdown than anything we saw in the first three years of Donald Trump’s presidency.

Global stocks are trading as though this round of tensions will be resolved in a similar fashion to the 2018-19 trade conflict. Even though that caused plenty of damage to the world economy, there were limits to the field of battle. And as the phase-one trade accord showed, a fudged resolution was possible. The market reactions were obvious despite the confusing ebb and flow of the underlying story - more tariffs meant lower stocks and yields, fewer tariffs the reverse. The yuan predictably weakened sharply when the tariff threat escalated in May/June 2018 and again in the summer of 2019.

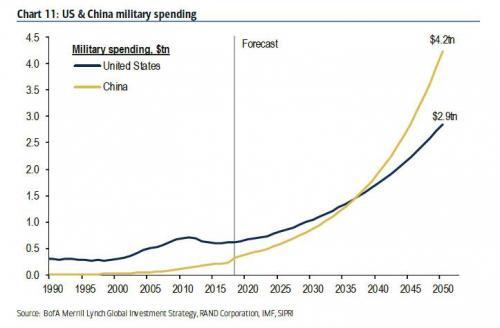

This year’s geopolitical cage-match has the potential to develop into a winner-takes-all affair, as the superpowers spiral into a Thucydides trap.

The always-difficult task of pricing in the risk of an extreme outcome is further complicated by the backdrop of extraordinary stimulus and Covid-19. That may explain why, beyond H.K. assets, it’s only the yuan which seems to be showing a sustained reaction.

Trump’s mild China comments on Friday spurred a rebound in risk assets, but the longer-term outlook remains skewed to the downside, as witnessed by fresh rhetoric over the weekend.

There’s a real threat of the global economy splitting into competing camps, raising costs and cutting productivity across industries as companies are forced to diversify and duplicate supply chains while they balance politics and profits.

China accounted for almost a quarter of world economic growth this century and is central to sustained global rebound from the pandemic. Australia, Vietnam and South Korea stand out as Asian stock markets whose outperformance in May only makes them all the more vulnerable to a U.S.-China fallout.

- AUD/USD and the S&P/ASX 200 are surging now as Australia flattens its Covid-19 curve, but their longer-term outlook is clouded by disputes with the nation’s biggest trading partner.

- The Kospi is almost 40% above its March low, even as South Korean data remain dire. The U.S. and China account for ~40% of the country’s trade, and many of its semiconductor shipments to China go via Hong Kong.

U.S. equities will also be in the firing line. Some of the Chinese companies targeted by listing rules were key drivers for the Nasdaq’s recent surge. Wall Street banks may miss out on billions, while companies like Apple, Intel, Nvidia have strong China exposure. Nvidia gets more than half its revenue from Greater China; Apple’s supply chain is dependent on suppliers based in China, South Korea and Taiwan.

On a positive note, European assets will gain extra allure. The potentially game- changing moves toward fiscal unity on the continent are an attractive contrast to Washington and Beijing’s shift toward geopolitical confrontation.

Perhaps recent moves by both sides are just posturing and the story will fade away soon but the signs aren’t good. In just the past two weeks, China has shown an increased willingness to challenge the U.S., Australia, India and others on a diverse array of issues. On the U.S. side, China-bashing has bipartisan support in the context of November’s election.

The market impact to the latest iteration of U.S-China tensions is far more complex to analyze than the damage from the trade war. Investors are wrong to mistake that for meaning it will be less damaging.

https://ift.tt/2ArvyLf

from ZeroHedge News https://ift.tt/2ArvyLf

via IFTTT

0 comments

Post a Comment