Authored by Jeffrey Tucker via The Brownstone Institute,

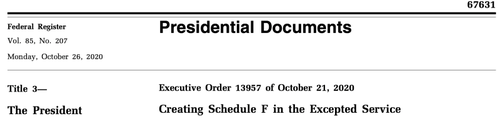

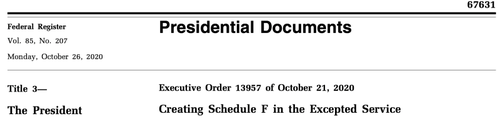

Two weeks before the 2020 general election, on October 21, 2020, Donald Trump issued an executive order (E.O. 13957) on “Creating Schedule F in the Excepted Service.”

It sounds boring.

Actually, it would have fundamentally changed, in the best possible way, the entire functioning of the administrative bureaucracy that rules this country in a way that bypasses both the legislative and judicial process, and has ruined the checks and balances inherent in the US Constitution.

The administrative state for the better part of a century, and really dating back to the Pendleton Act of 1883, has designed policy, made policy, structured policy, implemented policy, and interpreted policy while operating outside the control of Congress, the president, and the judiciary.

The gradual rise of this 4th branch of government – which is very much the most powerful branch – has reduced the American political process to mere theater as compared with the real activity of government, which rests with the permanent bureaucracy.

Any new president can hire the heads of agencies and they can hire staff, which are known as political appointees. These 4,000 political appointees ostensibly rule 432 agencies (as listed by the Federal Register) as well as some 2.9 million employees (aside from the military and postal service) that effectively inhabit permanent jobs. This permanent state – sometimes called the deep state – knows the ropes and the processes of government far better than any temporary political appointee, thus reducing the appointed jobs to cosmetic positions for the press to hound while the real actions of government take place behind the scenes.

From 2020 and onward, the American people got to know this administrative state well.

-

They ordered us to wear masks.

-

They deployed their influence to close small businesses and churches.

-

They limited how many people we could have in our homes.

-

They festooned our businesses with plexiglass and told everyone to stay six-feet apart.

-

They demanded two weeks of quarantine when crossing state borders.

-

They decided which medical procedures were elective and non-elective.

-

And they finally demanded compliance with vaccine mandates at the penalty of job loss.

None of this was ordered by legislation. It was all invented on the spot by the permanent staff of the Centers for Disease Control and Prevention. We had no idea they had such power. But they do. And that same power which allowed those egregious attacks on rights and liberties also belongs to the Food and Drug Administration, the Department of Labor, the Environmental Protection Agency, the Department of Agriculture, the Department of Homeland Security, and all the rest.

Donald Trump came into office with the promise of draining the swamp, without understanding entirely what that meant. He gradually came to realize that he had no control over most of the affairs of government, not because he had no patience for the legislative process but because he had no ability to terminate the employment of most of the civilian bureaucracy. Nor could his political appointees control it. The media, he gradually came to realize, echoed the priorities and concerns of this administrative state due to long-established relationships that led to nonstop leaks that spread false information.

In May of 2018, he took his first steps to gain some modicum of control over this deep state. He issued three executive orders (E.O. 13837, E.O. 13836, and E.O.13839) that would have diminished their access to labor-union protection when being pressed on the terms of their employment. Those three orders were litigated by the American Federation of Government Employees (AFGE) and sixteen other federal labor unions.

All three were struck down with a decision by a DC District Court. The presiding judge was Ketanji Brown Jackson, who was later rewarded for her decision with a nomination to the Supreme Court, which was affirmed by the US Senate. The prevailing and openly stated reason for her nomination was said to be mostly demographic: she would be the first black woman on the Court. The deeper reason was more likely traceable to her role in thwarting actions by Trump which had begun the process of upending the administrative state. Jackson’s judgment was later reversed but Trump’s actions were embroiled in a juridical tangle that rendered them moot.

Following the lockdowns of mid-March 2020, Trump became increasingly frustrated with the CDC and Anthony Fauci in particular. Trump was profoundly aware that he had no power to fire the man, despite his epicly terrible role in prolonging Covid lockdowns long after Trump wanted to open up to save the American economy and society.

Trump’s next step was radical and brilliant: the creation of a new category of federal employment. It was called Schedule F.

Employees of the federal government classified as Schedule F would have been subject to control by the elected president and other representatives. Who are they? They are those who met the following criteria:

Positions of a confidential, policy-determining, policy-making, or policy-advocating character not normally subject to change as a result of a Presidential transition shall be listed in Schedule F. In appointing an individual to a position in Schedule F, each agency shall follow the principle of veteran preference as far as administratively feasible.

Schedule F employees would be fired. “You’re fired” was the slogan that made Trump TV famous. With this order, he would be in a position to do the same to the federal bureaucracy. The order further demanded a thorough review throughout the government.

Each head of an executive agency (as defined in section 105 of title 5, United States Code, but excluding the Government Accountability Office) shall conduct, within 90 days of the date of this order, a preliminary review of agency positions covered by subchapter II of chapter 75 of title 5, United States Code, and shall conduct a complete review of such positions within 210 days of the date of this order.

The Washington Post in an editorial expressed absolute shock and alarm at the implications:

The directive from the White House, issued late Wednesday, sounds technical: creating a new “Schedule F” within the “excepted service” of the federal government for employees in policymaking roles, and directing agencies to determine who qualifies. Its implications, however, are profound and alarming. It gives those in power the authority to fire more or less at will as many as tens of thousands of workers currently in the competitive civil service, from managers to lawyers to economists to, yes, scientists. This week’s order is a major salvo in the president’s onslaught against the cadre of dedicated civil servants whom he calls the “deep state” — and who are really the greatest strength of the U.S. government.

Ninety days after October 21, 2020 would have been January 19, 2021, the day before the new president was to be inaugurated. The Washington Post commented ominously: “Mr. Trump will try to realize his sad vision in his second term, unless voters are wise enough to stop him.”

Biden was declared the winner due mostly to mail-in ballots.

On January 21, 2021, the day after inauguration, Biden reversed the order. It was one of his first actions as president. No wonder, because, as The Hill reported, this executive order would have been “the biggest change to federal workforce protections in a century, converting many federal workers to ‘at will’ employment.”

How many federal workers in agencies would have been newly classified at Schedule F? We do not know because only one completed the review before their jobs were saved by the election result. The one that did was the Congressional Budget Office. Its conclusion: fully 88% of employees would have been newly classified as Schedule F, thus allowing the president to terminate their employment.

This would have been a revolutionary change, a complete remake of Washington, DC, and all politics as usual.

Trump’s EO 13957 was a dagger aimed directly at the heart of the beast. It might have worked.

It would have gotten us closer to the restoration of a Constitutional system of government in which we have 3 – not 4 – branches of government that are wholly controlled by the people’s representatives. It would have gone a long way toward gutting the administrative state of its power and returning the affairs of state to the people’s control.

The action was stopped dead due to the election results.

Whatever one’s view of Trump, one has to admire the brilliance of this executive order. It shows that Trump had come to understand the problem and actually innovate a fundamental solution, or at least the beginnings of one. The “deep state” as we’ve come to know it would have been curbed, and we would have taken a step toward recreating the system that existed before the Pendleton Act of 1883.

Many efforts have been deployed through the years to regain constitutional control over the permanent bureaucracy. An example is the Hatch Act of 1939 which forbids employees of the government to work for political campaigns. That act turned out to be toothless – one does not need to work for a campaign in order to skew one’s labor in the direction of always granting the federal government more power and control – and largely made irrelevant in the succeeding decades.

Trump came to office promising to drain the swamp but it was very late in his term before he figured out the means at his disposal to do just that. His final effort took place merely two weeks before the election that was decided in favor of his opponent Biden, who quickly reversed this action just two days following the deadline of an ordered review that would have reclassified, and thus gained control over, a sizable portion of the administrative state.

With Executive Order 12003 (“Protecting the Federal Workforce”), Biden saved the deep state’s bacon, leaving the efforts finally to drain the swamp to another day and another president.

Still, Executive Order 13957 exists in the archives as a possible path forward to restore checks and balances in the US system of government. A new Congress can also take such steps at least symbolically.

Until something takes place to restore the people’s control of the administrative state, a sword of Damocles will continue to hang over the entire country and we will never be safe from another round of lockdowns and mandates.

Should a genuinely reformist president ever take office, this executive order must be issued on the very first day. Trump waited too long but that mistake need not be repeated.