Joe Biden Read This: All You Need To Know About The US Refining Industry

By John Kemp, Reuters senior markets analyst

President Joe Biden has written to major oil companies to complain about the high refining margins for gasoline and diesel and demanded an explanation for refinery closures since 2020. The president’s letter, dated June 14, should be seen mostly as a political exercise to deflect responsibility for high fuel prices and accelerating inflation (“Biden warns big oil over gasoline output”, Axios, June 15).

He blamed historically high profit margins made by refiners for causing an “unprecedented disconnect” between the international price of crude oil and the retail price of gasoline.

"At a time of war," the president wrote, record margins "are not acceptable" and demanded companies increase the supply of gasoline and other refined fuels immediately.

GLOBAL FACTORS

Biden acknowledged Russia’s invasion of Ukraine has been a primary driver of higher oil and therefore gasoline prices. Russia’s President Vladimir Putin was name-checked four times to ensure readers knew who to blame. But the U.S. president also complained that the lack of domestic refinery capacity and high margins are blunting the impact of other actions the administration has taken to stabilise fuel prices for consumers.

He has already ordered an unprecedentedly large release of crude oil from the strategic petroleum reserve and relaxed gasoline blending regulations in an effort to hold down pump prices. The shortage of refinery capacity is a global problem, with more than 3 million barrels per day (bpd) going offline since the onset of the pandemic.

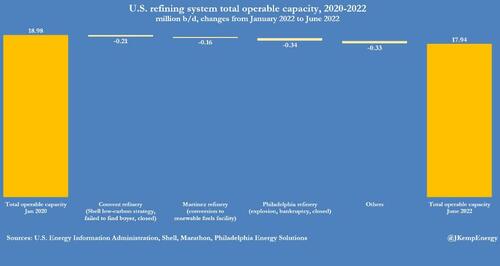

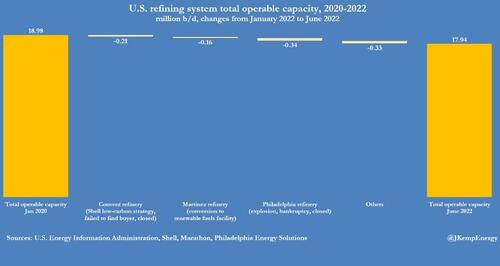

But the president noted more than 800,000 bpd of capacity had closed in the United States since 2020 and demanded an explanation.

He directed the secretary of energy to hold an emergency meeting with industry representatives and engage the National Petroleum Council to discuss the crisis.

He also called for companies to take "immediate actions to increase the supply of gasoline, diesel and other refined products."

And he said the administration was prepared to use all reasonable and appropriate tools and emergency powers to increase refinery capacity and output.

CAPACITY LIMITS

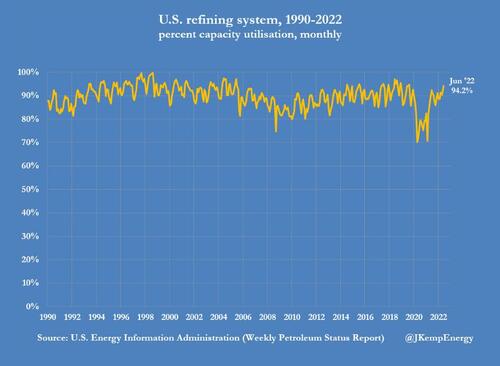

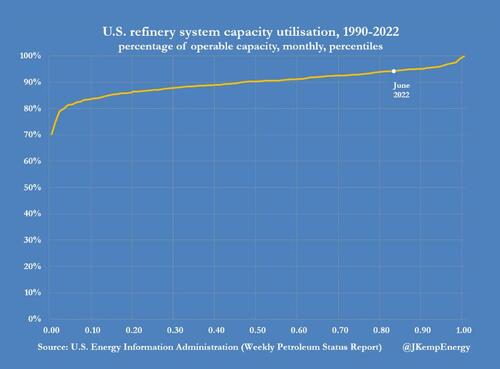

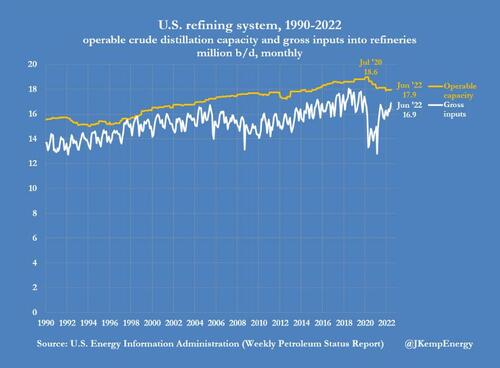

U.S. refineries are already running at close to their theoretical maximum so there is limited ability to squeeze more fuel from the current system. In recent weeks, crude processing has been running at 93-94% of maximum operable capacity, which is in the 80th to 83rd percentile for all weeks since 1990.

But if refineries could raise that to the 95th percentile, it would increase the utilization rate by only 2.5 percentage points to 96.4%.

If the utilization rate could be raised to the 98th percentile, it would rise by 3-4 percentage points to 97.5%, but such high operating rates have never been sustained for more than a few weeks at a time.

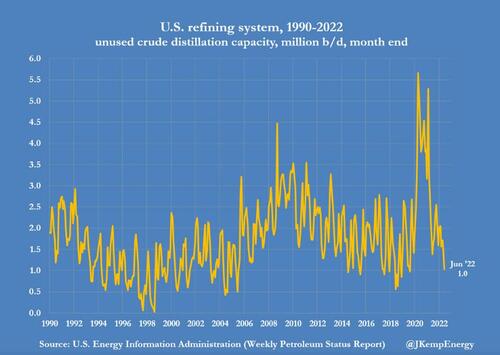

Put another way, the U.S. refinery system currently has around 1 million bpd of under-used crude processing capacity (19th percentile).

If the system was run very hot, it could potentially reduce unused crude processing capacity to 600,000 bpd (5th percentile) or even 400,000 bpd (98th percentile) but that would be difficult to sustain.

Extra processing would yield no more than 600,000 bpd of products, roughly split between light distillates such as gasoline (400,000 bpd) and middle distillates such as diesel and jet fuel (200,000 bpd), and probably less.

New crude distillation or downstream processing units would take at least two to five years from making an initial investment decision to coming onstream so they would not be available until the middle of the decade.

Even debottlenecking existing units to increase capacity incrementally is likely to take 12-18 months - and units have to be taken offline for the upgrades to happen.

CAPACITY REDUCTIONS

U.S. operable refinery capacity has fallen by around 1 million bpd since the start of 2020, according to data published by the U.S. Energy Information Administration (“Monthly refinery report”, EIA, May 2022). But around two thirds of the total is attributable to the closure of three refineries:

-

Philadelphia Energy Solutions closed its refinery in Pennsylvania (335,000 bpd) after an explosion and the operator went bankrupt.

-

Marathon is converting the Martinez refinery in California (161,000 bpd) into a biofuels facility as part of California's energy transition programme.

-

Shell closed the Convent refinery in Louisiana (240,000 bpd) as part of its strategy for transitioning to a low-carbon future and when it failed to find another buyer.

Even before the pandemic, many refiners were reluctant to replace obsolescent or damaged equipment let alone increase capacity because the prospective transition to more electric vehicles would reduce fuel demand.

Extra financial pressure from the pandemic-driven reductions in fuel consumption accelerated capacity reductions that would likely have happened in any event.

Rationalisation is the result of long-term pressures on the refining system, especially from the projected increase in alternative-powered vehicles.

Given the large amounts of capital involved in refinery upgrades and reconfigurations, the long lead times for planning and construction, and lengthy payback periods, these decisions cannot be reversed easily or quickly.

As a result, available capacity for 2022 and 2023 is largely fixed and nearly all being used already leaving little scope to increase output in the short to medium term.

Responding for the industry, the American Fuel and Petrochemical Manufacturers trade association has already explained the constraints in a letter it sent to the White House on June 15.

Even the White House has noted “you have ample market incentive” to increase fuel production if at all possible, which points to the constraints the refineries are operating under.

The political imperative for the White House to lower gasoline prices before November has run into the practical problem that refinery capacity is very inflexible in the short term and has to be planned for much longer periods.

[ZH: all we would add to John Kemp's excellent article, is what is responsible for the dire state US energy finds itself in, and that - as we explained over a year ago in "Will ESG Trigger Energy Hyperinflation" - is the Biden administration itself]

https://ift.tt/VEqB8Rx

from ZeroHedge News https://ift.tt/VEqB8Rx

via IFTTT

0 comments

Post a Comment