Banks Unveil Post-Stress-Test Dividend/Buyback Plans, Morgan Stanley Jumps On Boost To Both

As we detailed last week, all 33 banks tested this year passed the stress test though we noted that in the test's worst-case scenario, they would collectively lose more than $600 billion, the Fed said.

We note that this year, the biggest banks in the country, including JPMorgan Chase and Bank of America saw their capital levels fall further than last year on higher loan and trading losses ahead of their decisions today on what level of shareholder payback (dividends and buybacks) they would offer.

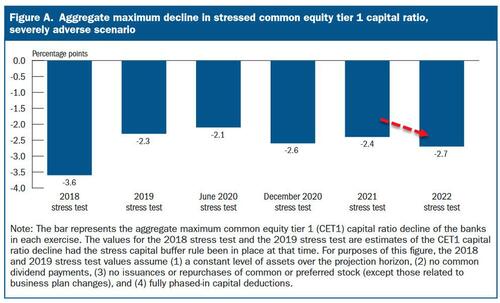

The 2.7 percentage point decline in the aggregate common equity tier 1 (CET1) capital ratio in the 2022 stress test is slightly larger than the 2.4 percentage point decline in the 2021 stress test but is comparable to projected declines in recent years

Some of the highlights so far:

-

*BANK OF AMERICA PLANS TO BOOST QUARTERLY DIV TO $0.22/SHR (FROM $0.21/SHR)

-

*MORGAN STANLEY: 11% DIV RISE TO $0.775/SHR, AUTHORIZATION OF A $20B MULTI-YEAR BUYBACK

-

*GOLDMAN PLANS QTRLY DIVIDEND BOOST TO $2.50/SHARE, EST. $2.25

-

*NORTHERN TRUST TO BOOST QTRLY STOCK DIV BY 7% TO $0.75/SHR

-

*TRUIST: PLANNED BOOST IN DIV TO 52CENTS FROM 48CENTS

-

*WELLS FARGO EXPECTS TO BOOST 3Q STOCK DIV TO $0.30/SHR, HAS CAPACITY FOR STOCK REPURCHASES

-

*BNY MELLON PLANS TO INCREASE QUARTERLY DIVIDEND 9% TO 37C/SHARE

-

*JPMORGAN TO MAINTAIN DIV AT $1/SHARE FOR 3Q, CITES HIGHER FUTURE CAPITAL REQUIREMENTS

-

*CITI PLANS TO MAINTAIN CURRENT COMMON DIV OF $0.51/SHR IN 3Q

Morgan Stanley shares are up 2% after hours...

Developing...

Finally, we note that, ahead of the stress test, Cowen analyst Jaret Seiberg warned of potential pushback from lawmakers.

"The political risk today is that Capitol Hill questions why banks should distribute any capital if a recession is possible," Seiberg said.

"We do not see that winning the day, but it could get attention."

So, how long after these results are broadcast will Senator Warren be firing up her Twitter mob?

https://ift.tt/kN0j38M

from ZeroHedge News https://ift.tt/kN0j38M

via IFTTT

0 comments

Post a Comment