JPMorgan Finds Bitcoin Trades At "Intrinstic Value" As Goldman Throws Up All Over Cryptocurrency Tyler Durden Wed, 05/27/2020 - 21:25

So much changes in just over two years. Back in late 2017 and early 2018, Goldman Sachs emerged as one of the most fervent adopters of bitcoin (perhaps because it presented at least some opportunity to trade vol in a market where the VIX was single digits), and even hired a head cryptocurrency trader . Then the cryptocurrency market crashed and despite fits and starts, has failed to recover its December 2017 highs.

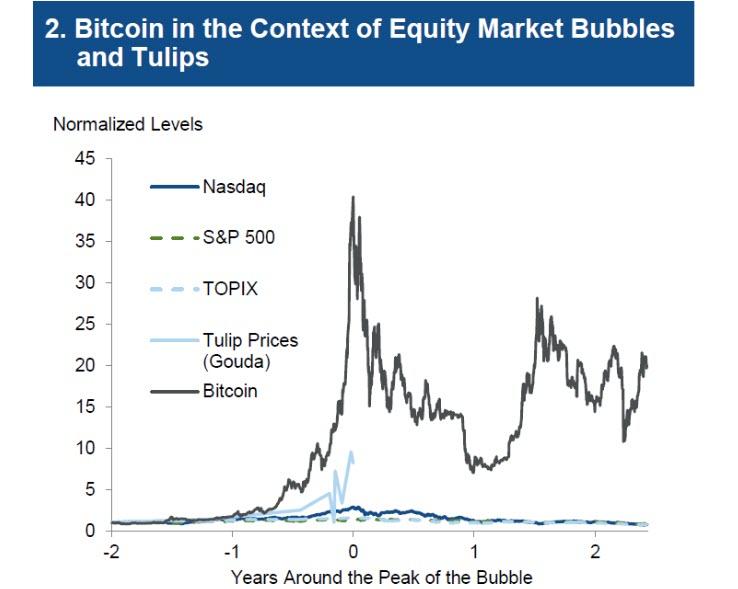

Fast forward to today when Goldman prompted howls of outrage among the bitcoin faithful when the bank released a multi-strategy report that took some pot shots at crypto, saying among other things, that "we do not recommend Bitcoin on a strategic or tactical basis for clients’ investment portfolios even though its volatility might lend itself to momentum oriented traders." The report also took the completely unoriginal track to compare Bitcoin’s rise, if not so much fall, to the Tulip mania of the 1600s in the Netherlands, although one look at the chart below suggest that such comparisons are woefully inaccurate with most bitcoin bulls laughing at repeated rumors of bitcoin's demise.

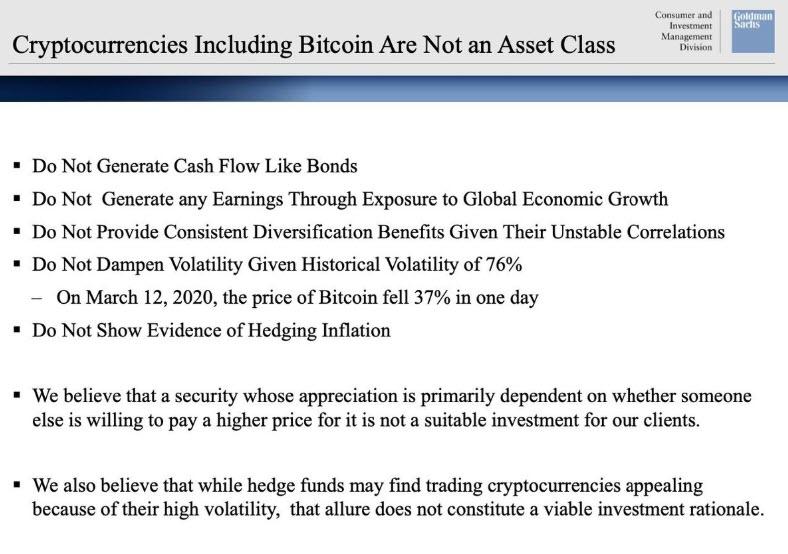

Goldman also issued several rebuttals against the merits frequently cited by crypto fans that aim to hold up the superiority of the digital tokens. As Bloomberg notes, Goldman said that cryptocurrencies are not an asset class, they do not generate cash flow or earnings and do not provide consistent diversification benefits, nor is there evidence they are an inflation hedge.

Of course none of that is news to anyone by now, with bitcoin increasingly seen as a limit-supply store of value and an alternative to fiat in a world where the money supply is exploding. Just ask Paul Tudor Jones, who last month said he's buying Bitcoin as a hedge against the inflation he sees emerging from the Fed's money-printing, even telling clients that bitcoin reminds him of "the role gold played in the 1970s".

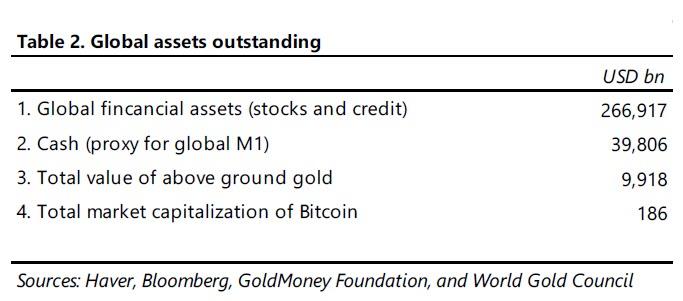

Preempting Goldman, PTJ, who said "I am not a hard-money nor a crypto nut", also laid out the various key verticals that set aside bitcoin, including Purchasing Power; Trustworthiness, Liquidity and Portability (his full note is below), and compared the total value of various financial assets showing just how significant the growth potential for bitcoin was in a world of wider adoption.

All of this left one of the world's greatest traders to conclude that, contrary to Goldman's conclusion, "at the end of the day, the best profit-maximizing strategy is to own the fastest horse. Just own the best performer and not get wed to an intellectual side that might leave you weeping in the performance dust because you thought you were smarter than the market. If I am forced to forecast, my bet is it will be Bitcoin."

Finally, let's not forget, it is Goldman...

who would've thought pic.twitter.com/LDLRE1O3cT

— Mark Constantine (@vexmark) May 27, 2020

Goldman, and its catastrophic predictive track record aside - especially since the bank dumped most of its iconic prop traders and decided to become a subprime lender and issuers of credit cards- aside, we found a far more interesting take in the latest Flows and Liquidity report from JPM's Nick Panigirtzoglou who analyzed something far more valuable to both fans and enemies of bitcoin: its intrinsic value.

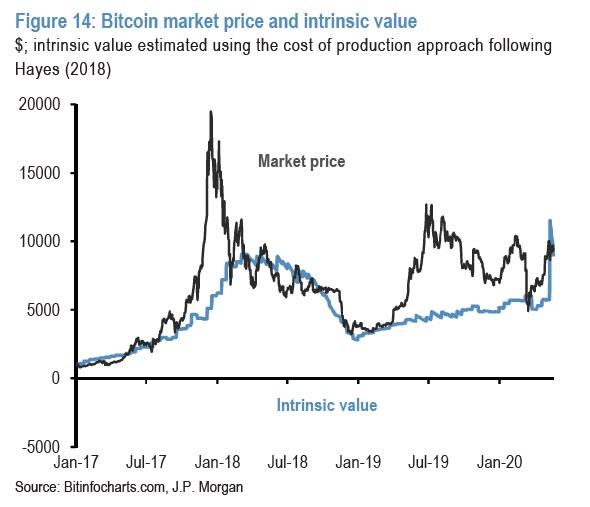

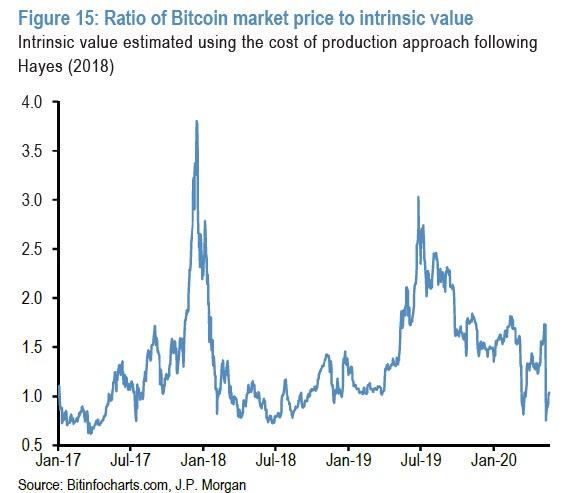

As the JPM strategist writes, "ahead of the halving of the bitcoin block reward from 12.5 bitcoins to 6.25, we updated our intrinsic value framework for bitcoin and used it to infer that markets effectively priced in a 25% decline in the amount spent on energy per day assuming market participants are rational and prices forward looking. How have things developed in the time since the halving event?"

To answer that question, the derivative strategist recapped his model for estimating this "intrinsic value." The approach taken to estimate a quantifiable intrinsic value for Bitcoin was to effectively treat it as a commodity and base it on the marginal cost of production. Mining cryptocurrencies consumes electricity, which results in a real-world cost incurred in nominal currency terms. In principle, a market price above that cost should induce miners to increase resources to mine coins, bringing the cost of mining higher until the marginal cost approaches the market price, while a price below that cost should induce higher cost producers to exit the market lowering the overall cost until it again approaches the marginal cost. The methodology was adopted by Hayes (2018), which first estimates the daily cost of production as a function of the computational power employed, cost of electricity, and energy efficiency of hardware. It then divides the daily cost of production by the expected number of bitcoins produced daily, estimated as a function of the block reward, hashing power employed and difficulty, to get a marginal cost of production per Bitcoin.

Long-story short, the market price and JPM's updated estimate of the intrinsic value of Bitcoin are shown in the chart below..

... while the ratio of actual to intrinsic price is in the following chart.

Given the halving of the bitcoin rewards that took place on May 11th, the intrinsic value estimate effectively doubled. Ahead of the halving event, JPM argued that, assuming market participants are rational and that the price is forward looking, the actual price trading 25% below what the intrinsic price would be after the event suggested markets effectively implying a significant decline in mining activity.

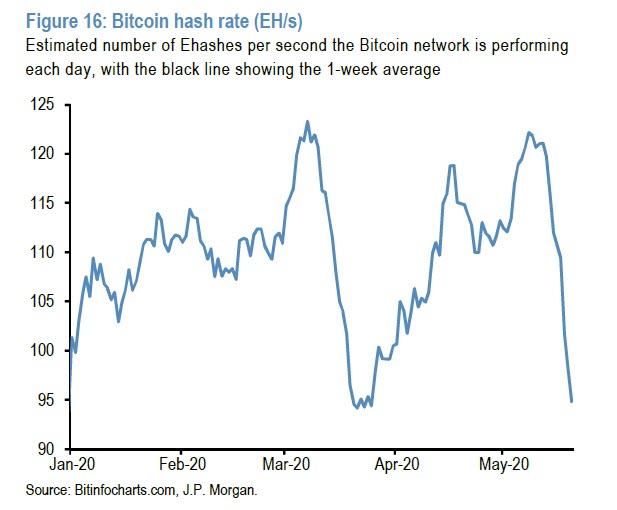

How have things developed since the halving? As the next chart shows, there has been a more than 20% decline in the hash rate on the bitcoin network since the halving event, similar to the one in magnitude that occurred during the nearly 50% collapse in bitcoin prices from late Feb to mid-March.

Moreover, the decline appears to have taken place against a backdrop of an improvement in average efficiency of mining hardware, as energy consumption per GH/s has declined by more than 15% from the day before the halving event according to estimates from Digiconomist, which would be consistent the idea that miners with less efficient rigs and/or in higher cost locations would in the short term bear the brunt of the decline in mining activity.

As JPM concludes, "the net effect of the two has been that the gap between our intrinsic value estimate and the market price has now effectively closed." In other words, a price of $9-10K is right around there bitcoin should be trading, something which the Goldman report failed to mention.

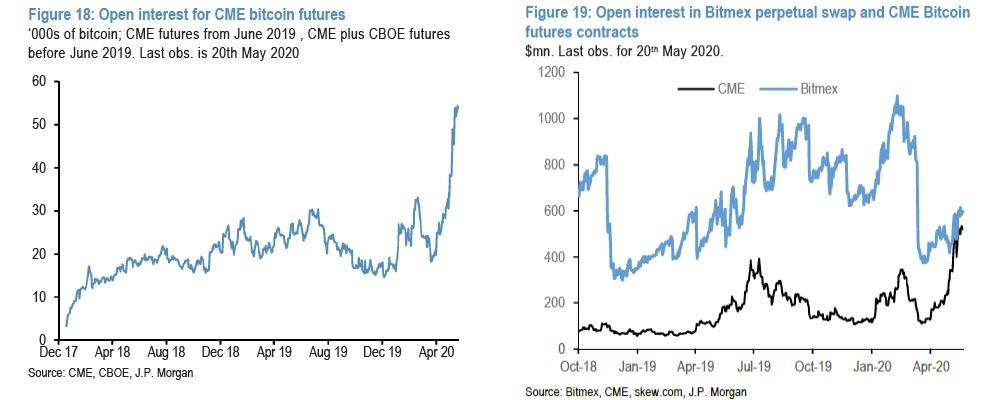

Intrinsic value of bitcoin aside, JPM looked at how institutions are positioned vis-a-vis the crytpocurrency. JPM found that the collapse in the market value of bitcoin in early March also saw a contraction in open interest of both bitcoin futures and options, which initially was slow to recover. However, in the run-up to the halving event, the open interest of both options and futures increased sharply, with option open interest in particular making new highs.

Moreover, futures open interest appears to have recovered faster for CME contracts than crypto exchanges, which saw a steep increase in open interest not just in dollar terms (partly due to the rise in prices since the March lows) but also increasing to 70% above its previous peak in bitcoin terms.

And the CME bitcoin options contracts launched in January this year, where aggregate open interest after an initially encouraging start had largely remained below $20mn, rose from around $13mn at the start of the May to around $170mn in recent days.

This suggests that, all else equal, the institutional adoption of bitcoin is starting to ramp up aggressively, just as Paul Tudor Jones predicted it would.

For those eager to read the PTJ report, it's attached below.

https://ift.tt/36yQY55

from ZeroHedge News https://ift.tt/36yQY55

via IFTTT

0 comments

Post a Comment