JPMorgan: Housing Affordability Could Be Restored Within 3.5 Years, But There's A Catch...

Authored by Sam Bourgi via CreditNews.com,

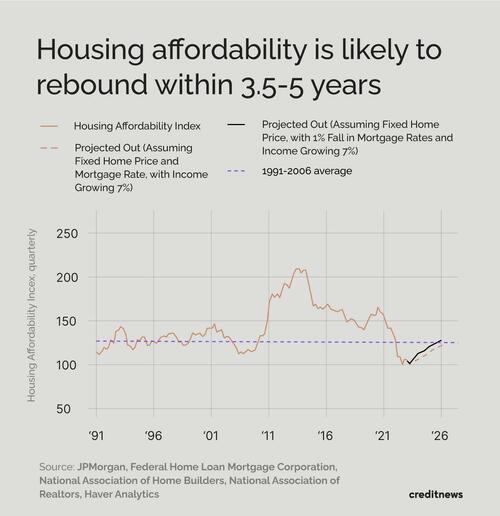

There may be light at the end of the tunnel for Americans struggling to afford a home, but it will take at least three and a half years to get there, according to Joe Seydl, JPMorgan’s senior markets economist.

Why three and a half years?

According to Seydl, that’s when Americans' paychecks will catch up to soaring housing costs.

That translates to an annual income growth of 7%.

“If you are looking to buy a house in the United States, don’t wait for, or expect, a home price crash,” Seydl wrote in a research report.

“We don’t foresee one coming (thankfully), nor do we think one is necessary to restore affordability at the national level. We think time and continued robust income growth can cure the problem on their own,” he explained.

There’s just one caveat to Seydl’s analysis: While housing affordability could potentially be restored in 3.5 years nationally, it’ll take longer in major metro areas.

If you are looking to snap up a house in Miami, Chicago, Houston, Las Vegas, Los Angeles, or New York, the wait may extend to five years.

While Seydl’s analysis should provide a boost of confidence to Americans struggling to afford their first home, they shouldn’t celebrate just yet.

Can wage growth be sustained?

Seydl’s conclusion hinges on "incomes continuing to rise at a robust rate." But can such growth be sustained?

According to the Atlanta Fed, wages were growing at 5.2% from September to November—much higher than at any point over the last two decades but down from a peak of 6.7% in mid-2022.

Meanwhile, inflation still remains well above the target and keeps eating into Americans’ paychecks. In fact, adjusted for inflation, Americans' wages have shrunk by 5% since pre-Covid.

Looking ahead to 2024, labor experts aren't expecting a wage renaissance either, pointing to shrinking annual budgets for payrolls.

"By all expectations, the mood for [wage growth in] 2024 is radically different than what it was going into 2023," Aaron Terrazas, Glassdoor’s chief economist, told CNBC.

According to a recent industry survey by Mercer, American companies are budgeting for a 3.9% increase in wages this year, down from 4.1% in 2023.

The other factor driving housing affordability

While higher wages would certainly improve housing affordability, fixing the chronically low supply of real estate may prove to be a much bigger challenge.

According to the National Association of Realtors (NAR), America is grappling with a "severe housing shortage that’s years in the making."

There are so few listings that even one of history's largest jumps in mortgage rates hasn't shaken the housing market.

In fact, as of November, median home prices stood at $409,000—16% higher than before Covid.

According to NAR, this has affected average or 'middle-income buyers' the most.

"Middle-income buyers face the largest shortage of homes among all income groups, making it even harder for them to build wealth through homeownership," said Nadia Evangelou, senior economist and director of real estate research at the National Association of Realtors.

"Even with the current level of listings, the housing affordability and shortage issues wouldn’t be so severe if there were enough homes for all price ranges," she said.

According to Redfin data, there were just 3.82 million existing homes for sale in 2023—a 7.3% decline from the previous year and the lowest since 2010.

https://ift.tt/piRaefj

from ZeroHedge News https://ift.tt/piRaefj

via IFTTT

0 comments

Post a Comment