Consumer Stress: Defaults Rise To Highest Level In 2019

One of the loudest narratives heading into the fall by the mainstream financial press is that a healthy consumer is propping up the US economy. Consumer spending at retailers, bars, and restaurants have slowed but nothing to warn about yet. Powered by record-high credit card spending, Americans are nearing the point of maximum leverage, which could be an ominous sign that good times are nearing an end.

The Trump administration, continuing to promote "the greatest economy ever" narrative to tens of millions of Americans ahead of a downturn is probably one of the most irresponsible things that a government can do. Artifical optimism has allowed consumers to rack up more debt than 2008, and it's a ticking time bomb that could shock millions since they haven't planned for a recession.

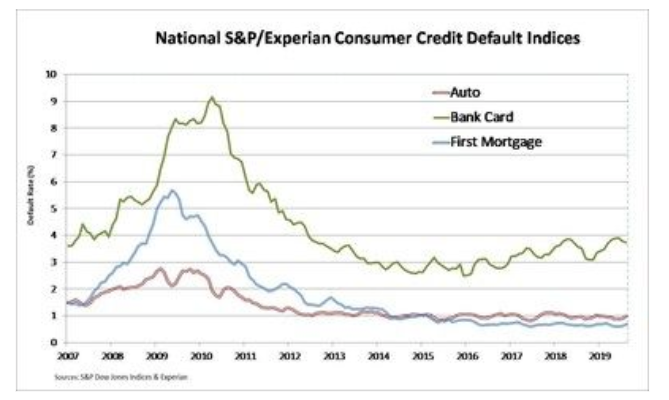

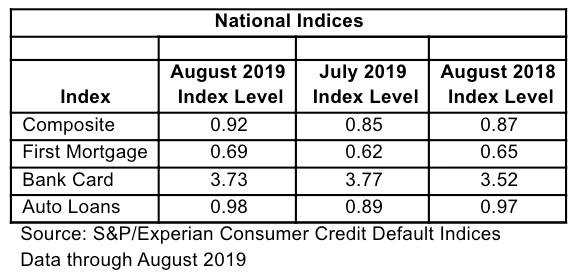

Consumer stress is starting to appear via new default data from S&P Dow Jones Indices and Experian. Their Consumer Credit Default Indices measure the changes in consumer credit defaults and show that the composite rate rose 7bps to 0.92% in August, the highest of the year. The auto loan default rate moved higher by 9bps to 0.98%, and the first mortgage default rate increased 7bps to 0.69%.

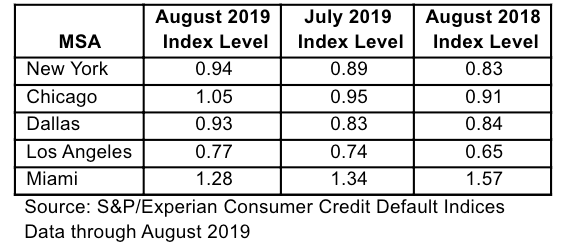

The report said Chicago and Dallas were some of the major metropolitan areas that showed MoM increases in default rates from July to August. Each was up 10bps to 1.05% and 0.93% respectively. The default rate for New York rose 5bps to 0.94%, while the rate for Los Angeles rose 3bps to 0.77 %. Miami was the only major city where default rates edged lower in late summer.

S&P/Experian Consumer Credit Default Indices are summarized in the table below. Auto loans and first mortgages were the drivers' late summer in pushing up the overall composite on an MoM and YoY basis.

Experian tracks the default rates of the consumer in four key loan categories: auto, bankcard, first mortgage lien, and second mortgage lien. Experian's database includes leading banks and mortgage companies and covers $11 trillion in outstanding loans sourced from 11,500 lenders.

And on a post World War II basis, the US economy has experienced 12 recessions, one every 6.1 years on average. After a decade from the financial crisis, the economy entered its fourth mini-cycle downturn in late 2018, seen in declining growth rates in inflation, manufacturing, and employment.

For a mid-cycle cut, the Federal Reserve needed to embark on a cut cycle last September. The failure to cut, and waiting at least 10 months (cut cycle started in July) -- is called a policy error, will likely result in a recession within the next several years.

Consumer confidence remains near two-decade highs, the unemployment level is at a 50-year low, and it's time the consumer prepares for the next downturn.

S&P/Experian consumer default data rising to the highest point of the year shows us the narrative of a robust consumer could be shortlived -- as the weakness in inflation, manufacturing, and employment will start to weigh more on the economy, contributing to a further rise in consumer stress.

https://ift.tt/2nuGq4y

from ZeroHedge News https://ift.tt/2nuGq4y

via IFTTT

0 comments

Post a Comment