Futures Slide As Gold Gets Monkeyhammered After Hitting $2,000 Tyler Durden Tue, 07/28/2020 - 08:01

S&P futures and European stocks slumped as market optimism faded during the busiest week of earnings season...

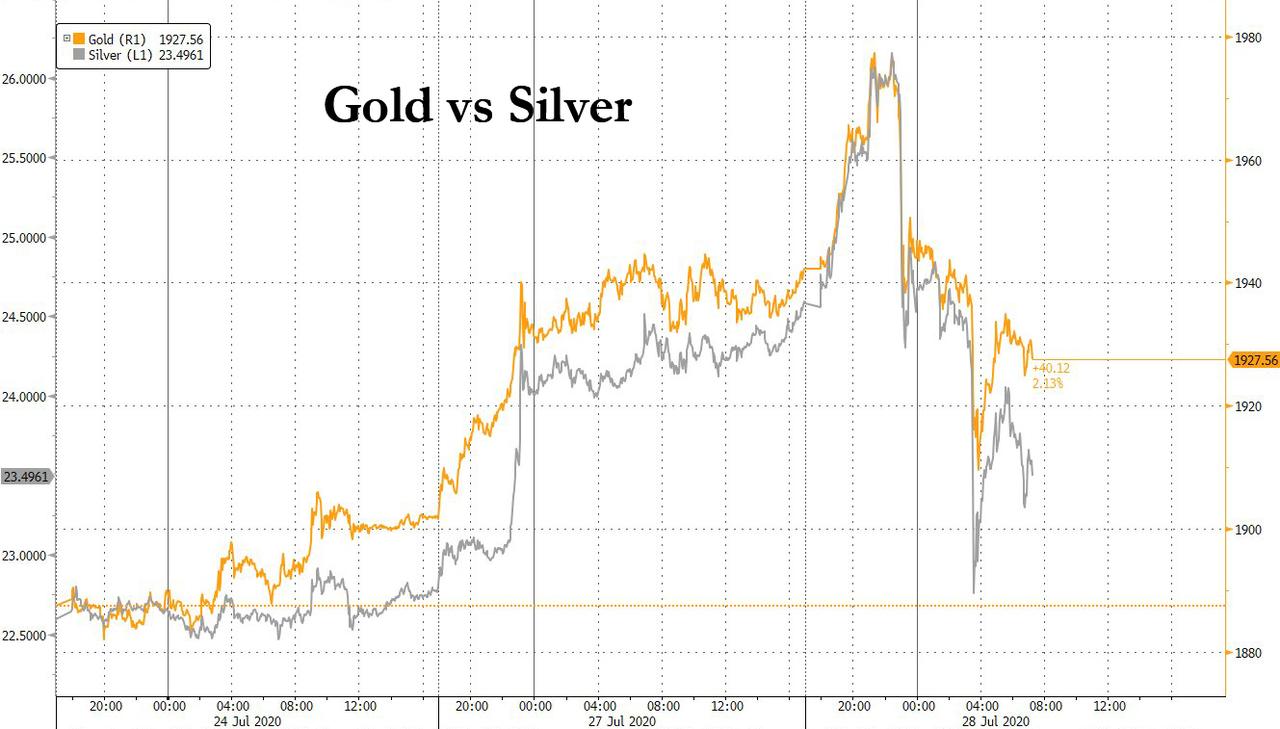

... while Gold was hammered moments after the December future hit an all time high of $2000 following a record-breaking rally, with spot gold tanking more than $30 in minutes and silver dropping as much as 2% before regaining composure.

Gold hit a record high on Tuesday before the sheer scale of its gains drew a burst of profit-taking, with the volatility prompting the Shanghai Gold Exchange to issue a notice on risk prevention and express a willingness to take action if required. The dump in gold also helped the dollar rebound from two-year lows.

It also appears that our old friend, Benoit Gilson is finally back in his Basel office.

After rising almost $40 higher at one point to reach $1,980 an ounce, gold was hit by a wave of selling which it pushed back to $1,915 in volatile trade. Gold is still up over $125 in little more than a week as investors bet the Federal Reserve will reaffirm its super- accommodative policies at its meeting this week, and perhaps signal a tolerance for higher inflation in the long run.

"Fed officials have made clear that they will be making their forward guidance more dovish and outcome-based soon," wrote analysts at TD Securities. “The chairman is likely to continue the process of prepping markets for changes when he speaks at his press conference.” One shift could be to average inflation targeting, which would see the Fed aim to push inflation above its 2% target to make up for years of under-shooting.

The retreat in gold took some steam out of stocks, with Europe’s STOXX 600 turning red even after MSCI’s broadest index of Asia-Pacific shares outside Japan ended up 0.8%. Italian and French markets led declining markets in Europe, with LVMH and Moncler SpA both dropping after the high-end apparel makers earnings missed analyst expectations. There were bright spots in earnings: PSA Group jumped as much as 5.6% after the Peugeot maker surpassed estimates for revenue and profit.

In the US, Pfizer jumped in the premarket after boosting its earnings forecast and saying it began a later-stage trial with a German partner for their top coronavirus vaccine candidate. McDonalds meanwhile slumped after missing on both earnings (EPS $0.65 vs exp. 0.74) and comp sales (-23.9%, exp. -22.3%).

Asian stocks trimmed tech-powered gains as the Taiex index briefly wiped out 3.5% rally, seen after TSMC extended its gravity-defying surge by another 9.9% to become 10th largest company in the world. Most markets in the region were up, with South Korea's Kospi Index gaining 1.8% and India's S&P BSE Sensex Index rising 0.9%, while Japan's Topix Index dropped 0.5%. The Topix declined 0.5%, with Chori and Mitsubishi Motors falling the most.

While China's Shanghai Composite Index rose 0.7%, with Sichuan Hongda and Jilin Forest Ind posting the biggest advances, the recent China stock bubble appears to have completely fizzled with trading in mainland equities cooling again on Tuesday with a further dip in turnover while overseas investors trimmed holdings for a fourth day, the longest streak in four months. Turnover in Shanghai and Shenzhen was 867 billion yuan on Tuesday, falling for a second straight day after ending a 17-day streak above 1 trillion yuan on Monday, according to Bloomberg. Overseas investors offloaded 2.23 billion yuan worth of Chinese stocks via exchange links; the four-day selling streak is the longest since late March, during a global slump in equities. Northbound net selling since July 23 has reached 23.75 billion yuan; for the month to date, overseas investors have net bought 10.9 billion yuan of mainland equities.

According to Bloomberg, investors are betting setbacks in the fight against the coronavirus will lead Jerome Powell to signal Wednesday that rates will stay near zero for longer. Health officials are tackling rising cases in countries ranging from Japan and China to Germany, underscoring the difficulty of curbing the pandemic.

Fabiana Fedeli, global head of fundamental equities at Robeco cast doubt on whether further Fed moves to supply liquidity and hold rates low will spark more gains in the biggest stock market: "What we’re going to need next for another leg up is a better macroeconomic outlook, because the next leg up will come from a rotation into cyclicals," Fedeli told Bloomberg TV. "Right now you can see some improvement in North Asia. But still not in the U.S.”

After days of sliding, the dollar turned stronger against all FX majors after the record-breaking precious metals rally showed signs of petering out. The euro pulled back from its highest since 2018; the pound slipped from a four- month high on a lack of fresh catalysts as some technical indicators suggested the U.K. currency’s recent gains were excessive. That said, the BBG DXY index slipped after a brief recovery when investors took profit on precious metal trades. A sharp drop in gold prices spurred a fall in commodity currencies, putting downward pressure on the Aussie and the Kiwi, which led losses against the greenback. Funds were seen cutting dollar balances before the start of the Federal Reserve’s two-day meeting, according to an Asia-based FX trader.

Alan Ruskin, head of G10 strategy at Deutsche Bank, noted currencies had been tracking the relative performance of their economies, so that high-ranked economic performance was associated with stronger currencies.

“One clear pattern is how economies linked most tightly to China — including commodity producers as diverse as Australia, Chile and Brazil — have tended to perform better than economies most directly linked to the U.S., notably its NAFTA trading partners," said Ruskin. The dollar has been falling almost across the board, reaching a two-year low against a basket of currencies at 93.416 before recovering to 93.975. The euro dropped back to $1.1710 after rising to its highest in two years at $1.1781. The dollar touched its lowest against the Swiss franc since mid-2015. It also fell to a four-month low of 105.10 against the Japanese yen before last trading at 105.57.

In rates, treasuries unwound Asia-session losses by early U.S. trading, leaving yields marginally richer across the curve vs Monday’s close. S&P 500 E-mini futures erased gains, helping lift Treasury futures off session lows, as Euro Stoxx 50 were pressured lower with no clear catalyst. U.S. 10-year yields were richer by 0.5bp at ~0.61%; bunds underperform by ~0.5bp, gilts by ~1.7bp following auctions of bonds due in 2027 and 2054. Treasury auction cycle concludes with record $44b 7-year note sale at 1pm ET; Monday’s 2- and 5-year auctions tailed while stopping at record low yields. IG credit issuance slate includes Adani Ports 7-year; $15.85 billion priced Monday, headed by AT&T jumbo deal.

Elsewhere in commodities, oil's front month benchmarks are modestly firmer but overall little changed and following the generally tentative equity sentiment this morning. Today's private inventory release is expected to show a build of 1mln compared to last week’s more considerable, and unexpected, build of 7.54mln.

Looking at the day ahead, expected data include consumer confidence. Harley-Davidson, McDonald’s, Pfizer, Amgen and Starbucks are among companies reporting earnings.

Market Snapshot

- S&P 500 futures -0.5% to 3,216.0

- STOXX Europe 600 up 0.4% to 367.59

- MXAP up 0.3% to 167.30

- MXAPJ up 0.9% to 551.70

- Nikkei down 0.3% to 22,657.38

- Topix down 0.5% to 1,569.12

- Hang Seng Index up 0.7% to 24,772.76

- Shanghai Composite up 0.7% to 3,227.96

- Sensex up 1.2% to 38,392.74

- Australia S&P/ASX 200 down 0.4% to 6,020.50

- Kospi up 1.8% to 2,256.99

- Brent futures down 0.1% to $43.36/bbl

- Gold spot down 0.6% to $1,930.73

- U.S. Dollar Index up 0.2% to 93.90

- German 10Y yield fell 0.4 bps to -0.495%

- Euro down 0.3% to $1.1714

- Italian 10Y yield fell 1.0 bps to 0.862%

- Spanish 10Y yield rose 0.9 bps to 0.349%

Top Overnight News

- Senate Republicans presented their $1 trillion plan to bolster the pandemic-ravaged U.S. economy with a package that that didn’t completely settle differences within the GOP

- Gold’s record-breaking rally showed signs of losing steam after futures touched $2,000 an ounce for the first time

- The European Central Bank urges banks to hold off on returning capital to shareholders and show moderation in setting bonuses amid the coronavirus outbreak in a blow to some lender

- China’s “bat woman” says the U.S. president owes her country an apology as she again denied assertions that the novel coronavirus is linked to the Wuhan lab where she works

- Spanish Prime Minister Pedro Sanchez lashes out in response to the U.K. ratcheting up its travel ban to Spain to include popular holiday islands

APAC stocks traded mostly higher as the initial optimism abated despite a lack of fresh catalysts and a positive handover from Wall Street, which saw the NDX rise almost 2% as tech stocks surged, with Netflix, Amazon and Apple all closing higher by between 1.5-3%. ASX 200 (-0.4%) was driven by upside in the mining sectors at the open as precious metals continued on their upwards trajectory before paring gains. Nikkei 225 (-0.2%) had somewhat of a lacklustre start amid currency dynamics but later managed to notch some gains for the session. KOSPI (+1.8%) saw firm advances amid hopes of an economic rebound coupled by stable COVID-19 infection rates, whilst Samsung Electronics joined the broader tech rally with gains in excess of 6% as it further propped up the index. On that note, Taiwan’s chip-behemoth TSMC rose as much as 10% today after a similar rally yesterday, to obtain a spot in the top 10 largest stocks by market cap. Elsewhere, Hang Seng (+0.7%) and Shanghai Comp (+0.7%) conformed to the broader gains across the region, with the former buoyed by IT stocks following the debut of its tech index, whilst Mainland China was supported by a PBoC liquidity injection.

Top Asian News

- SoftBank Hits New Highs as Son’s Investing Record Is Reappraised

- Nissan Forecasts Sharp Sales, Profit Drop as Business Struggles

- Tencent Offers $2.1 Billion for Chinese Search Giant Sogou

European equities (Eurostoxx 50 -0.4%) traded with little in the way of firm direction with incremental newsflow since yesterday’s close relatively light for much of the session; however, as US participants begin to arrive both European bourses & US equity futures have slipped a touch – with the e-mini S&P Sep’20 future down some 10 points. One of the minor outliers in Europe has been the CAC 40 (-0.7%) with the index hampered by performance in LVMH (-5.3%) after posting a 68% decline in H1 profits amid the COVID-19 hit to the luxury sector, whilst the Co. also refrained from providing much in the way of detail on its prospects for the recovery; Hermes (-2.2%), Kering (-1.7%) have been seen lower in sympathy. Stemming some losses from the index has been PSA (+3.3%) after exceeding expectations for H1 net revenues and adjusted operating profits, support for the CAC 40 has also been provided by Carrefour (+3.5%) ahead of aftermarket earnings later today. Sector-wise UK homebuilders are cheering reports in the FT suggesting that UK Ministers are said to be drawing up plans to extend the "Help to Buy" property scheme past its December deadline to prevent buyers from losing out due to pandemic-related delays. For the Eurozone banking sector, as flagged, ECB extended its recommendation for Eurozone banks not to pay dividends until January 2021. Other notable movers include, Delivery Hero (+0.5%) after raising FY revenue guidance and UBI Banca (+7.8%) with Intesa Sanpaolo (-1.3%) stating that it sees its bid for the Co. as likely to succeed. Notable US earnings today include Pfizer, 3M, Starbucks, Altria, Amgen, McDonald's, Visa & eBay.

Top European News

- Spain Lashes Out at the U.K.’s ‘Unbalanced’ Travel Ban

- Spanish Unemployment Rises Above 15%, With Worse to Come

- Intesa Expects UBI Takeover to Succeed as Deadline Is Extended

In FX, it seems as if Usd 2000/oz and 1.1800 were just too rich or resistant for bullion and single currency buyers, but the subsequent reversals also coincided with specific factors such as the US Mint cutting Gold and Silver coins to suppliers and Japanese data revealing the biggest net oversold Eur/Jpy intraday positioning since October 2018. Moreover, one trader in Japan contended that Euro optimism based on economic recovery is simply overdone and the cross is now well below 124.00, while Eur/Usd is testing 1.1700 bids from a circa 1.1781 high on Monday. Back to the yellow metal, spot hit a fresh peak around Usd 1980 and the December 2020 future did crest the 2k mark, but only briefly and some might say for sentiment’s sake or the tape before an abrupt and aggressive about face. Clearly, long liquidation, profit taking and stops were tripped amidst the recoil, with contacts noting technical selling when the prior record high (Usd 1921 or so) was breached on the way back down, but the retracement has petered out ahead of Usd 1900 and very close to a Fib level as the clock ticks down to front month July contract expiry on Wednesday where there could still be residual physical demand for delivery.

- USD - The Dollar looks in prime position for a classic turnaround Tuesday, albeit at the behest or whim of others and notwithstanding another twist in the tale. Indeed, after only just holding above yesterday’s low (at 93.492 vs 93.469) the index is back near 94.000 and has been a fraction over the round number on broad recovery gains in Buck/major pairings. Ahead, US consumer confidence and some regional Fed surveys on FOMC day 1.

- NZD - Not quite a case of hero to zero, but the Kiwi has been hit hardest in G10 circles by the Greenback’s revival, and with added pressure from NZ joining the throng of countries cutting extradition ties with Hong Kong in response to China’s new national security law. Nzd/Usd has retreated through 0.6650 after touching 0.6700 and braced for Beijing’s anticipated response.

- CAD/AUD/JPY/GBP/CHF - Also yielding to the US Dollar’s ‘renaissance’, but to varying degrees with the Loonie unwinding gains between 1.3330-90 parameters, Aussie pivoting 0.7150, Yen straddling 105.50, Sterling slipping from 1.2900+ and Franc back under 0.9200, though the latter clawing back some heavy losses vs the Euro from under 1.0800.

- SCANDI/EM - The Swedish Crown continues to outperform and solid data is helping as retail sales gathered pace in June, while the trade surplus swelled compared to May, but the Norwegian Krona is lagging despite an even bigger pick up in consumption as Eur/Nok hugs 10.7000 in contrast to Eur/Sek holding sub-10.3000. Elsewhere, at last a break from monotony for the Turkish Lira, but not a positive move as the Try succumbed to a flash crash overnight and is struggling to recover within a 6.9075-6.8615 range even though the country’s BDDK banking watchdog has exempted foreign development banks from restricted access to Lira liquidity.

In commodities, precious metals have once again taken the spotlight but are somewhat tarnished after this mornings & APAC price action. Overnight, spot gold fell from highs of USD 1981.20/oz by some USD 40/oz, with little in the way of a clear fundamental catalyst or driver for the move. Since then, price action has come under further pressure dropping to the session low of USD 1907.20/oz shortly after the European cash equity open. In terms of potential drivers for this move the reversal in the USD is a plausible catalyst with the DXY having picked up considerably given recent price action to a high above the 94.00 handle. Alongside this the GOP stimulus unveiling and positioning pre-FOMC may have a role to play. Technically, investors may well be electing to take physical delivery of gold rather than roll their futures contract over, July future expires on 29th July, alongside the US mint reducing gold and silver coin supply to purchasers; the latter may be factoring into the demand side as well as the obvious supply implications as investors could be concerned regarding the scope for physical delivers to be readily available in the period ahead. In terms of levels to watch out for, USD 1900/oz serves as the clear psychological barrier to watch and below this USD 1898.75/oz was the low from Monday. Note, the volatility seen in gold and silver has prompted the Shanghai Gold Exchange to issue a notice on risk prevention and express a willingness to take action if required. Turning to WTI and Brent it has, again, been a session devoid of fundamental catalysts explicitly for the crude complex and as such the front month benchmarks are modestly firmer but overall little changed and following the generally tentative equity sentiment this morning. Tonight’s private inventory release is expected to show a build of 1mln compared to last week’s more considerable, and unexpected, build of 7.54mln.

US Event Calendar

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.3%, prior 0.33%; YoY NSA, est. 4.05%, prior 3.98%

- 10am: Conf. Board Consumer Confidence, est. 95, prior 98.1; Present Situation, prior 86.2; Expectations, prior 106

- 10am: Richmond Fed Manufact. Index, est. 5, prior 0

DB's Jim Reid concludes the overnight wrap

Truth be told it’s not been the most exciting last 24 hours to report in markets at least for newsflow, however with some of the more significant events still to come, the Fed meeting on Wednesday and a slew of corporate earnings being the most obvious, hopefully there should be more to talk about over the coming days.

Despite what felt like a classic summer lull session, equities still trended higher across the pond with the S&P 500 closing +0.74% and reversing all of Friday’s decline. As we’ve become accustomed to, the market had large cap tech to thank with the NASDAQ rallying +1.67%. That means that since the March 23 lows, the index has gained at least 1% in a single session 33 times in the 87 trading days during the period. As noted at the top, we’ve got a jam-packed next four days for earnings with 179 S&P 500 companies reporting including the likes of Alphabet, Amazon and Apple so the sector will be firmly in the spotlight. Speaking of earnings, so far the overall story has been positive with 82% of companies beating analyst’s estimates (with 129 companies having reported), compared to 65% last quarter. Although how much of that is due to the number of companies that pulled guidance three months ago at the height of the selloff.

Meanwhile, there’s been no stopping Gold recently with the precious metal up another +2.11% yesterday. Overnight, futures briefly touched $2000/oz with spot now at $1945/oz. That puts it up an incredible $475 since the March lows. Silver also made headway yesterday, jumping another +8.00% which means that since the end of June alone it is up +35.05%. Treasuries were a shade weaker through all of this, with 10y yields up +2.6bps while the USD index fell another -0.81%, meaning it’s now dropped 7 days in a row and 11 times in the last 12 trading days.

Asian markets are following Wall Street’s lead this morning with the Nikkei (+0.10%), Hang Seng (+0.53%), Shanghai Comp (+0.60%), Kospi (+1.23%) and ASX (+0.09%) all advancing while futures on the S&P 500 are up +0.09%.

Back to yesterday, where we did get some headlines around the latest fiscal developments in the US. Senate Republicans unveiled their opening salvo, with the bill a reported $1tn and which includes cutting supplemental unemployment benefits to $200 weekly from $600 until states are able to provide 70% of a worker’s previous pay. There remains a great deal of consternation within the party, as Senator Lindsey Graham said Sunday that half of his caucus are going to vote no on any additional stimulus. Majority Leader McConnell said that the end of the first week of August is still the target date, so time is ticking. Overnight, House Speaker Nancy Pelosi delivered a harsh assessment of the GOP plan, calling it a “pathetic” piecemeal approach and saying it wasn’t adequate to the country’s needs. However, she added “having said that, we are going to see if we can find some common ground. But we are not there yet.”

In other news, it was a slightly different picture here in Europe yesterday where the STOXX 600 closed -0.31% albeit on well below average volumes. Bonds were stronger, with 10y Bund yields down -4.3bps and with the rally it’s worth noting that the stock of negative yielding debt in the world hit $15.18tn yesterday, taking it above the March highs. However it’s still some way off the $17.04tn back in August 2019. The weakness in Europe appeared to be due to some of the deteriorating virus data. In Germany, the public-health authority announced a “very concerning” trend of case growth traced to a farm in Bavaria. Similar concerns are faced in the Catalonia region of Spain, where the regional President Torra said the region faces a critical situation with coronavirus outbreaks. For more, see the latest Exit Strategy Policy Tracker from our team member Marion, (link here).

Staying with the virus, Moderna started its late-stage vaccine trial in the US with 30,000 people and received an additional $472 million award from the Biomedical Advanced Research and Development Authority (BARDA) over the weekend. In terms of cases, California’s 7-day average of new cases fell to just under 2.3%, which is the lowest level since mid-June before the recent acceleration in cases. Florida similarly has seen its 7-day average rate of new cases drop under 3% for the first time since the current wave started last month. Overall the US’s 7 day average is now under 1.7% new cases per day for the first time this month, indicating reinstated restrictive measures are indeed slowing the rate of spread.

Elsewhere, Australia’s state of Victoria reported a further 384 new cases in the past 24 hours and said that it will suspend all but the most urgent elective surgeries. In Vietnam, provinces are now making it mandatory to wear masks in public after an unexpected flare-up in community infections in Danang (reported 11 new cases yesterday). Danang province has put about 7,000 people in quarantine for 14 days. China also reported 68 new infections overnight with 1 new case in Beijing which went without any case for over 2 weeks in a row. Hong Kong, India and Japan are also showing concerning trends.

In terms of data, Germany’s July Ifo business climate reading came in at 90.5 (vs. 89.3 expected), up from a revised 86.3 from last month, but still well below pre-pandemic levels. US preliminary June durable goods orders rose by 7.3% (vs. 6.9% expected) last month after the prior month’s downwardly revised 15.1%. The speed of recovery slowed even though the overall level of orders remains well below February’s recording. Staying in the US, the July Dallas Fed manufacturing activity index was at -3.0 (vs. -4.8 expected) up from the prior month’s -6.1 reading and nearly at 2019’s average overall level. Euro Area June M3 money supply grew to 9.2% y-o-y, (vs. -9.3% expected) up from last month’s 8.9%.

Finally to the day ahead, where this morning we get the UK July CBI distributive trade survey, while this afternoon releases in the US include the July Conference Board consumer confidence and the July Richmond Fed manufacturing index. In terms of earnings we will see results from Starbucks, Visa, McDonald’s, Pfizer, Peugeot and Nissan.

https://ift.tt/3g8Ax38

from ZeroHedge News https://ift.tt/3g8Ax38

via IFTTT

0 comments

Post a Comment