Sovereign Wealth Funds Shun US Stocks As Valuation Concerns Mount Tyler Durden Sun, 08/30/2020 - 09:35

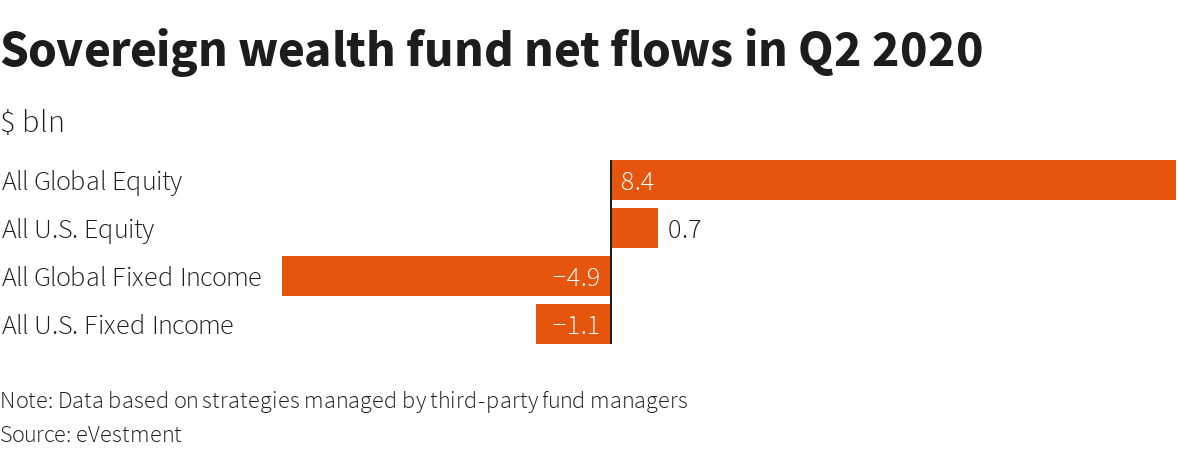

Sovereign wealth funds flocked to global equities (ex-U.S.) and out of bonds during the second quarter, reported Reuters, citing new data from eVestment.

U.S. equity strategies were not in favor during the quarter (only attracting a net $704 million) as funds pulled a net $5.2 billion out of fixed income and shifted a net $6 billion into global equities outside the U.S.

"We're seeing the sovereign wealth funds doing quite a lot of active search activity now in international equities, equities excluding the U.S.," said Matthew Williams, head of institutional sales at Franklin Templeton, who spoke with Reuters.

"There is usually an increased allocation to equities as a hedging mechanism, given the historical negative correlation between equities and oil prices, and I think that's evident in what the oil-dependent sovereign wealth funds have been doing," Williams said.

He said fund inflows into U.S. equity strategies were limited because of stock market valuations and election concerns.

"Institutional allocators are keeping some of their powder dry on the U.S. equity allocations at the moment," he said.

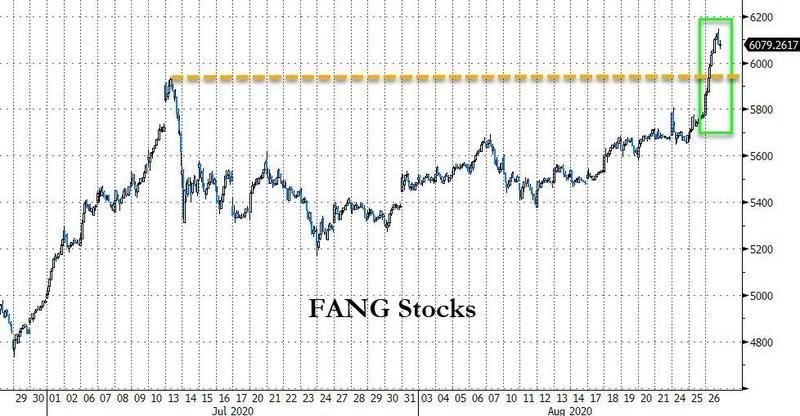

The investment flows suggest sovereign funds are staying clear and or selling the tech-induced blowoff in U.S. stocks.

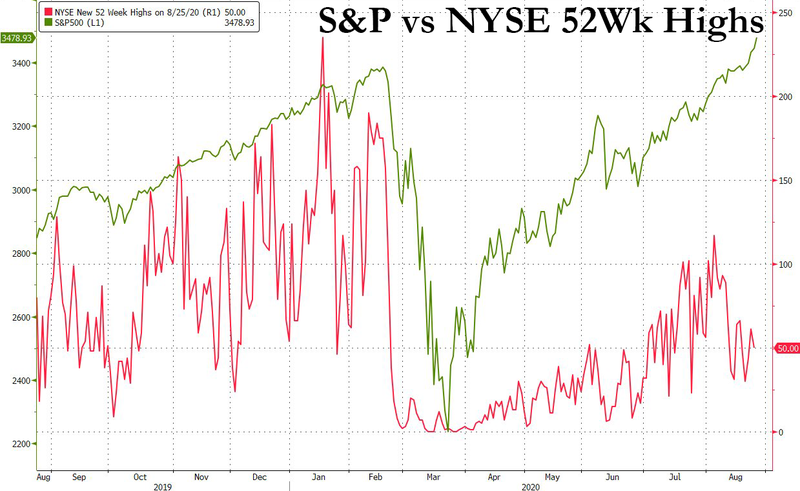

These funds are certainly watching terrible market breadth as only a handful of technology stocks powers main equity indexes higher.

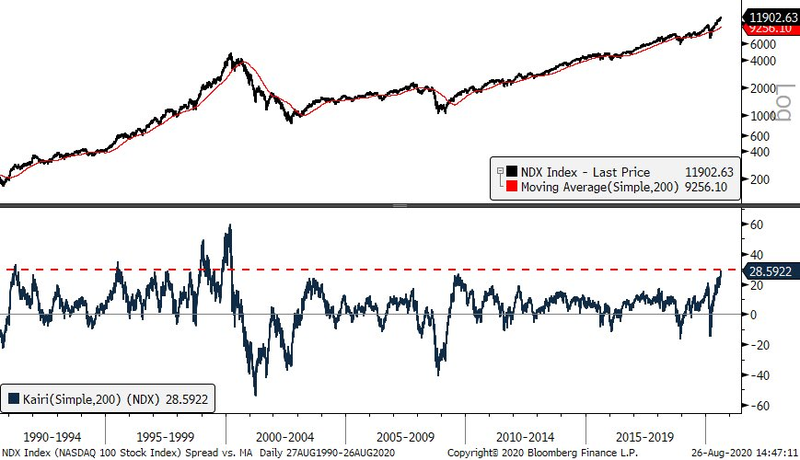

Nasdaq is now 28% above its 200 DMA, the widest spread since 2000... Funds are concerned a breadth scare is ahead.

FANG stocks aren't cheap, now hitting new highs.

Bad market breadth, overvaluation, and election concerns are some of the reasons why sovereign fund flows into U.S. stocks during the second quarter remained low.

https://ift.tt/2QEsFLG

from ZeroHedge News https://ift.tt/2QEsFLG

via IFTTT

0 comments

Post a Comment