30Y Treasury Yield Tumbles Below 2.00%, Japanese Stocks Plunge

Short-dated Treasury yields are extending their rise from Friday's bloodbath as the collapse of the long-end of the term structure accelerates in early Asia trading.

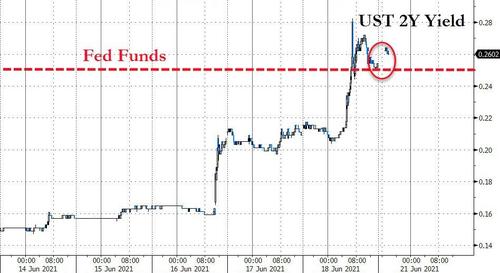

2Y is back above the Fed Funds rate...

Source: Bloomberg

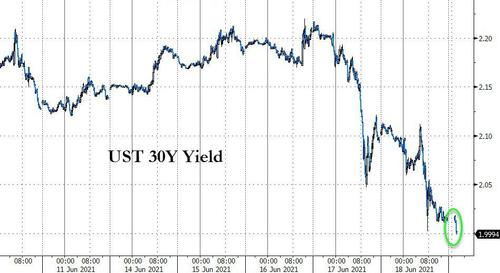

and 30Y yields are back below 2.00%...

... for the first time since March...

Source: Bloomberg

10Y yields are at their lowest since early March...

Source: Bloomberg

And Japanese equity markets are none too happy with Powell's policy error malarkey...

Source: Bloomberg

As Lance Roberts noted earlier, there have been ZERO times in history when the Fed started a rate hiking campaign that did not lead to a negative outcome. We suggest this time won’t be any different.

https://ift.tt/3zISe3N

from ZeroHedge News https://ift.tt/3zISe3N

via IFTTT

0 comments

Post a Comment