Goldman Explains Why Investors Panic-Bid Long Bonds Today

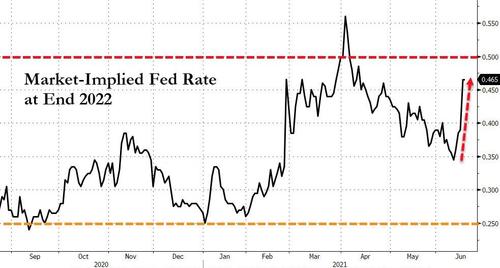

After spiking significantly immediately after The Fed's so-called "hawkish" statement, the long-end of the yield curve collapsed today with 30Y yields down 17bps from the post-FOMC highs before finding some support as investors may be interpreting the Fed’s hawkish tilt Wednesday as a sign that an extended US post-pandemic economic expansion may be a bit harder to achieve in a potentially emerging environment of less accommodative monetary policy....

Source: Bloomberg

Why buy long-dated US risk-free bonds if the US central bank just indicated that it may want to raise its benchmark Fed funds rate earlier than previously expected?

Goldman's Chris Hussey explains that the answer may lie more in duration than anything else.

Shorter-term US Treasuries are little changed today. But the longer-term view for US growth seems to be taking on a bit more of a cautious complexion with the bid for long-dated yield.

Given the post-Great Financial Crisis history of anemic US growth, investors may be saying today that they are uncomfortable with how strong the US economy can grow without monetary accommodation once we have reached out beyond this current post-pandemic reopening bounce period.

Interestingly, however, David Mericle and team are not totally certain that the Fed will raise rates sooner than 2024 - even after Wednesday’s revelation that 13 of the 18 Fed members now anticipate a rate hike by 2023...

Source: Bloomberg

The weekly jobs update also disappointed today with a rise in weekly jobless claims to 412k from 375k last week. The monthly Payrolls report has disappointed for two months in a row and may further suggest that the initial boost from people finally getting outside again may already be starting to fade - just as the Fed turns a bit more hawkish.

In other words, the bond markets are starting to price in another policy error by The Fed.

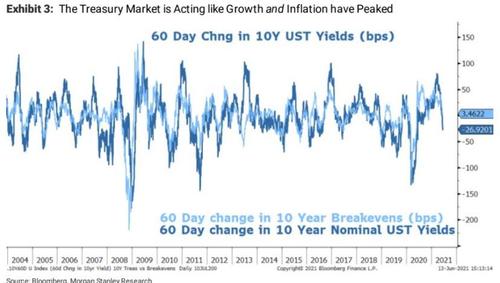

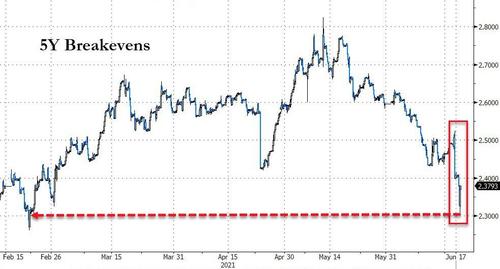

This perspective agrees with BofA's Mike Wilson who warned earlier in the week that the sharp reversals in nominal 10Y yields and breakevens...

Source: Bloomberg

... could be an early signal that both growth and inflation may start to disappoint what are now lofty expectations.

The culprit in our view is a first quarter level of demand that was aided by $1.9 trillion fiscal stimulus and a rise in crypto currencies that added another $1 trillion to wealth. Neither one of these are likely to be repeated in our view; and in the case of crypto, there has been an approximately $ trillion reduction of wealth in just the last month that could have a negative effect on demand/spending.

Bottom line, we still think growth and inflation will be quite strong over the next year. However, the first quarter experienced extraordinary demand that we think is likely to mark the peak rate of change for both.

The Treasury market appears to agree, not to mention some of the more cyclical equity sectors,especially early cycle ones like autos, home builders/improvement, retailers, semiconductors and transports

https://ift.tt/3xvLvIw

from ZeroHedge News https://ift.tt/3xvLvIw

via IFTTT

0 comments

Post a Comment