"Now In Bust Cycle" - China Hog Futures Plunge Near Record Lows On Pork Glut

Chinese hog futures have fallen nearly 38% since launching in January amid rising concerns that the Chinese pork market has gone from shortage to surplus.

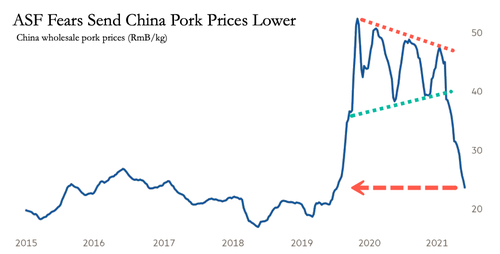

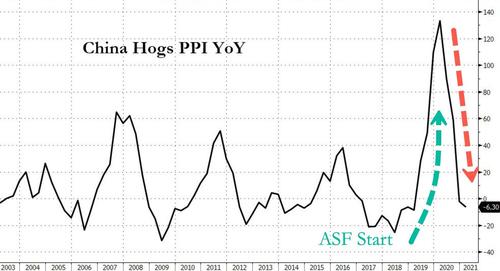

Readers may recall African swine fever was first reported in China in August 2018. The spread of the disease slashed the country's hog herd by at least 40%, resulting in hyperinflation of pork prices by 2019.

African swine fever has since been eradicated to some extent in the country as the government urged farmers to breed more pigs. At the same time, China Customs data showed the country imported a record amount of pork from the US in late 2019 and 2020 to replenish supplies.

Now the country has gone from a supply deficit to a supply surplus, sending domestic prices tumbling in 2021.

Hog futures on the Dalian Commodity Exchange dropped more than 8% in the last four sessions to Rmb18,980 ($2966.23), a record low. Since the contracts started trading in early January, hog prices are down nearly 38%.

Pork prices are back to levels not seen since the beginning days of the outbreak.

Plunging prices are getting out of hand as farmers race to slaughter their herds before prices head lower - adding to oversupply fears, according to Financial Times.

"It's definitely surprising how fast and far pork prices have fallen," said Darin Friedrichs, an analyst at commodities broker StoneX Group in Shanghai.

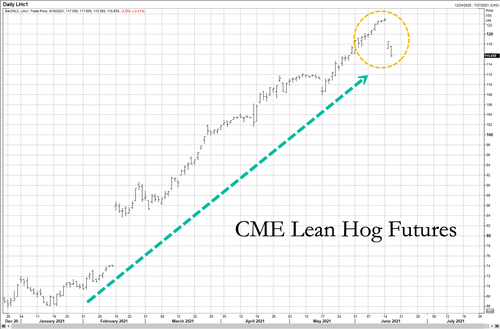

Oversupply pork conditions have affected US pork markets on Tuesday. Lean hog futures trading on the Chicago Mercantile Exchange are down 3%.

The latest drop in Dalian-traded hog futures is likely linked to a report by Beijing's Xinfadi market, a large wholesale market, last Friday that noted smaller pigs were being brought for sale.

This "indicates some farms have significantly lowered their expectations for future meat prices and . . . are slaughtering ahead of schedule", according to the report.

Downward pressure on prices has been so concerning that China's cabinet, the National Development and Reform Commission, addressed the issue last week by promising to "maintain supply and stabilize prices in the pork market." However, there was no word on what policies the agency would take.

Friedrichs said the government had anticipated the launch of hog futures contracts would flatten out boom and bust cycles in Chinese pork prices. "Now we're in a bust cycle, so the volatility is still there," he said.

Pork prices are a heavyweight in China's consumer price index, and declining prices in late 2020 managed to push inflation into negative territory for the first time in over a decade. Also, China's producer price index for hogs has gone negative on a year-over-year basis.

What may happen is that Chinese importers will order much less pork from the US this year.

https://ift.tt/3vxQUgD

from ZeroHedge News https://ift.tt/3vxQUgD

via IFTTT

0 comments

Post a Comment