Amidst COVID-Fueled Demand, Bike Company Shimano Is Shattering Profit Projections

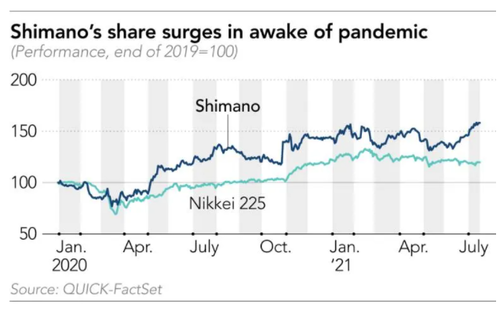

Bike company Shimano has been a massive beneficiary of the Covid-19 pandemic.

During the midst of 2020, it was difficult to find a bike to buy almost anywhere in the world - local shops were drained of inventory and service centers had lead times for appointments that were stretching out months; all for an industry that usually stays at a relatively steady ebb and flow.

Osaka based Shimano, which was founded in 1921, has "hundreds of employees" working "flat out" to try and meet a "voracious" global demand that shows no signs of stopping, according to Nikkei.

Taizo Shimano, the company's president, said: "There is no factory that is not in full operation at the moment."

The demand has driven the company's sales and profits to record levels; it posted $574 million in net income in 2020, up a stunning 22.5% from the year prior. The company is estimating another jump in net income to about $717 million.

88% of the company's sales came from outside of Japan last year, with Europe being its largest market and accounting for about 40% of its sales. Taizo Shimano is looking to expand the company geographically: "Asia has two enormous markets, China and India."

Its market cap exceeded that of Nissan last year, the report notes. Shimano says demand "has grown explosively", commenting to Nikkei: "We deeply apologize [for the lack of supplies]. ... We are reprimanded by [bicycle makers]."

He remains unsure whether or not pandemic-catalyzed demand will continue to rise after 2023. Nonetheless, the company is expanding. "There are growing number of people concerned about [their] health," Shimano said, citing a reason as to why the trend could continue.

Satoshi Sakae, a Daiwa Securities analyst, said: "There is a risk factor, as bicycle demand after the pandemic is uncertain." A second analyst claims that the company "owes much of the rise in the stock price in 2020 to its former president, Yozo."

The company says its production will rise 50% this year compared to 2019. It's also investing "13 billion yen in domestic factories in Osaka and Yamaguchi Prefecture to increase capacity and improve efficiency" and "expanding in Singapore, the company's first overseas production site, which it built almost five decades ago" by erecting a 20 billion yet plant, the report says.

China's bicycle market is forecast to reach $16 billion in 2025, which is a rise of 51.4% from 2020. India is expected to grow 48%.

Justinas Liuima, a senior consultant at Euromonitor International, concluded: "Urbanization, rising health awareness, investments into bicycle infrastructure and changing commuting patterns after the pandemic are anticipated to lift demand for bicycles [in Asia]."

https://ift.tt/3xPgu2M

from ZeroHedge News https://ift.tt/3xPgu2M

via IFTTT

0 comments

Post a Comment