China GDP Growth Disappoints As Credit Impulse Crashes

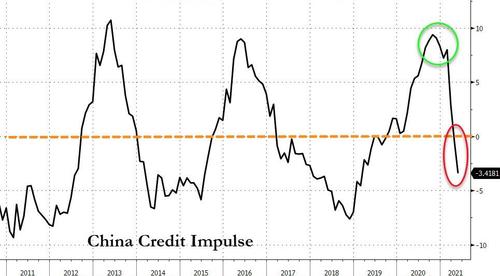

Following Q1's record-breaking surge in China's YoY GDP (thanks to base-effect malarkey and a massive credit impulse), tonight's Q2 GDP was expected to slow drastically (especially given the crackdown on investment/real estate deleveraging and the collapse in the credit impulse)...

Source: Bloomberg

The question is how much? Consensus estimates called for an 8.0% YoY GDP rise, but whisper numbers were notably lower with Bloomberg Economics' Shu noting that various early indicators are consistent in pointing to some weakening in consumption in June.

“On balance, these indicators suggest production growth - after base effects are taken into account - may have slowed, but only a touch.”

The official services PMI fell to 52.3 in June from 54.3 in May, while its Caixin counterpart showed a much steeper slide from a strong reading to just slightly above 50 - the line between expansion and contraction.

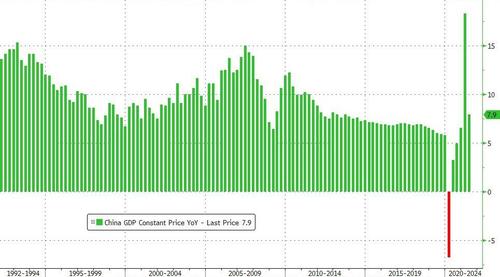

The headline GDP growth figure printed a very slightly disappointing +7.9% YoY

Source: Bloomberg

On A QoQ basis, Q1 GDP growth was downwardly revised from +0.6% to +0.4% which helped push Q2's QoQ GDP 1.3% higher (better than the +1.0% QoQ expected).

Source: Bloomberg

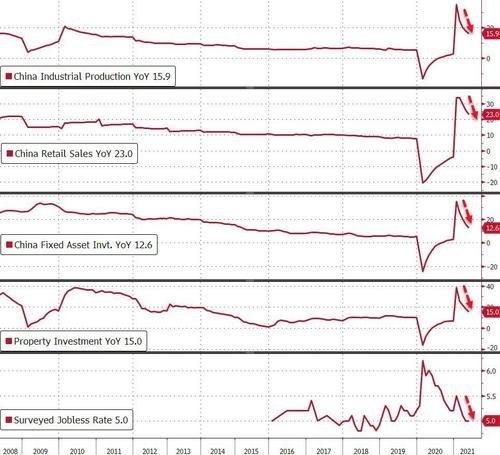

Other data was mixed, with Industrial Production and Property Investment disappointing as all major data items showed slowing growth...

Source: Bloomberg

June Retail Sales rose 23.0% YTD YoY (better than the +22.8% expected) but slower than the +25.7% in May.

June Industrial Production rose 15.9% YTD YoY (slightly weaker than the +16.0% expected) and slower than the +17.8% in May.

June Fixed Asset Investment YTD YoY rose 12.6%, down from the 15.4% rise in May (but better than the +12.0% expectation).

June Property Investment YTD YoY rose just 15.0% (worse than the +16.0% expected) and well down from the +18.3% in May.

June Surveyed Jobless Rate was unchanged at 5.0%.

This will likely be a little confusing to traders.

Given China's headline data wasn’t terrible, with retail sales even beating estimates, why does the economy needs more central bank support?

Bloomberg's Chief China Markets Correspondent, Sofia Horta e Costa, points out that "it may be that’s there’s a problem with China’s financial plumbing where banks aren’t lending or credit demand is weak. This is tricky to read."

Can we say the RRR cut and calls for lower interest rates are not at all about the economy, but about the banking system? The sector is struggling under the impact of a negative credit impulse, the deleveraging campaign and increasing corporate defaults.

There is one side note: The country’s energy companies are starting to see demand declining after months of robust increase underpinning the recovery.

Apparent oil demand fell for a second straight month, down 1.7% from a year earlier.

No major reactions in markets to any of the data for now as Yuan is leaking lower against the dollar and Chinese bank stocks are rallying.

https://ift.tt/2VJpmsB

from ZeroHedge News https://ift.tt/2VJpmsB

via IFTTT

0 comments

Post a Comment