Goldman Flow Desk: No Institutions Bought Today's Dip

Overnight, Goldman trader John Flood had some advice for its institutional clients: "don't buy this dip."

I am a consistent buyer of dips but this wobble feels different and I am bracing for a weaker tape this week. Negative Covid headlines are picking up in velocity. Issuance spigots are fully turned on and this paper is getting harder to place from my seat (after some choppy px action related to issuance last week).

Well, judging by today's furious bounce in the market which was the biggest one-day gain in the S&P following three days of losses, few followed his advice. Or maybe not - according to Goldman's flow desk, despite all the sound and fury of today's gain, virtually no institutions took part. Here is Flood again after the close:

I was surprised by the velocity of today's rebound but dont think we can scream all clear just yet (i am still bracing for choppiness over the next week or so due to various positioning dynamics I flagged pre mkt yesterday).

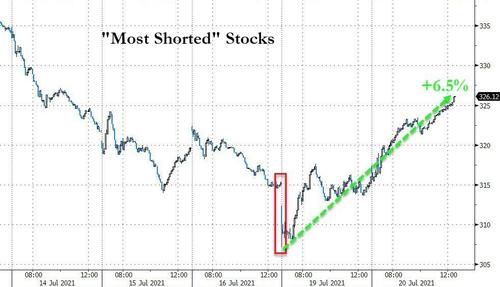

Our desk during the drawdown yesterday was active but today eerily quiet and not seeing institutions add to risk on our desk...feels like short hedge band aids being ripped off at the moment...ETFs represent 32% of total tape (down from 35% yesterday but up from 24% ytd avg) Consumer Discretionary shorts a focal point of pain today....(GSCBMSDS INDEX) +437bps.

Earlier today we showed that the biggest highlight of today's move was the face-ripping short squeeze that started yesterday and ended almost where it started one week ago.

If Goldman is right, and if today's move was just one giant squeeze, brace for more fireworks tomorrow as the selling resumes from a freshly squeezed and higher price point...

https://ift.tt/3hZ1slH

from ZeroHedge News https://ift.tt/3hZ1slH

via IFTTT

0 comments

Post a Comment