"World's Most Bearish Hedge Fund" Goes Short Tech

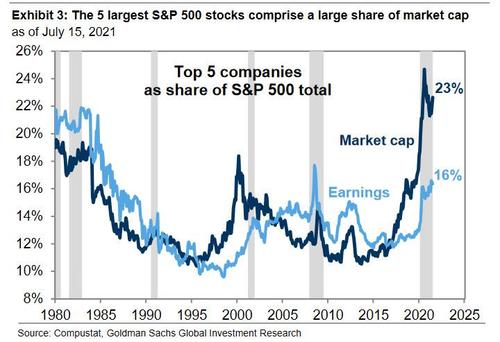

The world's financial graveyards are covered with the career tombstones of those who, over the past decade, have called the end to a tech bubble that not only has yet to pop but has culminated with just 5 tech names - the FAAMGs - comprising 23% of the S&P's market cap vastly surpassing the lofty dot com days, with a combined valuation of over $7 trillion.

Among those who were steamrolled by the tech juggernaut is Ned David Research, traditionally known for its accurate market timing calls if certainly not this time: two months ago it slapped a sell reco on tech right before it ripped the bears' faces off and embarked on a 14% rally. And then, just as the FAAMGs fell out of bed late last week, the firm’s strategists pulled a Gartman, and abandoned their underweight stance, expecting that the rotation out of reflation and into growth, coupled with a plunge in yields, will lead to more tech buying when we may well be facing the first market rout since March considering last week's coordinate selloff.

“The rapidly evolving COVID landscape, coupled with the Fed’s more hawkish tone at the June FOMC meeting” have “gone against cyclical Value sectors that tend to be positively correlated to interest rates and the yield curve,” said Ned Davis strategist Rob Anderson. “The progression of the virus will likely influence whether Growth or Value sectors gain the upper hand in the second half.”

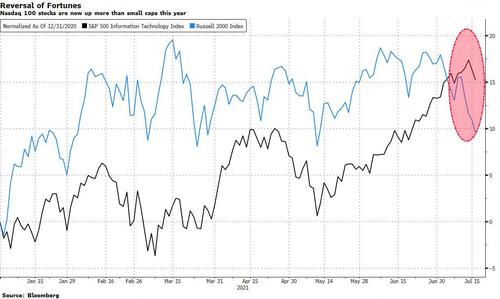

After trailing small-cap stocks which were the biggest beneficiaries of economic reopening, the Russell 100 Index erased its underperformance last Wednesday. The momentum continued this week, when small caps plunged 3.9%, while the Nasdaq 100 Index fell 0.2% and tech stocks in the S&P 500 added 0.4%.

As Bloomberg further notes, halfway into July, small caps trail their megacap peers by the most since March 2020, adding anxiety that a once-hot reflation trade is sputtering, with the delta variant of coronavirus quickly spreading and economic indicators moderating after a breakneck advance.

By abandonging its bearish bias, Ned Davis joins a host of Wall Street strategists who are currently bullish on tech including Goldman Sachs, Citigroup, UBS, Oppenheimer and JPMorgan, all of whom are overweight the sector while Deutsche Bank, Morgan Stanley, BMO, Bank of America and BTIG strategists are neutral on information technology.

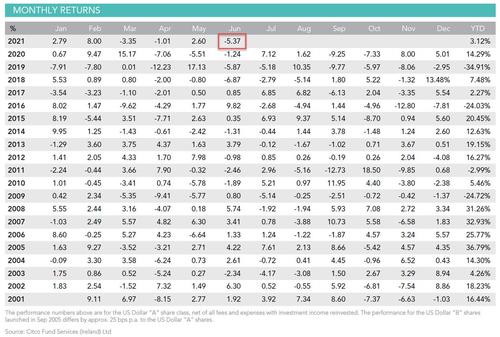

Yet as institutional strategists cover their bearish bets at the first sign of a substantial uptick, the mega bears crawl out of the woodwork, and in the world of bears (those that manage money) none is more familiar to our readers than Russell Clark, formerly of Horseman - which had earned the reputation of the world's most bearish hedge fund on these pages - and currently of Russell Clark Investment Management, who in his latest letter tells his patient investors that his fund, which is now down to just $296MM in AUM, had its worst month of the year in June when it dropped 5.37%...

... and may be en route to much more painful months if indeed the tech rally is just getting restarted. Why? Because as Clark says, "I am thinking of going net short in tech." The only question is where.

This is how Clark lays out the investment thesis:

First of all, I now understand why tech stocks, even loss-making ones, have been able to move such excessive valuations. Amazon showed that loss making companies capturing the consumer can build a monopoly position. Facebook shows even when firms abuse a monopoly position, the Federal Trade Commission (FTC) can only fine USD 5bn, and not force a breakup. A Supreme Court ruling in 2019 (Ohio v American Express) showed that the court only considers a company to be a monopoly if it raises prices to both its suppliers and its customers. In American Express’ case, it could charge high fees to retailers, but unless it could be proven that consumers suffered, the Supreme Court would do nothing to stop the abuse of market power. The potential implications of cases like these is that investors could find potential consumer facing monopolies, and force excessive valuations to make both capital raising and M&A easy (making it more likely companies are the dominant player). This has a knock-on effect of making M&A targets more attractive. You can see this effect in stocks like Tesla, Adobe, Slack, and it seems to be present in every 20 times sales loss making company I can find.

The question then, is "why should this end?"

Well, as mentioned last month, the US House of Representatives are keen to regulate big tech. But as mentioned above, the Supreme Court is still supportive of monopolies. So much so its dismissal of a lawsuit by the FTC against Facebook saw Facebook shares rally 5%. China has recently enacted very similar regulations against tech companies. And of course, in China government is king, with no Supreme Court to get in the way. The regulations, basically stop the two big tech oligopolies from favouring subsidiaries, has had a dramatic effect. Vipshop, TAL Education, Oriental Education and KE Holdings have all seen share prices break away from the Nasdaq, some falling 50% or more.

Taking this argument to its absurd extreme, Clark concludes that while Facebook, Amazon, Netflix and Facebook (FANG) stocks continue to rise, "it is beginning to look more difficult to invest in loss making stocks in the hope they can become a monopolist or be bought by a monopolist. The combination of the current US administration and the Chinese authoritarian government will ensure that every transaction will be scrutinised, and competition will be encouraged. For venture capital, this could be a disaster, particularly for those invested in Chinese start-ups. I am encouraged to take this view by the poor performance of Softbank, which has also diverged radically from the Nasdaq. The Softbank Vision Fund is the largest VC fund in the world, by quite a margin."

Going even further, Clark picks up on a point BofA CIO Michael Hartnett has been making for the past year, and claims that as China is attacking income inequality, he believes that Beijing is leading the world here, and is not an outlier:

Its policies are set to reduce liquidity in markets, keep a strong currency, whilst raising wages, and promote competition. These policies now seem to be taking hold, which means we are adjusting the fund’s portfolio.

In practical terms, this means that Clark has started to short Chinese tech, "as many of these companies seem to have no business strategy for making money" and he is also looking at loss making tech companies in the West whose exit strategy was M&A and shorting them as he believes that they are set to underperform.

At the same time, Clark will pair trade his growing tech short with agricultural related longs, "but we are going to hedge with liquidity driven assets that are being affected by Chinese monetary policy, namely crypto and gold."

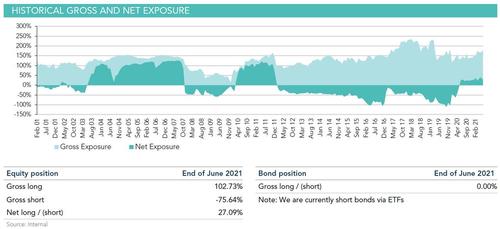

As a result, Clark concludes that he expects his fund - which has been net short for much of the past decade before briefly turning bullish around the time of the covid crisis helping its 14.3% return in 2020...

... once again "being mildly net short either this month or next month" as he is "long farmers, and short monopolists and proto monopolists."

While we wish Clark all the best, we would like to remind him that by going short tech he is not only fighting the central banks whose primary goal - above all else - is to prop up the wealth effect and nowhere do they have as much leverage as with the 5 companies which account for more than 20% of total market cap, but will also now be fighting the retail/reddit crowd which hones in like a heatseeker missile on any fund net short and then squeezes its biggest short holdings until the fund taps out (see Melvin). So while we wish Clark all the best - as we have for so many years - we can't help but wonder if the fund's AUM one year from now won't be in the double (or fewer) digits, if it's still around at all...

https://ift.tt/3rqwuFZ

from ZeroHedge News https://ift.tt/3rqwuFZ

via IFTTT

0 comments

Post a Comment