Treasuries Trounced As Trump Triumph Looms, Crude & Cryptos Soar

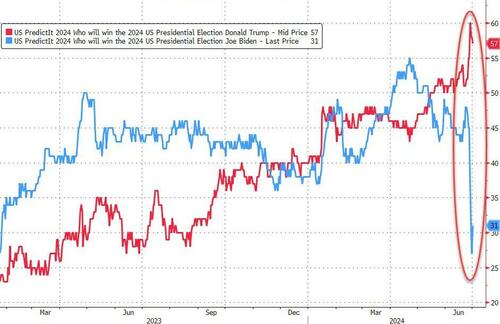

Politics and macro data dominated flows/technicals today as weak macro weighed on stocks but political 'wins' for Trump/Republicans weighed on bonds.

The ISM manufacturing index declined in June, against expectations for a modest increase. The composition of the report was mixed, with an increase in the new orders component but declines in the production and employment components. Construction spending decreased 0.1% in May, somewhat below expectations for a small increase, while growth was revised up in March and April.

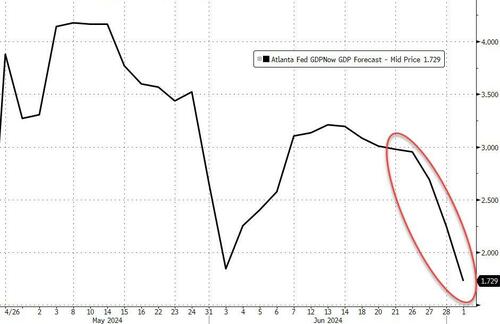

So 'soft' and 'hard' data disappointed and the collapse of the latter continues unabated...

Source: Bloomberg

...which dragged down the Atlanta Fed's GDPNOW forecast for Q2 GDP to 1.7% (it was 4.3% a month ago!)...

Source: Bloomberg

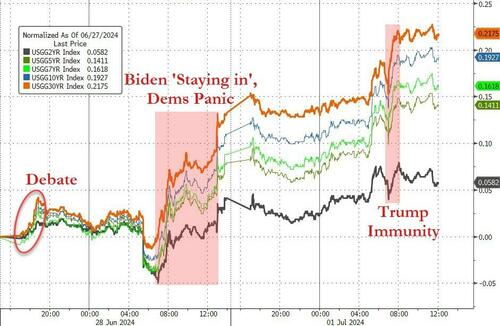

but against that shitty backdrop, yields on USTs soared today... as it appears Biden will keep running and Trump won his immunity ruling at SCOTUS...

Source: Bloomberg

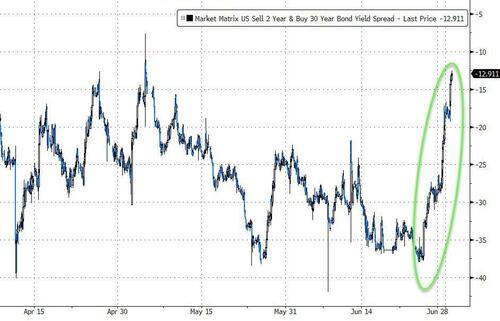

The long-end of the curve underperformed bigly today (10Y +10bps, 2Y +3bps), extending its post-debate weakness...

Source: Bloomberg

With the last few days seeing a massive bear steepening in the curve...

Source: Bloomberg

The surge in yields weighed on stocks - but not as much as one might expect (for similar Trumpian reasons we suspect)...

Source: Bloomberg

As UBS notes, the first day of a new quarter and no shortage of questions given the choppy start to Monday.

Many investors are out of seats, so the lack of liquidity is also exacerbating things under the hood, but many of these single stock dislocations cannot be explained by fundamentals.

There are a lot of cross currents within Mega Cap Tech, which is holding up (AMZN, MSFT, AAPL - cloud names supported by positive 3PP data) while anything tied to consumer or rates is getting hit right now, suggesting investors are playing the growing headwinds for US consumers.

Torsten Sippel notes that flows wise, it feels there is a de-risking in semis/internet/rideshare/online travel agents while investors continue to look more favorably on SW, adding incrementally in Large Cap names and Consumption (MSFT positive 3PP data and SNOW added to conviction list among the highlights propelling outperformance in subgroups).

Simply put, this confirms the theme we noted over the weekend - hedgies dumping and retail still buying (but that demand is fading fast).

Small Caps were the day's biggest losers as Nasdaq outperformed with The Dow and S&P clinging to unch. A very late day buying panic put some lipstick on the pigs...

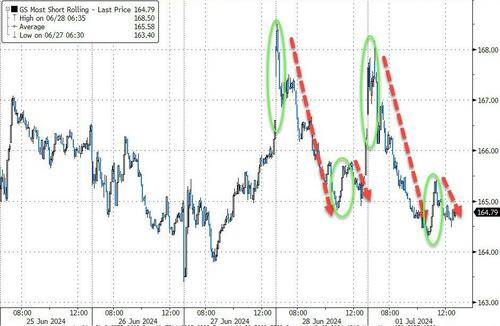

"Most Shorted" stocks followed a very similar trajectory to Friday - early punchy squeeze followed by slow bleed lower

Source: Bloomberg

Mag7 stocks rallied back after a not-so-pretty start (driven by NVDA's regulatory scare HL)

Source: Bloomberg

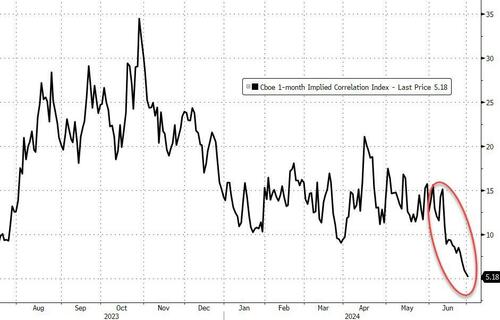

Dispersion remains crazy as implied correlation crashed further today to new record lows (index vols 'low' relative to single-stock 'vols')...

...as breadth is off the charts decoupled from the market...

The S&P has traded up on low breadth and down on high breadth for 5 days in a row (a streak that ended Thursday), the longest stretch on record.

— zerohedge (@zerohedge) July 1, 2024

The distribution phase is almost finished pic.twitter.com/8kOMAOv4wx

Crypto rallied strongly over the weekend and held the gains today, erasing most of the post-Mt.Gox plunge losses from last week. Is this another pro-Trump reaction?...

Source: Bloomberg

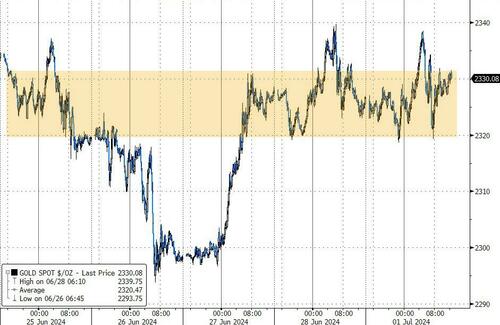

Gold was pretty much flat on the day (very modest gains)...

Source: Bloomberg

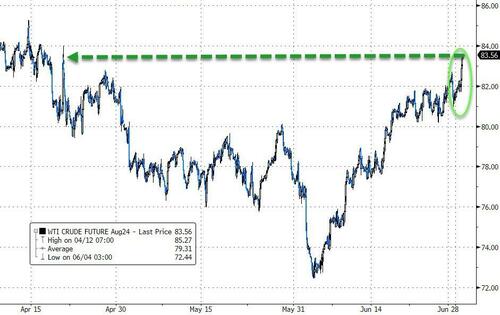

Crude prices shot higher, with WTI topping $83.50 for the first time since mid-April..

Source: Bloomberg

Oil's move is dragging wholesale gasoline prices higher and pump prices are starting to turn as the lags start to hit the supply chain...

Source: Bloomberg

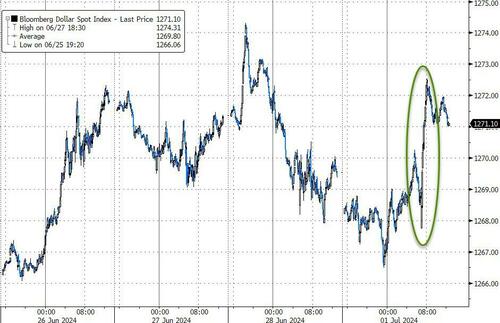

The dollar rallied on the day, spiking higher around 10am (ISM and Trump immunity)

Source: Bloomberg

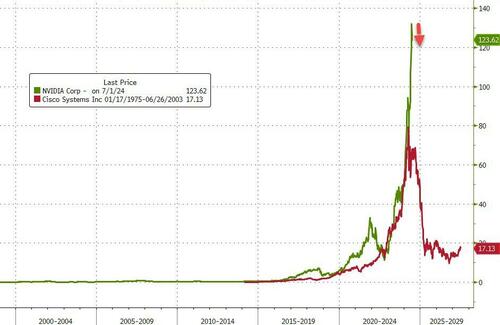

Finally, NVDA faded on anti-trust news from France this morning, but bounced back. However, it's still looking very head-and-shoulder on a longer-term chart...

Source: Bloomberg

But remember, it's different this time...

Source: Bloomberg

With vols so low, now seems like a good time (with payrolls imminent on an extremely illiquid Friday) to lock in some gains and protect downside.

Source: Bloomberg

While this next two weeks is historically the best 'seasonal' for stock gains of the year, Washington seems to be doing its best to mess that pattern up.

https://ift.tt/uvlkHbT

from ZeroHedge News https://ift.tt/uvlkHbT

via IFTTT

0 comments

Post a Comment