Authored by Lance Roberts via RealInvestmentAdvce.com,

In July 2007, just before the financial crisis erupted, Citigroup CEO Chuck Prince summed up Wall Street’s dangerous exuberance:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Eighteen years later, Wall Street is dancing again, and the rhythm feels disturbingly familiar.

Private equity (PE), once a niche strategy reserved for sophisticated endowments and mega-pensions, is being aggressively marketed to everyday investors. It’s creeping into 401(k)s, target-date funds, and retirement accounts under the seductive promise of higher returns and diversification. But for investors who’ve forgotten history, or worse, were never taught it, the risks are mounting.

What Is Private Equity & How We Got Here

Private equity refers to investments in companies not publicly traded on a stock exchange. Instead of buying shares of companies like Apple or Microsoft, private equity firms purchase entire companies, or large stakes in them, using a mix of their own capital and large amounts of borrowed money (leverage).

Once they take control, they often restructure the company, cut costs, increase debt, and aim to “flip” it for a profit within a few years. This can be done by selling it to another company, a PE firm, or publicizing it via an IPO.

The pitch? Higher returns.

The reality? Higher risk and lower transparency.

PE’s ascent began after the 2008 financial crisis when near-zero interest rates pushed institutional investors out of traditional bonds and into “alternatives.” As I’ve written, institutional FOMO (fear of missing out) drove billions into private markets with questionable due diligence. So they turned to alternatives: private equity, private credit, hedge funds, and real estate.

In 2019, Ben Meng, then-CIO of CalPERS (California’s massive public pension fund), epitomized the mentality when he said, “We need private equity, we need more of it, and we need it now.”

And Wall Street delivered.

The results were predictable. With cheap credit abundant, deal volume exploded, topping $3.1 trillion globally in 2021. Valuations were detached from reality. According to McKinsey, buyout multiples surged from 6.5x EBITDA in 2009 to 12x in 2022, nearly doubling in just over a decade. But this boom was built on artificially low interest rates and easy liquidity.

That means PE firms paid twice as much for companies as a decade ago. The reason is simple: They could borrow more cheaply and charge investors higher fees.

However, with rates normalized and liquidity tightening, private equity’s structural weaknesses are surfacing. Therefore, as sophisticated investors become more risk-averse to the deals they take on, Wall Street is turning to a new source of capital: unsophisticated retail investors.

What Makes Private Equity Risky for You

Let’s break down some key concerns the average investor should understand before allocating capital—directly or indirectly—to private equity.

1. Illiquidity Is a Feature, Not a Bug

PE funds lock up investor capital for 7-10 years, sometimes longer, depending on extensions and follow-on investments. This means that investors lose the fundamental flexibility that public markets provide, namely, the ability to liquidate assets in response to life events, market downturns, or better opportunities. For example, if you invested in PE through the COVID-19 market shock, you couldn’t reallocate capital even as public markets sharply corrected and rebounded. This rigid illiquidity is especially dangerous for retirees or individuals who may require access to funds unexpectedly.

2. Opacity Masks Risk

In public markets, pricing is determined every second by the forces of supply and demand, providing price discovery and transparency. However, private equity relies on subjective valuation models that are updated quarterly or less frequently. This allows PE funds to “smooth returns,” creating the illusion of low volatility. For instance, during market sell-offs like 2022, many PE funds reported negligible markdowns while public equities fell double digits. This masks the true underlying risk, potentially misleading investors about the health of their portfolios and delaying the recognition of losses until forced asset sales or fund closures

3. Fees Are Devastatingly High

PE funds follow a “2 and 20” fee structure: a 2% annual management fee plus 20% of profits above a specific hurdle rate. Over a decade-long lock-up, even in mediocre-performing funds, fees can erode a substantial portion of gross returns. For example, on a hypothetical $100,000 investment, you could pay $20,000 in management fees over ten years, excluding performance fees. Compared to passive investment vehicles like S&P 500 ETFs costing 0.03%-0.10% annually, the fee drag in PE is enormous. Academic studies, such as those by Ludovic Phalippou at Oxford, have consistently shown that net returns after fees in PE barely exceed, and often underperform, simple public index strategies.

4. Leverage Amplifies Fragility

Leverage is a double-edged sword in private equity. While it can amplify returns in bull markets, it dramatically increases financial fragility during downturns. PE buyouts frequently involve debt levels of 5-7 times EBITDA, far exceeding leverage ratios typical of public companies. This dependence on cheap debt made sense in a zero-rate world, but is becoming a liability as borrowing costs rise. For instance, companies acquired at peak valuations in 2020-2021 face refinancing risks as interest coverage ratios deteriorate. Reports of loan covenant breaches and distressed sales are already emerging across sectors like healthcare, retail, and infrastructure, previously touted as “safe” plays in the PE world.

But while these issues are important, there are seven “red flags” that signal trouble ahead.

Seven Red Flags That Signal Trouble Ahead

The CFA Institute recently highlighted seven red flags signaling serious trouble brewing in private markets—risks magnified for retirement savers who lack the tools and resources to properly evaluate these risks. For retail investors, each of these red flags represents a significant warning that could impact long-term financial outcomes, especially when embedded within retirement plans like 401(k)s and target-date funds.

1. Declining Deal Quality

With record amounts of capital flowing into private equity, more money is chasing fewer high-quality investment opportunities. This leads to PE firms lowering their standards and investing in weaker companies or more speculative ventures. For retail investors, this means exposure to riskier businesses with less predictable cash flows. For example, during the 2021 SPAC boom, many companies that would have traditionally struggled to access public markets instead found their way into private portfolios, leading to high-profile failures post-acquisition.

The chart below from S&P Global shows the number of private transactions terminated between 2020-2023.

2. Inflated Valuations

PE managers often base valuations on future projections rather than tangible market transactions. As a result, portfolios can appear healthy on paper even when underlying fundamentals are deteriorating. For retail investors, this creates the illusion of stability, where portfolio statements show steady or appreciating values while the true market value could be significantly lower. A prime example occurred during 2022, when public tech stocks corrected sharply, but many PE tech holdings barely adjusted, delaying loss recognition and masking portfolio risk.

To that point, you should realize that most private equity investments (65%) either fail or return the initial investment at best.

Yes, private equity can be very lucrative. Depending on the deal you invest in, it can also be very harmful.

3. Fee Pressures = Riskier Deals

Institutional investors are increasingly pushing back on high fees, which puts pressure on PE firms to maintain profitability. This can lead to riskier behavior, such as over-leveraging or engaging in more aggressive cost-cutting at portfolio companies to boost short-term returns. For retail investors, this translates into an even worse alignment of interests: high fees remain in place, while portfolio risk quietly increases. Worse, retail channels often lack the negotiating power to secure fee reductions, leaving them exposed to premium costs for subpar investments.

4. Frozen Exit Markets

An essential part of private equity returns depends on the ability to sell portfolio companies at a profit. However, the current environment of rising interest rates and lower public market valuations has led to a sharp decline in IPOs and M&A activity. This creates a backlog of unsold assets, commonly referred to as an “exit overhang.” For retail investors, this means delayed distributions, longer-than-expected lock-up periods, and an increased likelihood of forced sales at discounted prices. Recent data from secondary market platforms show private equity interests trading at significant discounts, clear evidence of deteriorating liquidity.

5. Discounted Secondaries

When existing investors seek to exit PE investments early, they often turn to secondary markets. Today, these interests are commonly trading at 20-40% discounts to their stated net asset values (NAVs). This is a stark warning sign: even sophisticated investors are willing to accept steep losses to exit PE positions early. Retail investors, who often lack access to these secondary markets or the liquidity to exit early, are particularly vulnerable to being locked into declining assets with no realistic way out.

6. Rising Borrowing Costs

The foundation of many PE deals is built on cheap debt. With interest rates at multi-decade highs, borrowing costs have surged, eroding profitability across PE portfolios. Companies acquired during 2020-2021 at high multiples are now facing refinancing cliffs, where new debt comes at significantly higher rates. For retail investors, this increases the risk of portfolio companies defaulting or entering distressed restructurings, outcomes that can wipe out equity holders while still rewarding debt financiers higher in the capital structure.

7. Dry Powder FOMO

Private equity firms are sitting on record amounts of unallocated capital, or “dry powder.” While that may sound reassuring, it creates pressure to deploy capital quickly, often leading to questionable investment decisions and inflated deal pricing. For retail investors, this means being funneled into PE funds at the tail-end of a market cycle when managers are most desperate to deploy funds and least disciplined in underwriting. Historically, vintages raised during peak fundraising years, such as 2007 or 2021, have produced the worst returns.

When you see multiple red flags flashing across a sector, it’s time to reassess.

What the Average Investor Should Do

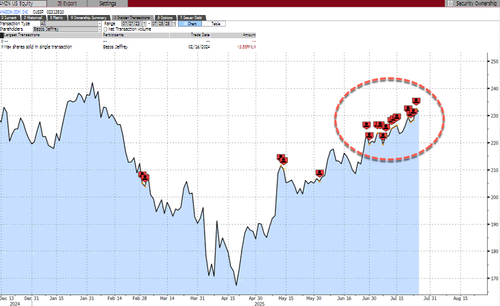

As discussed in “Why Am I So Lucky,” individuals hear tales of how high-net-worth investors (the smart money) own private equity in their allocations. As shown in the chart below from Long Angle, roughly 17% of their allocations are to private equities. These reports don’t generally tell you that their allocation to “private equity” often tends to be their personal businesses. Nonetheless, individual investors frequently see this type of analysis and think they should be replicating that process. But should they?

Before investing in private equity, significant differences must be considered between the vast majority of retail investors and high-net-worth individuals. The underlying risks of private equity investments can define these differences. However, with the right knowledge and proactive steps, investors can avoid the most common pitfalls and protect their long-term financial security.

1. Know What You Own

Start by reviewing your retirement plan allocations, especially if you are invested in a target-date fund or managed account solution. Many of these funds now include allocations to private equity or private credit, often buried deep within the prospectus. Request a detailed holdings report if necessary. For example, some widely used TDFs from major asset managers have added “private market” sleeves that investors are unaware of, effectively exposing them to higher fees and illiquidity.

2. Prioritize Liquidity

Liquidity provides optionality, especially during volatile markets or personal financial emergencies. If your retirement funds are locked up for years, you lose the ability to rebalance, take advantage of market dislocations, or fund unexpected needs. Favor investment options that allow for daily liquidity, such as low-cost index funds and ETFs. Remember, having access to your capital is a risk management tool in itself.

3. Focus on Transparency and Fees

Insist on clear, net-of-fee performance reporting. Avoid products with opaque valuation methodologies or excessive fee layers. As a rule of thumb, compare fees: if a private investment costs 2-3% annually versus 0.10% for an S&P 500 index fund, it must deliver dramatically higher returns to compensate, which few consistently achieve.

4. Stay Simple, Stay Diversified

Decades of evidence show that a well-diversified portfolio of simple, liquid public investments outperforms most complex alternatives after fees and taxes. Don’t be lured by “fancy” strategies with marketing sizzle but structural drawbacks.

Final Thoughts: Don’t Dance Just Because the Music Is Playing

Private equity may have its place in a diversified, institutional portfolio, but even then, it demands scrutiny. For the average investor, the risks are magnified by a lack of transparency, long lock-ups, and a fee structure that often benefits managers more than investors.

Wall Street has a long history of selling the newest shiny object to Main Street just as the trade begins to sour. If the music stops at this private equity party, you don’t want to be the last one still dancing.

When in doubt, stick to the core investing principles: transparency, liquidity, low costs, and discipline. Complex products are often designed to enrich the seller, not the buyer. Safeguard your financial future by keeping your portfolio simple, transparent, and aligned with your long-term goals.

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.