Global Stocks Cling To Record Highs As Dollar, Treasuries Pounded

Global stocks and US equity futures slipped modestly in thin overnight trading on the second to last day of what may be the best year for stocks in 22 years, with broad if shallow losses in Asia and Europe, despite renewed optimism over a U.S.-China trade deal and the global growth outlook, while US Treasurys and the dollar slumped, and the euro climbed to a 4-1/2 month high.

Investors were cautious in thin pre-holiday trading at the end of a year that’s propelled global equity benchmarks to record highs,and with a backdrop of persistent central bank stimulus and the anticipated sealing of a U.S.-China interim trade deal in January, many market participants say they’re still bullish for early 2020.

Easing trade war worries lifted global equities this month, putting MSCI’s global equity index on track for a 3.8% rise in December - its fourth straight month of gains.

All major US equity indexes were set to open near their record highs in the countdown to the New Year’s Day holiday Wednesday, even as tech giants Facebook and Amazon.com edged lower in pre-market trading following a furious rally that has sent the tech sector into extremely overbought territory.

Europe's Stoxx 600 index was 0.3% lower, led by declines in telecommunications and carmaker shares, while Germany's DAX slipped 0.5%. European banks which had been lagging the 2019 rally, were the only sector to mark small gains in thin year-end trading.

"Investors appear to be growing a tad apprehensive about chasing the record setting U.S. equity market risk-reward premise into year-end," Stephen Innes at AxiTrader wrote in a note to clients. “Much focus continues to fall on the abundance of liquidity offered up by the Fed as a critical driver behind the late-season equity market window dressing.”

"As fears of a global recession have dissipated and the manufacturing cycle looks to be heading for a U-turn in the first half of 2020, expect to see some rotation from the U.S. into emerging and European markets," Hussein Sayed, chief market strategist at online brokerage ForexTime Ltd., said in a note to investors. “If this scenario plays out, expect the dollar to remain under pressure for the next couple of weeks.”

Earlier in the session, Asian stocks were little changed ahead of the New Year holiday with Chinese blue chips roaring 1.2% higher, led by consumer services and basic materials stocks, bolstered by a report that 2019 retail sales are forecast to rise 8% and expectations that a new benchmark for floating-rate loans could lower borrowing costs and boost flagging economic growth. Japan’s Topix index declined 0.7% on last trading day of the year as the yen strengthened ahead of a four-day break. Japan's Nikkei finished its last trading day of the year down 0.76%. The index gained 18.2% in 2019 after dropping 12.8% last year.

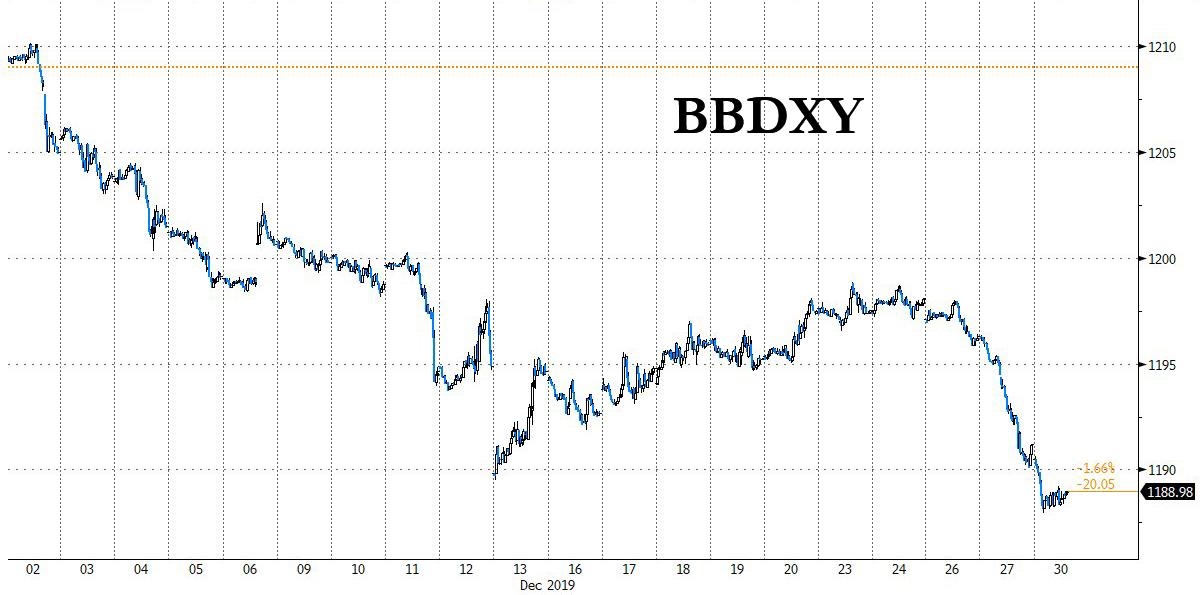

In FX markets, the Bloomberg Dollar Spot Index dropped to a six-month low as the greenback weakened versus most major peers amid unwinding of long positions into year-end. Thin end-of-year volumes exacerbated the broad weakness in the greenback which on Friday suffered its biggest one-day fall since June.

“The U.S. dollar is the worst performing G10 currency overnight,” said MUFG’s Fritz Louw. “The main drivers of the weaker dollar have likely been risk appetite holding up in the wake of comments from the U.S. pertaining to a Phase One trade deal recently as well as the U.S. Federal Reserve’s continued repo operations.”

The weak greenback helped other currencies shine. The euro climbed as high as $1.1211, its strongest level since mid-August. Sterling also benefited, rising 0.2% to $1.3122 against the dollar. Yet the pound was flat against the euro at 85.38 pence amid concerns that Britain could be headed for a disruptive "hard Brexit" at the end of 2020. China's yuan held below the key level of 7 per dollar, rising in offshore markets to 6.9752 its highest since Dec. 13.

There was also some commotion in the rates market, as rising risk appetite saw euro zone bond yields rise across the board, with most 10-year bond yields two basis points higher on the day. Germany’s Bund yield stood at -0.23%, heading back toward recent six-month highs. US 10Y Treasuries also sold off, with the yield on the benchmark paper spiking as high as 1.9332%

In commodities, oil prices held near three-month highs with traders also keeping a close watch on the Middle East following U.S. air strikes in Iraq and Syria against Kataib Hezbollah, an Iran-backed militia group. U.S. officials said on Sunday that the attacks were successful, but warned “additional actions” may be taken to defend U.S. interests. The weaker dollar also lifted commodity markets with gold hitting a two month peak. Brent crude traded at $68.33 a barrel and U.S. West Texas Intermediate stood at $61.74.

Oil prices were also supported by a bigger-than-expected decline in crude inventories in the United States, the world’s biggest fuel consumer. Stockpiles fell by 5.5 million barrels in the week to Dec. 20, far exceeding a 1.7-million-barrel drop forecast in a Reuters poll, government data showed on Friday.

Economic data include wholesale inventories, pending home sales. Looking ahead, China’s official manufacturing PMI is due Tuesday, and the Caixin version comes Thursday. World leaders including China’s Xi Jinping and North Korea’s Kim Jong Un are set to deliver New Year addresses. Federal Open Market Committee minutes will be released on Friday. U.S. ISM manufacturing is also due Friday. The Institute for Supply Management’s PMI is forecast to show a contraction for a fifth straight month.

Market Snapshot

- S&P 500 futures up 0.1% to 3,241.25

- STOXX Europe 600 down 0.4% to 418.18

- MXAP down 0.04% to 171.01

- MXAPJ up 0.09% to 555.91

- Nikkei down 0.8% to 23,656.62

- Topix down 0.7% to 1,721.36

- Hang Seng Index up 0.3% to 28,319.39

- Shanghai Composite up 1.2% to 3,040.02

- Sensex unchanged at 41,573.98

- Australia S&P/ASX 200 down 0.3% to 6,804.86

- Kospi down 0.3% to 2,197.67

- German 10Y yield rose 3.9 bps to -0.217%

- Euro up 0.1% to $1.1193

- Brent Futures up 0.2% to $68.33/bbl

- Italian 10Y yield fell 5.7 bps to 1.203%

- Spanish 10Y yield rose 3.2 bps to 0.441%

- Brent futures up 0.2% to $68.33/bbl

- Gold spot up 0.2% to $1,513.12

- U.S. Dollar Index down 0.1% to 96.80

Top Overnight News

- China’s central bank ordered lenders to adopt a new loan-pricing regime for all credit from next year, marking an end to the previous benchmark and another step toward liberalizing the financial system

- The U.K. is likely to drop its opposition to extending the Brexit transition period beyond 2020, European Union Trade Commissioner Phil Hogan said in an interview with the Irish Times

- Spain’s acting Prime Minister Pedro Sanchez has a second term in office within reach after his Socialist party lined up an agreement with the Catalan separatist group Esquerra Republicana, El Pais reported

- Outgoing Bank of England Governor Mark Carney said that the financial sector needs to act more quickly to shift investment away from fossil fuels and help avert damaging climate change, according to excerpts of an interview published Monday by the BBC

- Kim Jong Un urged “positive and offensive measures” to bolster North Korea’s security, as the Trump administration said it was watching for provocations around the regime’s year-end deadline

- Hedge funds are approaching the end of the year more optimistic on global oil prices than they’ve been since May. Their net-bullish wagers on Brent crude climbed for the ninth week in 10, reaching a seven-month high, data released Friday show

Top Asian News

- Monex Founder Matsumoto Sees Nikkei 225 Heading Toward 29,000

- India Citizenship Row May Spook Investors, Risk Advisers Say

- HNA to Win ‘War’ Against Debt Problems Next Year, Chairman Says

- Here’s What You Need to Know About Asia Stock Markets Today

Top European News

- EssilorLuxottica Uncovers $213 Million Fraud at Thai Factory

- Italian Bonds Drop Before Sale, Leading Euro-Area Debt Declines

- Sanchez Set to Take Power in Spain With Catalan Help, Pais Says

- U.K. Labour’s Long Bailey Mulls Bid for Party Leadership

In FX, the Bloomberg Dollar Spot Index dipped 0.2%. The British pound rose 0.4%. The euro climbed 0.1% to $1.1191. The Japanese yen strengthened 0.2% to 109.18 per dollar. The South Korean Won appreciated 0.4% to 1,156.18 per dollar.

In commodities, West Texas Intermediate crude gained 0.6% to $62.09 a barrel. Gold climbed 0.1% to $1,511.88 an ounce. Iron ore increased 0.2% to $90.25 per metric ton. Soybeans climbed 0.8% to $9.49 a bushel.

https://ift.tt/2SFfjRC

from ZeroHedge News https://ift.tt/2SFfjRC

via IFTTT

0 comments

Post a Comment