"Haven Of Last Resort" - Goldman Sees Gold At $1800 Due To Virus & Bernie Sanders Fears

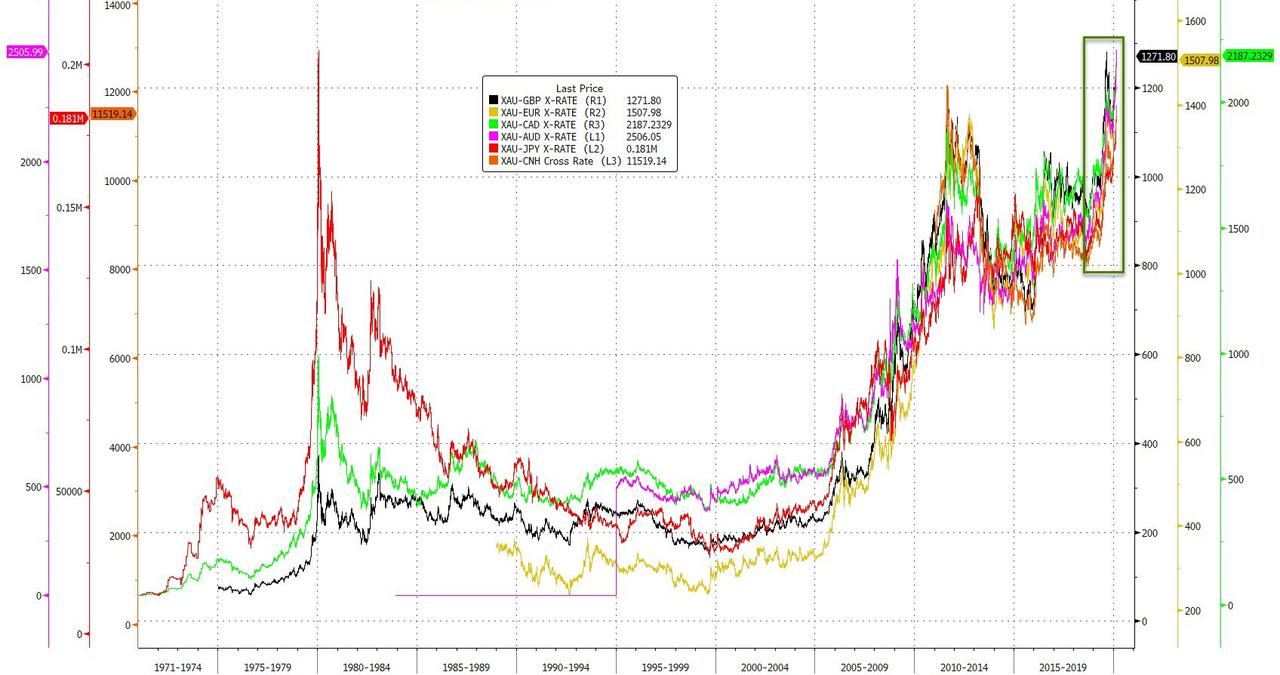

Over the past two weeks gold has surged higher, in line with the decline in long-term bond yields and global equity sell-off as new cases off Covid-19 in Europe and the Middle East threaten to curtail global economic activity.

Goldman Sachs suggests there is more to come for precious metals as with rates getting closer to their lower bound, gold looks increasingly like the safest haven.

Mikhail Sprogis outlines three factors behind continued gains for gold (12m forecast $1800)...

1) Fear-Driven investment demand

2) Large global savings glut

3) The rise of Bernie Sanders

Gold has outperformed traditional haven currencies, such as the Yen and Swiss Franc, underscoring its status as the safest haven in a world where all currencies are susceptible to a virus-related shock.

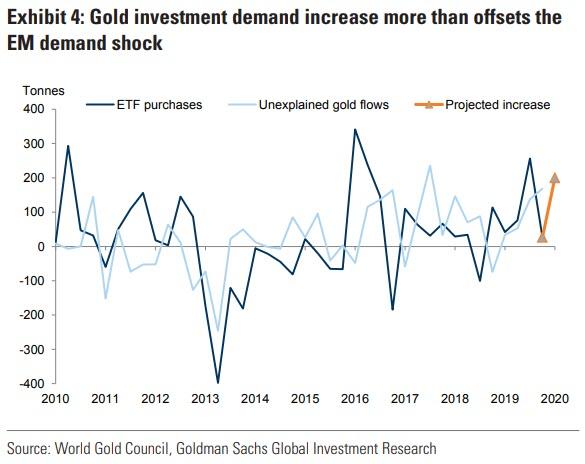

1. This surge in ‘fear-driven’ investment demand has been significantly larger than the consumer demand lost owing to any negative wealth shock to EM consumers as a result of China’s shutdown.

We estimate that gold purchases fall 2.6% for every 1% hit to Chinese real GDP growth. Therefore, our Economists’ forecast of a 6% contraction in Chinese GDP in Q1 implies only a 28 tonnes loss in gold demand. Adding losses for other East-Asian countries implies a total loss of 40 tonnes. This is small relative to 130 tonnes of additional demand from gold ETFs since January 12. If it continues at this pace total ETF demand could reach 200 tonnes by end of Q1.

The actual increase in gold investments could be up to twice as large owing to non-transparent purchases. Therefore, for gold, the fear-effect from Covid-19 more than offsets any wealth shock as the result of quarantines.

While the number of new cases in China has been declining, Goldman warns that it is premature to say we are out of the woods yet. The Chinese economy is yet to materially restart and the effects on global supply chains are only now becoming visible.

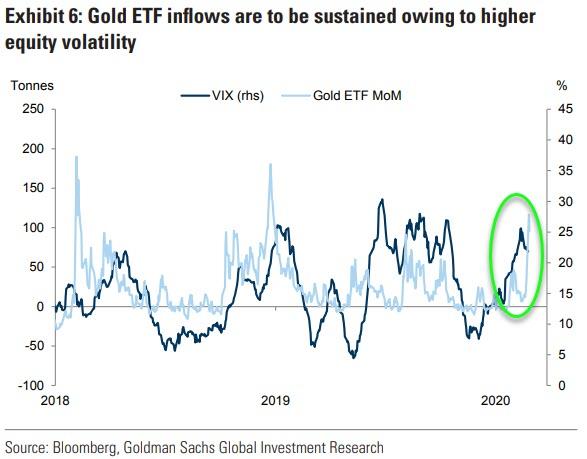

Our Strategy team sees risks of further equity downside which should keep volatility high and ETF inflows strong.

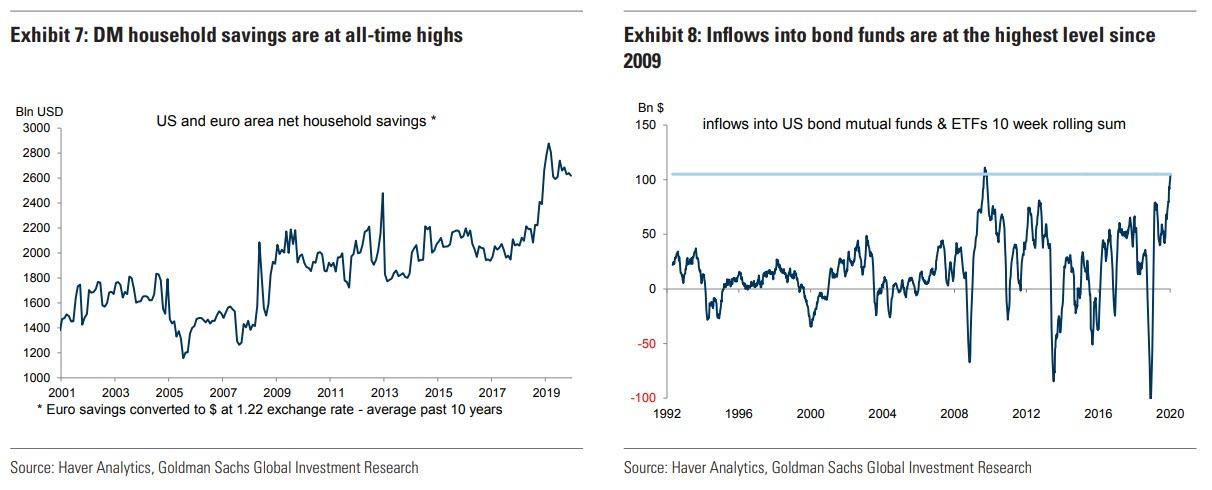

2. Investment demand for gold is further supported by the large global savings glut.

Household savings in developed markets are at historically high levels while global capex remains depressed creating a shortage of places to invest. Inflows into bond mutual funds and ETFs – a good proxy for retail demand of defensive assets – is at its highest level since 2009. At the same time, supply of government bonds globally is restricted owing to central bank purchases creating a deficit in high quality assets. This supports demand for alternative portfolio diversifiers such as gold.

We continue to believe that gold remains attractive relative to bonds. It has a greater capacity to increase during the next recession as bonds may be constrained by the lower bound on central bank rates. Gold is also a better hedge against the risk of inflation overshoots.

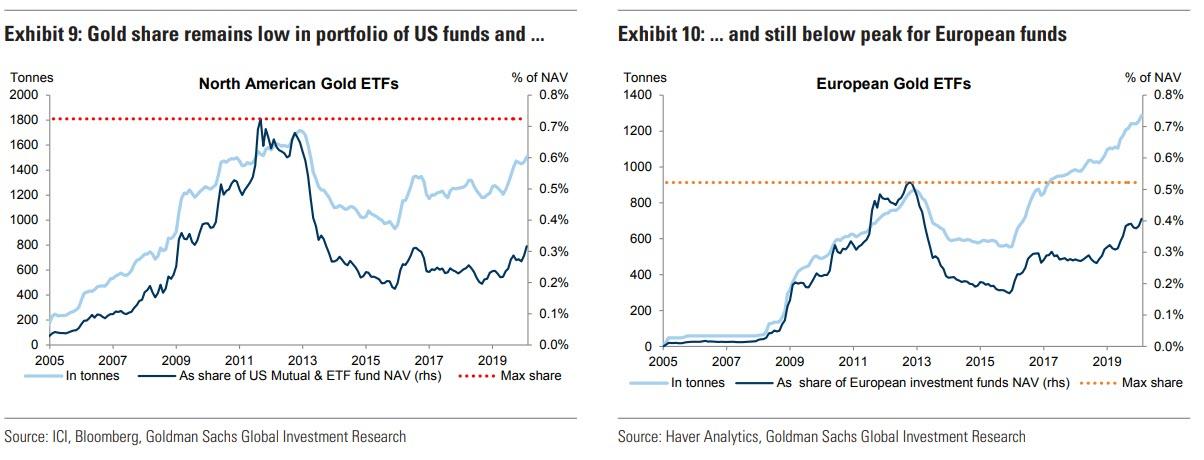

Additionally, gold’s share in investor portfolios remains at a very depressed level. The value of gold ETFs relative to the NAV of funds in North America and Europe indicates that the value of gold ETFs is only 0.3%-0.4% of the funds’ NAV and that we are materially below gold’s peak allocation of 2011-2012. As such we see scope for material rotation of investment funds into gold.

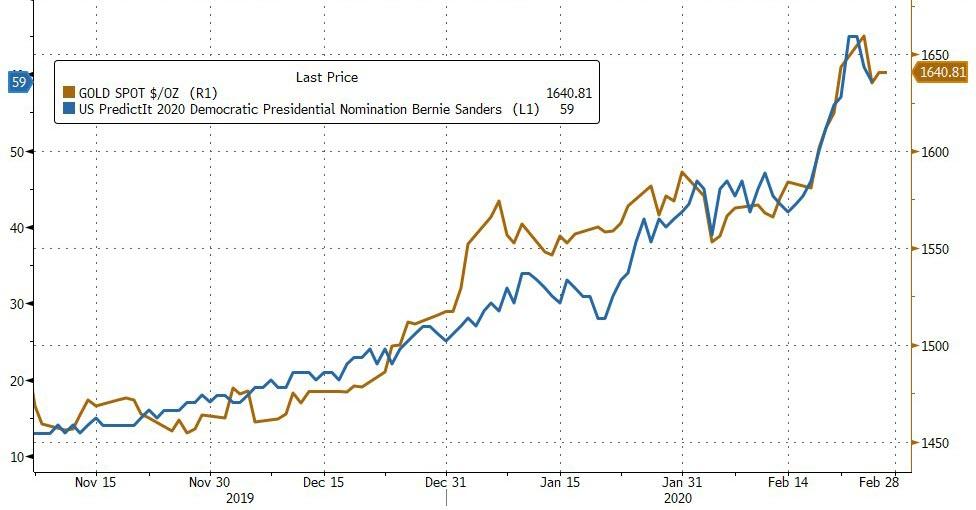

3. Finally, the increase in the probability of Bernie Sanders winning the Democratic nomination could further boost investment demand for gold.

Sanders' proposed tax hikes could pose risks to equities, and he has proposed a large increase in government spending.

The last time this happened in the US outside of a recession was during Regan’s stimulus in the 1980s. Gold rallied as market participants became concerned regarding increases in inflation.

Finally, the proposed wealth tax could incentivize high net worth individuals to buy physical gold bars and store them in a vault, where it is more difficult for governments to reach them.

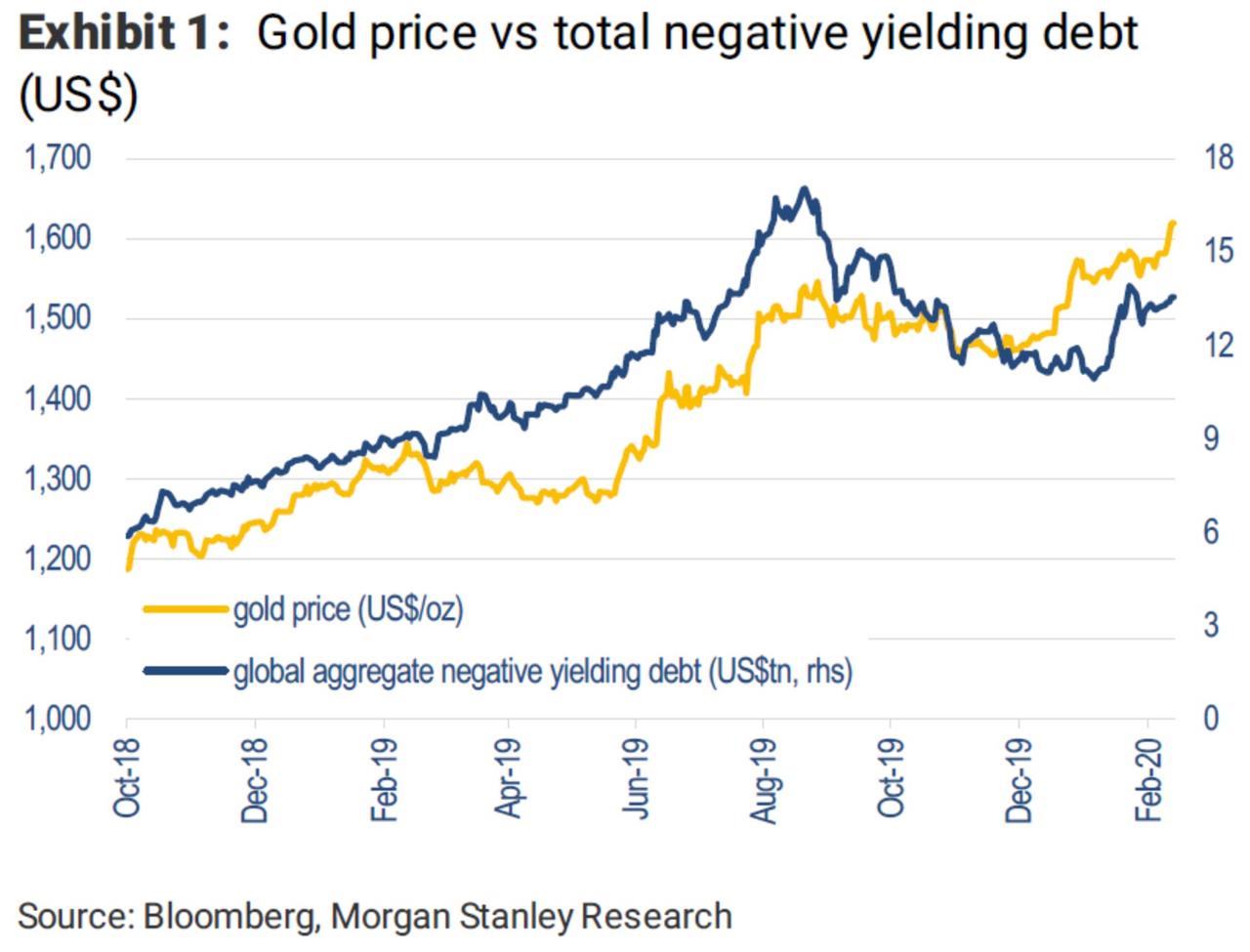

Additionally, Morgan Stanley sees more than just safe-haven demand as rising negative yielding debt bring fresh impetus to gold's price...

Having fallen through 4Q19, total negative yielding debt has climbed 19%ytd to $13.5tn (Exhibit 1), making holding gold an attractive proposition.

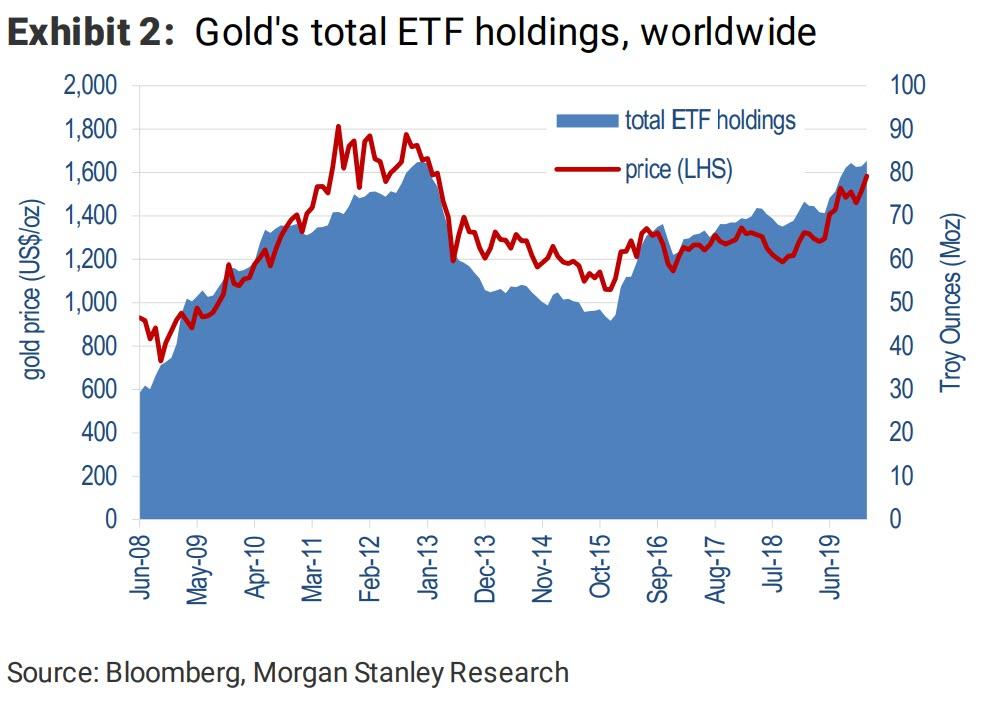

That's helped propel total ETF holdings to fresh all-time highs, following inflows of 1.2Moz in Jan-20.

So, summing it al up, risks to global growth surrounding the virus together with a continued savings glut, depressed real rates, and increased focus on the US election should take the gold price higher by year-end with their new 3, 6 and 12 month forecasts are now $1,700/toz, $1,750/toz and $1,800/toz.

In the event that the virus effect spreads to Q2, we could see gold top $1800/toz already on a 3 month basis.

Goldman also increased their 3, 6 and 12m silver forecasts to $18.5/toz, $18.75/toz and $19/toz.

https://ift.tt/2Vsuz5M

from ZeroHedge News https://ift.tt/2Vsuz5M

via IFTTT

0 comments

Post a Comment