We Just Experienced The Fastest 10% Correction In S&P500 History

If only there were signs that the market was poised for a crash. Oh wait, there were,like the market being the most overbought and complacent ever, with every investor all-in as recently as last month:

... only to become even more overbought and even more complacent, with investors even more all-in...

... with record leverage and unprecedented "smart money" concentration in the same handful of stocks:

... and since nothing could dent the relentless Nasdaq ascent, even as Apple cut guidance due to the coronavirus...

... retail investors unleashed a never-before seen buying spree, and not just momentum stocks, but calls of momentum stocks...

... to the point where retail investors' record levered beta helped them outperform the entire hedge fund class!

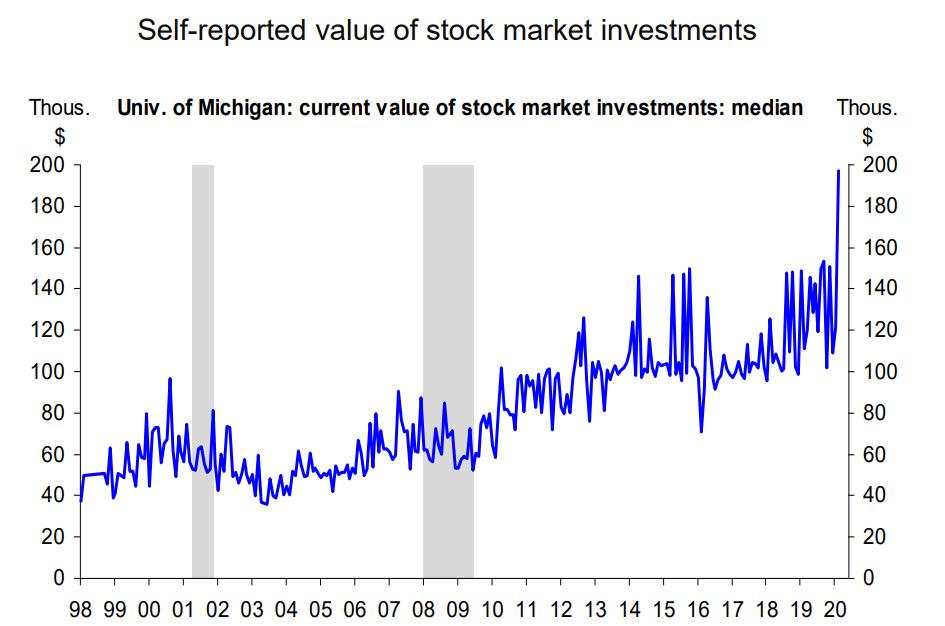

... and ushered in the "Profane, Greedy Traders of Reddit" who "Are Shaking Up the Stock Market" even as US consumers just reported the highest median current value of their market investments.

In short, everyone felt invincible, and all thanks to the Fed's QE4 which injected $600BN in the market and made even a modest drop appear impossible.

Only... it was not meant to last, and in a market that took the express elevator up and the Wile-E Coyote anvil down, less than a week after markets hit an all time high, stocks crashed, suffering three 3%+ drops in the past week as algos suddenly realized that not even the Fed can print viral antibodies, resulting in the biggest one-day Dow Jones point drop on record (down 1,191 on "Viral Thursday"), but more importantly, the fastest 10% correction from an all-time Dow Jones high since just a few months before the start of the Great Depression.

What about S&P? Well, since that particular index wasn't around at the time of the Great Depression, one has to look elsewhere, which is what Deutsche Bank's Torsten Slok has done, and as he shows in the next slide, the outcome is just as stark: with just 6 trading days passing between last week's the all-time S&P500 high and today's 10% correction, this was the fastest correction from a peak on record.

This means that in under six trading sessions, the US stock market lost half of its massive (mostly post-QE4) gains from all of last year.

Even more amazing, is that in under a week the S&P has lost a third of all its peak gains (which hit 62% last week) since the Trump election!

The only question now is what will Trump do - besides more jawboning that the US is extremely well prepared for "whatever this thing is" - to prevent even more furious losses in the market, culminating with the fastest bear market in history.

https://ift.tt/2wUkF2I

from ZeroHedge News https://ift.tt/2wUkF2I

via IFTTT

0 comments

Post a Comment