China Suffers Economic Double-Whammy As Current Global Demand Collapse Follows Earlier Supply Crash

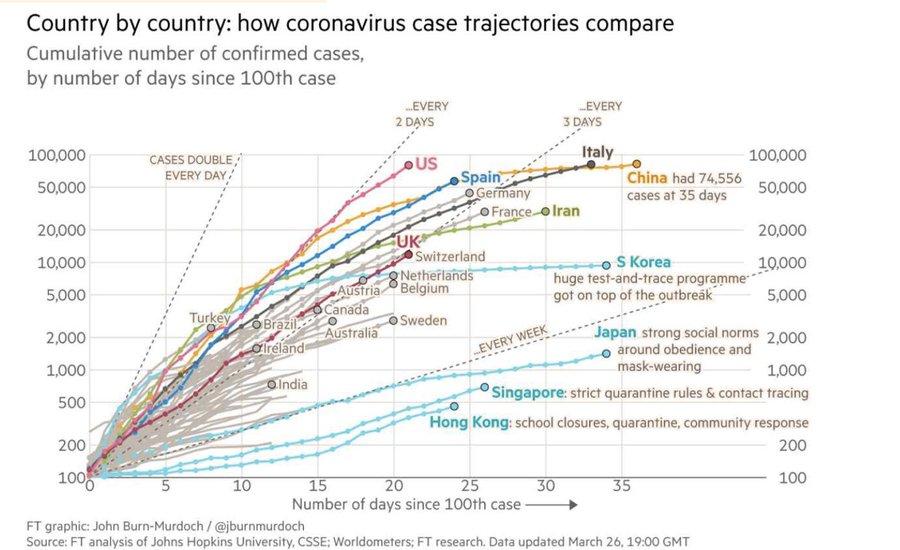

As the first quarter is about to close, many Chinese factories are still operating below full capacity, have been gradually ramping up production over the last several weeks as government data suggests the country's pandemic curve has flattened.

But as Bloomberg notes, there is a serious problem developing, one where the virus crisis is locking down the Western Hemisphere, has resulted in firms from Europe and the US to cancel their Chinese orders en masse, triggering the second shockwave that is starting to decimate China's industrial base.

A manager from Shandong Pangu Industrial Co. told Bloomberg that 60% of their orders go to Europe. In recent weeks, manager Grace Gao warned that European clients are requesting orders to be delayed or canceled because of the virus crisis unfolding across the continent.

"It's a complete, dramatic turnaround," Gao said, estimating that sales in April to May could plunge by 40% over the prior year. "Last month, it was our customers who chased after us checking if we could still deliver goods as planned. Now it's become us chasing after them asking if we should still deliver products as they ordered."

A twin shock has emerged, one where China shuttering most of its industrial base from mid-January through early March, generated a supply shock. Now, as those Chinese firms add capacity, expecting to be met with a surge in demand from Western companies, that is not the case and is resulting in a demand shock.

"It is definitely the second shockwave for the Chinese economy," said Xing Zhaopeng, an economist at Australia & New Zealand Banking Group. The pandemic across the world "will affect China manufacturing through two channels: disrupted supply chains and declining external demand."

With orders canceled, supply chains disrupted, and payments delayed – the road to recovery in China is going to be a bumpy one at best. Overly optimistic analysts who have been touting a V-shape recovery in China, thus the world, in the first half of the year, will likely be wrong, and as we've explained several times, the best case is a U-shape or even perhaps an L-shape.

"Manufacturers are seeing many cases where overseas clients regretted their orders or where goods can't be delivered due to customs closures in other countries," said Dong Liu, vice president of Fujian Strait Textile Technology Co. in southeastern China. Liu's factory was on the cusp of resuming full capacity this month until a demand shock severely dented export orders.

Nomura International HK Ltd warned earlier this week that China could be on the verge of "plummeting export growth in the coming months."

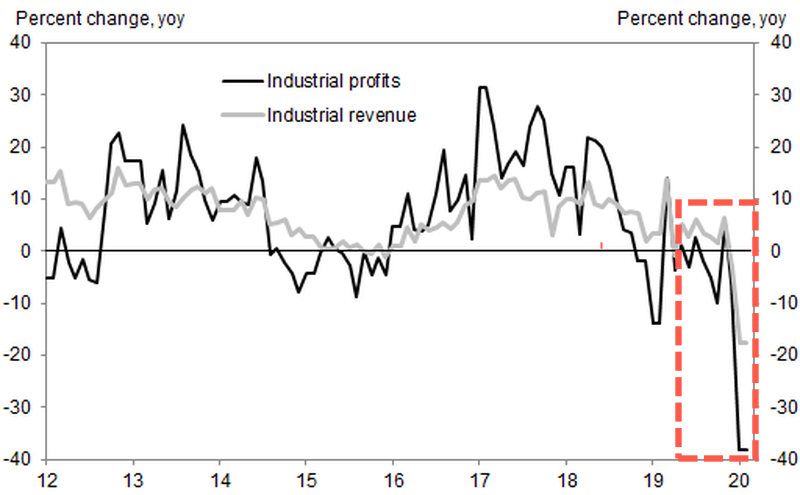

We noted on Friday morning that Chinese industrial profits crashed the most on record in January-February, due mostly because of the Lunar new year holiday, coupled with the virus outbreak and strict social distancing measures implemented by the government. This means many Chinese firms are struggling to survive, running out of cash, and on the brink of bankruptcy as demand from abroad has collapsed.

In Keqiao, Shaoxing, a district known for textile manufacturing, many firms are in rough shape after several months of shuttering operations. Have now been greeted with a collapse in demand, thwarting any hope that full capacity can arrive in the coming weeks.

The twin shocks, first being a supply shock, originating from shutdowns in China, then a demand shock, now coming from the Western world, is the evolution of the global economic crash that is unfolding right in front of us. The world is headed for a depression, if not already in one, as central banks are frantically deploying MMT and unleashing helicopter money to save the world.

https://ift.tt/2QRoVHt

from ZeroHedge News https://ift.tt/2QRoVHt

via IFTTT

0 comments

Post a Comment