Japan Printer Go Brrr As BOJ Launches Unlimited QE, Expands Corporate Bond Buying

As was purposefully leaked last week to avoid any chance of market surprise, that giant monetary chemistry lab that is the Bank of Japan did precisely as had been reported, and on Monday morning the BOJ joined the Fed's and announced it would launch unlimited QE, or rather that it would purchase "a necessary amount of JGBs without setting an upper limit so that 10-year JGB yields will remain at around zero percent." Previously, the BOJ’s guideline on government debt was to increase holdings by around 80 trillion yen ($743 billion) per year, which is ironic as the BOJ was having trouble monetizing a far smaller percentage of this amount.

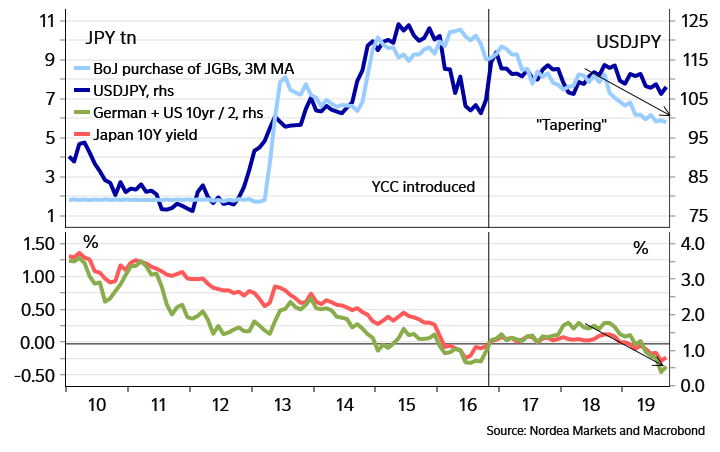

While we wish Kuroda the best of luck in overtaking the Fed and ECB in nationalizing the market, we will remind the central banker that it is not an issue of monetization demand, but rather supply, that has shrank the impact of Japan's QE on devaluing the Japanese Yen, with the annual amount of bonds purchased by the central bank declining consistently every year as there are simply not enough bonds available in the open market for the central bank to buy, and is also one of the reasons why Japan has been urged by various entities to boost its fiscal stimulus to provide the BOJ with the "helicopter money" ammo it so desperately needs to keep the Japanese economy running.

Monday’s decision signals that the BOJ’s concern over the pandemic has intensified quickly with Bloomberg reporting that "unlimited bond buying was not an ideal option to take, in the view of some officials, as it further narrows bank’s policy choices at a time of heightened uncertainty." On the other hand, it underscores that central banks are now fresh out of any original ideas and will keep doubling down on policies that crashed the system until the entire fiat edifice crashes.

As was also leaked before, the central bank also increased its scope for buying corporate bond and commercial paper by raising its ceiling on holdings to 20 trillion yen, according to its statement Monday in Tokyo.

In keeping with the now default gibberish of the past few years, Kuroda's central bank said it will "conduct further active purchases of both JGBs and T-Bills for the time being, with a view to maintaining stability in the bond market and stabilizing the entire yield curve at a low level."

The BOJ said that it would keep negative rate and yield target for 10-year JGB unchanged, and added that it will continue to closely monitor the impact of coronavirus and won’t hesitate to take additional easing measures if necessary although what the BOJ can do after launching unlimited QE while it is also massively monetizing the entire stock market- short of actively starting short squeezes - was unclear.

As Bloomberg notes, a return to relative stability in stock markets and reduced concern over the possibility of a sudden strengthening of the yen have given the BOJ some breathing space to leave its main interest rate policy levers untouched. Furthermore, the BOJ also likely saw a need to take action before the Fed and the European Central Bank meet later this week, so as not to be seen lagging behind its peers, which too have become deranged chemical labs.

The bank had come under increasing pressure to take more action as the declaration of a nationwide state of emergency this month brought more shutdowns and a growing need for financial support.

The central bank also said it "expects short- and long-term policy interest rates to remain at their present or lower levels," removing a reference to a need to "pay close attention to the possibility that the momentum toward achieving the price stability target will be lost."

In short, the BOJ isn't even pretending any more that it is pursuing a "stable" 2% inflation, a goal which is now - for all intents and purposes until the arrival of currency collapse and hyperinflation - impossible to achieve. Instead the only goal now is spraying helicopter money on as much of the population as possible.

The additional measures announced by Governor Haruhiko Kuroda also show a greater degree of fiscal-monetary policy coordination, with Prime Minister Shinzo Abe unveiling more than $1 trillion in stimulus this month and an accompanying plan to issue more bonds.

“The BOJ must be aggressive as Japan’s virus situation is getting worse,” Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities, said before today’s decision. “The BOJ will continue to be walking on a tight rope with few tools left.”

And speaking of few tools, with the BOJ decision leaked so far in advance today's announcement was just a formality, there wasn't even a trace of a reaction in the market.

https://ift.tt/2VGm5Yp

from ZeroHedge News https://ift.tt/2VGm5Yp

via IFTTT

0 comments

Post a Comment