The US Will Sell $4 Trillion In Debt This Year, A 300% Increase: This Is What It Will Look Like

Don't look now, but just weeks after it passed the biggest fiscal stimulus in US history, Congress passed an additional round of fiscal measures totaling $484bn. This raises Goldman's estimated 2020 US deficit financing need to ~$3.5 trillion. But there's more: the bank does not think the latest measure is the final word here, and its economists expect another round totaling $550bn to pay for items such as aid to state and local governments, that haven’t been fully addressed thus far.

On the whole, this would translate to between $3.8-$4 trillion in financing needs for 2020, almost a trillion dollar increment Goldman's prior deficit estimate, and 300% more than the US sold in calendar 2019. Financing such a massive gap, amounting to 20% of GDP, will require a broad-based increase across maturities and product types.

So how will the US pay for this massive financing hole. Below Goldman lays out what it believes to be a "sensible strategy" to raise these funds. In the subsequent two years, Goldman turns optimistic and sees the deficit declining to $2.4tn in FY2021 and $1.65tn in FY2022, and reversing some of this year’s increases. We doubt it: once you go helicopter money, you never go back, just look at Japan.

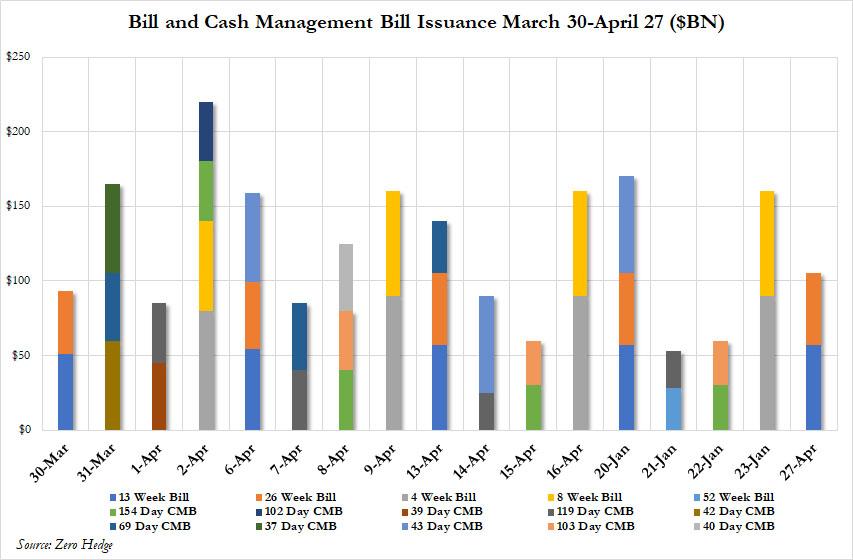

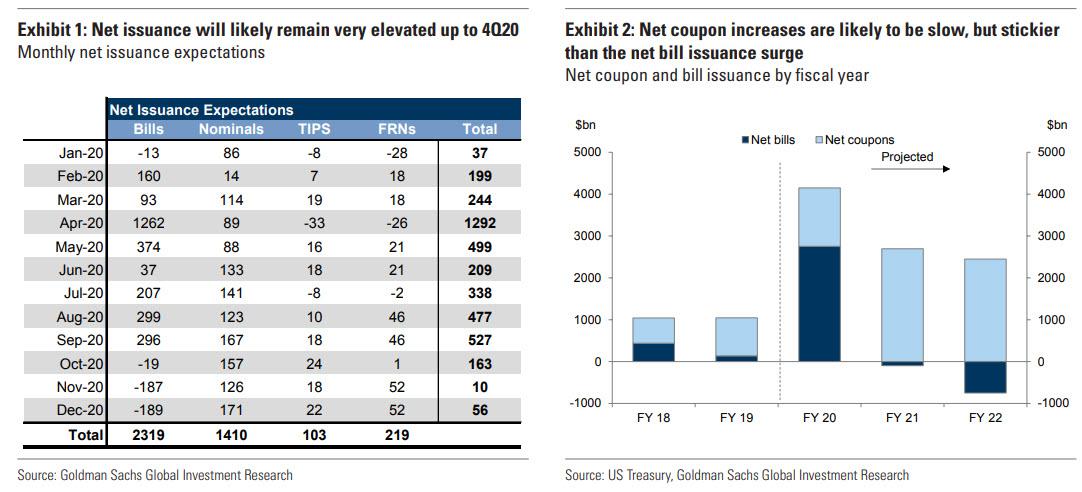

Exhibit 1 shows Goldman's latest split for CY2020 funding. Bills are still the dominant venue for raising funds, with net supply from April to year-end coming in at around $2.1tn (and about $2.3tn for the calendar year), a magnitude large enough to mean that the bills market will have nearly doubled in size this year. That projection isn’t as far-fetched as it might seem—just in the month of April, Treasury has issued roughly $1.26tn of bills.

This heavy near term reliance on bills is even more visible when looking at split on a fiscal year basis. Exhibit 2 shows Goldman's projections for net bill and coupon issuance for FY2020, FY2021, and FY2022. As can be seen, as financing needs drop from nearly $4tn this year to about $2.6tn and $1.7tn in the next two years, bills again adjust as the shock absorber. This pattern should be very similar to issuance around the 2008-2009 recession, when bills outstanding shot up to over 30% of USTs outstanding, only to decline to between 15-20% over the subsequent two years.

Such an initial surge in bill issuance makes sense, according to Goldman, only when there’s reason to believe a sizable portion of the funding gap is temporary and likely to fade quickly (it would take a huge optimist to believe that's the case now). That way, coupon auction size changes can be more gradual, and absorb less of the uncertainty/volatility in deficits. Still, given the large amount that has to be raised, even with bills doing the heavy lifting, Goldman estimates Treasury will have to fund about $1.4tn in FY2020 from coupon issuance.

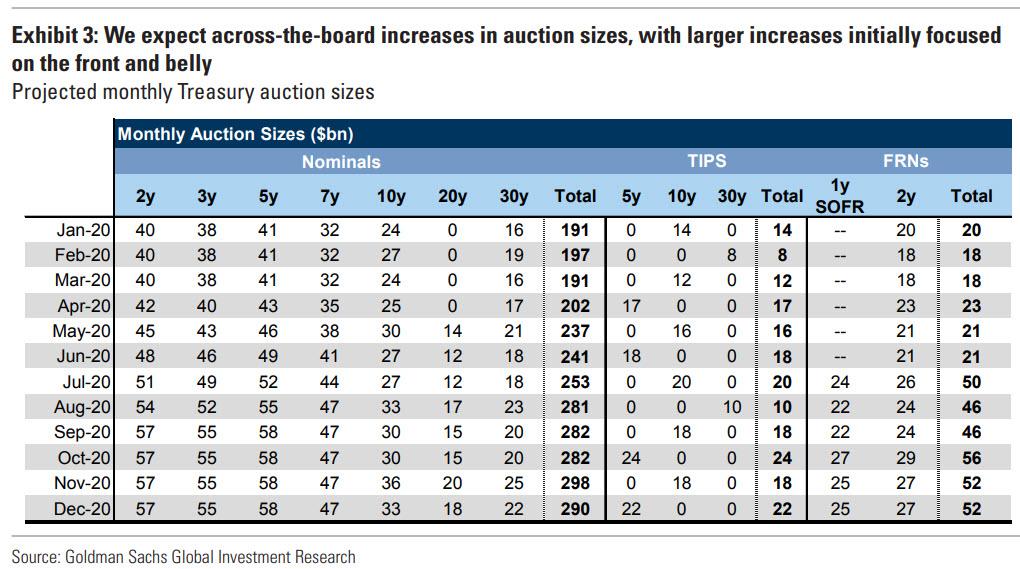

Exhibit 3 shows Goldman's best guess of the auction sizes that would be required to raise this amount. As can be seen, auction sizes will have to be lifted fairly aggressively across the spectrum—a conservative estimates sees increases of $12-$15bn in monthly auction sizes across the front and belly, and a more conservative $5-$8bn in longer maturities. Goldman also expects the introduction of both the 20y bond at the upcoming refunding, and a 1y SOFR-linked FRN in summer. For most of the maturities, the auction sizes will hit their peak levels later this year or early next year.

On the demand side, Goldman expects - for obvious reasons - that the Fed will remain the largest player in the market, as Helicopter money goes BRRRRR. In the bank's most recent analysis, it had estimated that the Fed would have to absorb slightly more than $2tn of the issuance this year to maintain “normal functioning”; with the upsized deficits, the bank now believes that number is now closer to $2.4-$2.6 trillion.

https://ift.tt/2SdBdL0

from ZeroHedge News https://ift.tt/2SdBdL0

via IFTTT

0 comments

Post a Comment