Global Trade Recovery Could Be Weakened By Multiple Disputes Tyler Durden Mon, 06/29/2020 - 05:00

Submitted by Christophe Barraud

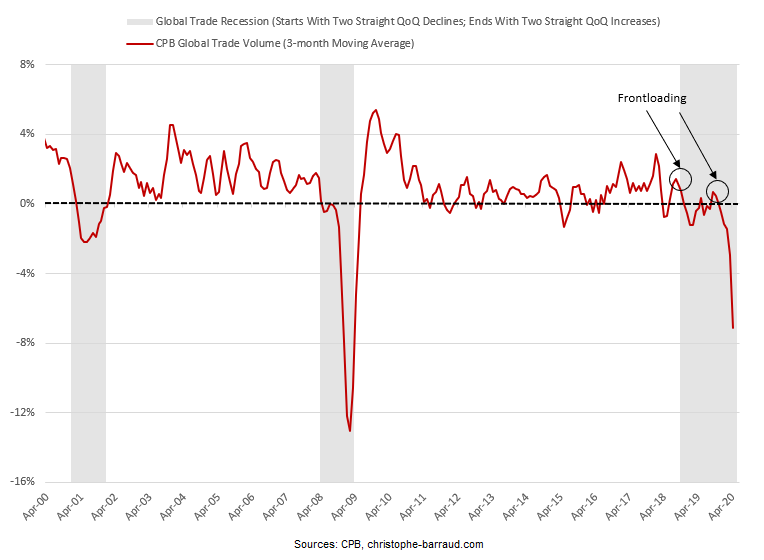

According to CPB Netherlands Bureau for Economic Policy Analysis, world trade experienced an “unprecedented” decline in April as major economies suffered from strict lockdowns due to coronavirus. The volume of global trade in goods dropped by 12.1% MoM in April (the largest monthly contraction since records began in 2000). On a three-month moving average, the index was also down 7.2% in April (largest decline since March 2009) and should contract even more in May.

Ongekende daling van# wereldhandel in april.

— Centraal Planbureau (@CPBnl) June 25, 2020

De #wereldhandelsmonitor van het Centraal Planbureau @CPBnl laat in april een historische daling van de wereldhandel zien van -12,1% ten opzichte van maart.

Voor meer informatie: https://t.co/5TMd4SC9bB of https://t.co/4n2Rd6XqOg pic.twitter.com/6xAVjE1O12

🌎 #Trade falls steeply in first half of 2020 - WTO

— Christophe Barraud🛢 (@C_Barraud) June 24, 2020

*Link: https://t.co/S6HtY2rlqT pic.twitter.com/gCAyn4cLBn

However, WTO Director‑General, Roberto Azevêdo, noted that “The fall in trade we are now seeing is historically large – in fact, it would be the steepest on record. But there is an important silver lining here: it could have been much worse.” In the details, the latest WTO report highlighted that “In light of available trade data for the second quarter, the April forecast’s pessimistic scenario, which assumed even greater health and economic costs than what had transpired, appears less likely.

#WTOForecast update: World trade fell sharply in the first half of 2020 due to #COVID19 but rapid government responses helped temper the decline. The trade slump is unlikely to track the worst case scenario in the WTO’s forecast from April. Full report: https://t.co/lMvgS1eE5B pic.twitter.com/Gjd9ESnCqM

— WTO (@wto) June 23, 2020

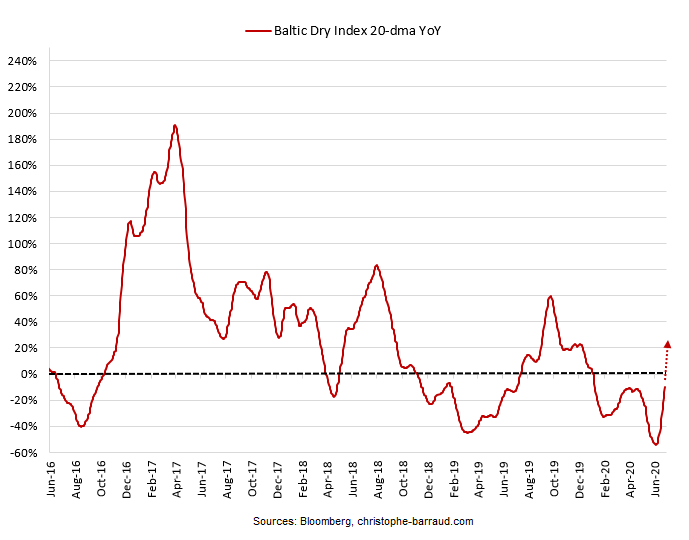

As a matter of fact, latest high frequency data suggest that the worst seems behind us (if there is no second coronavirus wave later this year) with the Baltic Dry Index recovering since late May/early June. Looking at the 20-day moving average, the index could even turn positive on a YoY basis in early July.

The ongoing normalization (reopening) in China, Eurozone, several U.S. states and Asian countries imply that both private investment and household expenditures will mechanically rebound from 3Q20 so that global trade growth will exit almost two years of recession.

Nevertheless, excluding several risks such as a second coronavirus wave, several trade disputes could slow the recovery. First of all, the long-lasting clash between U.S. and China. Despite positive comments from U.S. officials, the latest figures showed that, even if China boosts significantly its purchases of U.S. goods, it will be far from meetings U.S. demands defined in the “phase one” agreement.

Today's data indicate China’s purchases of US goods remain well under 50% of prorated, year-to-date targets of Trump's Phase One dealhttps://t.co/L2Be1ozw68

— Chad P. Bown (@ChadBown) June 4, 2020

As a result, U.S. officials could be tempted to increase pressure on Beijing soon in order to support 3Q U.S. GDP just ahead of the presidential election (November 3). Yet, Chinese officials would probably disagree creating further tensions between the two countries. In the short term, investors will have to focus on the lobster industry. According to press reports, White House trade adviser Peter Navarro said Donald Trump is directing U.S. Trade Representative Robert Lighthizer to report by July 15 on whether China is beginning to comply with $150 million in lobster purchase commitments under the “phase one” agreement. If not, Trump told Lighthizer to consider placing retaliatory tariffs on the Chinese seafood industry.

🇺🇸 🇨🇳 Navarro said Trump is directing #USTR Lighthizer to report by July 15 on whether #China is beginning to comply with $150 million in lobster purchase commitments - NYT

— Christophe Barraud🛢 (@C_Barraud) June 25, 2020

*If not, Trump told Lighthizer to consider placing retaliatory tariffs.https://t.co/zqdv4Ia0yQ pic.twitter.com/bPJdjQoAQ3

In the meantime, tensions between the U.S. and Europe should be scrutinized. According to Bloomberg, “Transatlantic relations could reach a new low next month as the European Union readies tariffs on billions of dollars of American exports aimed at politically important industries for President Donald Trump and his Republican allies in Congress. The EU has asked the World Trade Organization to give it the green light to place levies on $11.2 billion of U.S. products over a long-running aircraft subsidies dispute. A ruling is expected as soon as July and the EU is planning to target coal producers, farmers and fisheries, in addition to the makers of aircrafts and parts.”

🇪🇺 🇺🇸 #Europe Targets U.S. Coal, Farms in Election-Year Trade Staredown - Bloomberg

— Christophe Barraud🛢 (@C_Barraud) June 25, 2020

*Europe could impose tariffs against the U.S. as soon as July

*States like Missouri, Louisiana could be affected by tariffshttps://t.co/G9KDw5tygr

More recently, Bloomberg also reported that “The European Union moved closer to recommending that travelers from the U.S. shouldn’t be allowed to enter the bloc even after July 1.” In this context, “European diplomats are braced for President Donald Trump to take unkindly to Americans being kept away, while the Chinese are allowed in.”

🇪🇺 🇺🇸 U.S.-EU Discord Imperils Rebound in Prime Trans-Atlantic Flights - Bloomberg

— Christophe Barraud🛢 (@C_Barraud) June 27, 2020

*Link: https://t.co/7ZqBgQfsCY pic.twitter.com/1IEO9FBtMU

Separately, another dispute has emerged in Asia. Bloomberg revealed that ”India plans to impose stringent quality control measures and higher tariffs on imports from China”, as a military standoff between the neighbors threaten economic ties. In the details, “The state-run Bureau of Indian Standards is finalizing tougher norms for at least 370 products to ensure items that can be locally produced aren’t imported, the people said, asking not to be identified citing rules. The products include chemicals, steel, electronics, heavy machinery, furniture, paper, industrial machinery, rubber articles, glass, metal articles, pharma, fertilizer and plastic toys. Discussions are also on to raise import duty on products including furniture, compressors for air conditioners and auto components, they said.”

🇮🇳 🇨🇳 #India Plans to Impose Strict Rules and Tariffs on Chinese Imports - Bloomberghttps://t.co/etEzzuwAR7

— Christophe Barraud🛢 (@C_Barraud) June 25, 2020

Other disputes are not excluded with the U.S. also considering re-imposing tariffs on aluminum imports from Canada. Therefore, in the short term, it seems that risks look skewed toward a slower global trade recovery than expected.

https://ift.tt/2Zklk7X

from ZeroHedge News https://ift.tt/2Zklk7X

via IFTTT

0 comments

Post a Comment