Futures Rise To All Time Highs After Chinese Liquidity Injection Tyler Durden Mon, 08/17/2020 - 08:02

Markets drifted higher in a slow start to the week as China flooded the market with a new one-year liquidity and as most European equity indexes traded modestly in the green, shrugging off the unexpected postponement of US-China trade talks and EU regions raising coronavirus travel warnings.

U.S. equity futures rose and traded just shy of all time highs again, as retailers prepared to wind down a better-than-feared quarterly earnings season, while the countdown to Election Day was set to begin with the Democratic National Convention kicking off later in the day.

As Bloomberg notes, trading in markets was subdued on Monday as traders weighed the prospect of tighter quarantine measures against continued government support. Declines among airline shares and travel agencies kept a lid on gains in Europe as Spain and Italy told nightclubs to close and France’s public health agency warned that virus indicators are trending upward. Meanwhile, tensions are continuing to mount between the U.S. and China. On Friday, senior officials from Washington and Beijing postponed trade talks that had been set for this past weekend to discuss the status of the “phase one” trade deal signed early in the year. A source suggested the US-China meeting was delayed as US wanted more time to allow China to increase US imports; another referenced a conference of senior Communist Party leaders

"The economy is going to continue to reopen as we move into the end of this year,” Brett Ewing, chief market strategist at First Franklin Financial Services, said on Bloomberg TV. "If you can buy into that story, you need to be ahead of money flowing into these value and cyclical stocks -- if you wait for a vaccine to come out, you’re going to be missing probably the biggest opportunity right now."

Europe's Stoxx 600 was up 0.2%, supported by commodity and technology shares amid light trading volumes. Covid-19 vaccine contender CureVac continued Friday’s rally, surging more than 50% in U.S. pre-market trading. Gains in miners and tech are offset by losses in real estate and travel names.

A bit reason for the positive overnight sentiment is that on Monday, The People’s Bank of China offered 700 billion yuan ($101 billion) of one-year funding via the medium-term lending facility, more than offsetting the 400 billion yuan in loans coming due Monday and another 150 billion yuan maturing on Aug. 26. The central bank also added a net 40 billion yuan via 7-day reverse repurchase agreements, after injecting the most short-term funding into the interbank market since May last week.

The MLF injection signals "a moderate easing of the monetary condition and will be good to China government bond performance, especially the short-dated," said Xing Zhaopeng, an economist at Australia and New Zealand Banking Group Ltd. in Shanghai. Interbank borrowing costs also decreased following the cash additions, with the overnight repurchase rate slipping 4 basis points to 2.12%.

The PBOC's extra liquidity injection helped the Shanghai Composite close up 2.3%. The net injection indicates “a more accommodative stance on keeping liquidity levels ample” so that commercial banks can continue to support bond issuance and to stabilize credit growth, said Liu Peiqian, a China economist at Natwest Group Plc. in Singapore.

In rates, yield curves were mixed, as bunds and gilts bull steepen slightly and Treasuries flatten. Treasuries held small gains after retreating from session highs reached during European morning, outperforming gilts and bunds. Yields were lower by as much as ~2bp across the curve with 7- to 30- year sectors leading, flattening 2s10s by nearly 2bp, 5s30s by ~1bp; 10-year, lower by ~2bp at ~0.692%, outperforms gilts and bunds by ~1bp. After last week’s supply-driven surge in long-end yields, there’s apprehension about Wednesday’s 20-year bond and Thursday’s 30-year TIPS auctions. In Europe, peripheral spreads widened marginally.

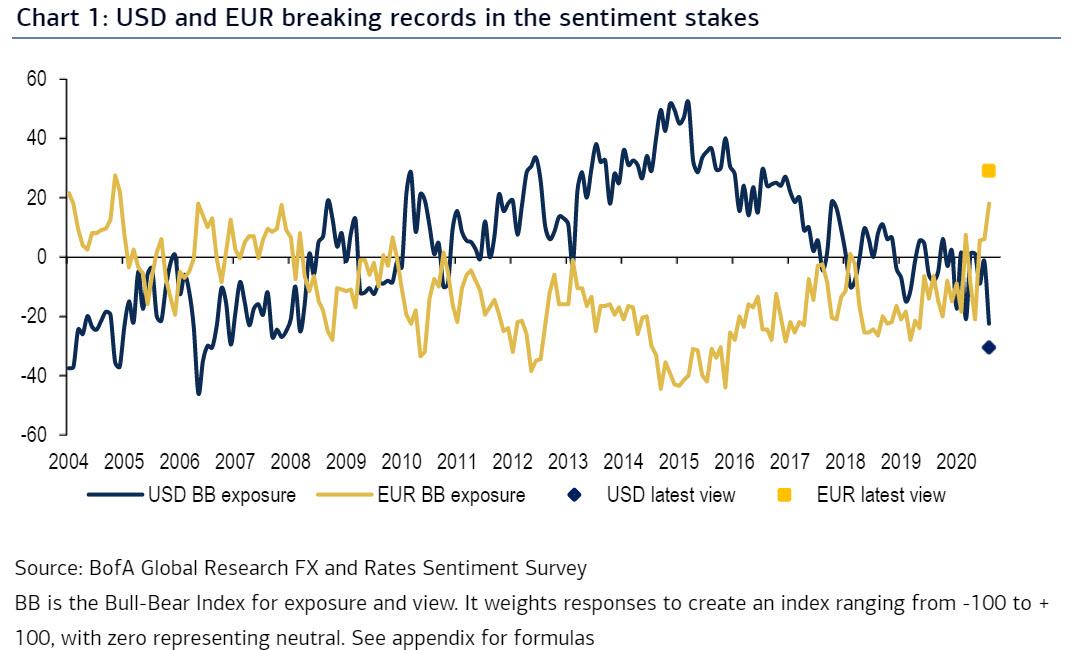

In FX, the Bloomberg dollar index faded a small dip in Asia to trade flat to slightly down. As a reminder, we showed on Sunday that "short dollar" is now the world's most consensus trade.

Elsewhere, the pound rose against the dollar and edged up against the euro ahead of the next round of Brexit negotiations. The pound is trending near a five-month high against the greenback, close to forming a bullish pattern known as a “golden cross” that signals further gains ahead. The New Zealand dollar fell as Prime Minister Jacinda Arderndelayed the general election by four weeks after a rise of coronavirus cases. The Australian dollar surged past 1.10 against the kiwi for the first time since 2018 on speculation New Zealand interest rates could fall below zero.

In commodities, crude futures trade off the overnight highs, but hold a narrow range. Spot gold rises ~$7 to trade near $1,950/oz, silver gains 1%.

Figures this week are likely to show another jump in housing starts as demand surges for single-family homes in the suburbs, in turn benefiting sales of home improvement chains such as Lowe’s Companies Inc and Home Depot Inc. The retailers, along with Walmart, Kohls and Target are due to report second-quarter earnings later in the week. As of Friday, 457 companies in the S&P 500 had reported results, of which 81.4% came in above dramatically lowered expectations, according to Refinitiv data.

Also in the week ahead, the FOMC minutes due to be released on Wednesday may provide some more clues about whether officials plan to introduce new average inflation targeting language in September. Investors are also girding their portfolios for market moves ahead of the U.S. presidential vote, as election season kicks into higher gear with the Democratic National Convention, which runs Monday through Thursday. The Republican convention will be held from Aug. 24 to Aug. 27 and both will be mostly virtual this year due to the COVID-19 pandemic. On today's relatively quiet calendar, we get the latest Empire State Manufacturing data.

Market Snapshot

- S&P 500 futures up 0.3% to 3,371.25

- STOXX Europe 600 up 0.1% to 368.59

- MXAP down 0.08% to 170.88

- MXAPJ up 0.3% to 564.58

- Nikkei down 0.8% to 23,096.75

- Topix down 0.8% to 1,609.82

- Hang Seng Index up 0.7% to 25,347.34

- Shanghai Composite up 2.3% to 3,438.80

- Sensex up 0.2% to 37,956.54

- Australia S&P/ASX 200 down 0.8% to 6,076.38

- Kospi down 1.2% to 2,407.49

- Brent futures down 0.3% to $44.66/bbl

- Gold spot up 0.3% to $1,950.47

- U.S. Dollar Index down 0.1% to 92.99

- German 10Y yield fell 1.3 bps to -0.434%

- Euro down 0.08% to $1.1832

- Italian 10Y yield fell 2.3 bps to 0.862%

- Spanish 10Y yield fell 1.2 bps to 0.345%

Top Overnight News from Bloomberg

- European nations are fighting a resurgence of the coronavirus, with Italy and Spain ordering the closure of nightclubs and France’s public health agency warning that all of the country’s Covid-19 indicators are showing an increase

- Bank of England Chief Economist Andy Haldane, writing in the Daily Mail, said that the U.K. is heading for a “quick recovery” from the coronavirus crisis, expecting the economy to rise by more than a fifth in the second half of this year

- Stocks in China rose after China’s central bank supplied liquidity to commercial lenders on Monday to help them manage upcoming government bond sales

- Workers across Belarus are taking part to a general strike, following some of the biggest protests seen in the country, with thousands of people marching to call for the resignation of current president Alexander Lukashenko

Courtesy of NewsSquawk, here is a quick rundown of global markets:

Asian equity markets which began the week mixed amid uncertainty following the indefinite postponement of the US-China trade agreement review talks and with President Trump increasing the pressure on ByteDance and is said to be looking at pressuring other Chinese companies including Alibaba. ASX 200 (-0.8%) and Nikkei 225 (-0.8%) were negative with Australia led lower by underperformance in financials and with a deluge of earnings updates also in focus, while the Japanese benchmark suffered on recent currency effects and after a larger than expected contraction for Q2 GDP. Hang Seng (+0.6%) and Shanghai Comp. (+2.3%) traded positively despite the ongoing tension between the world’s two largest economies, as risk appetite was helped by efforts from the PBoC which announced a CNY 50bln reverse repo injection and a CNY 700bln in 1-year Medium-term Lending Facility. Furthermore, notable gains were seen in Xiaomi and WuXi Biologics as they are set to join the Hang Seng Index from September 7th and with Xiaomi also buoyed after the CEO debuted a live showcase of products on TikTok. Finally, 10yr JGBs were slightly higher to track the mild gains in T-notes and with the weakness seen in Japanese stocks, although upside was only marginal amid the lack of BoJ presence in the market today.

Top Asian News

- Church Flareups in South Korea Spur Fear of Old Virus Threat

- Turkey’s Budget Falls Deeper in the Red as Pandemic Hits Revenue

- Billionaire Agarwal’s Vedanta Tests India Junk Bond Demand

A choppy start to the week for European stocks [Euro Stoxx 50 Unch] as the region swung between gains and losses in the first hour of cash trading before calming in mixed trade. This comes as the region failed to sustain the mostly positive APAC lead amid a lack of fresh catalysts in what has thus far been a quiet start to the week. Spain’s IBEX (-0.8%) is the marked laggard as the country’s recent COVID-19 case spikes prompted the closure of nightlife, whilst Germany reaffirmed its travel warning to Spain and Tui (-4.8%) extended the suspension of flights to Spain, Portugal, Cyprus and Morocco. Sectors also see a mixed performance with no clear risk profile to be derived, with Basic Resources and Tech holding their top spots, with some aid potentially derived from the PBoC’s liquidity injection overnight, whilst Travel & Leisure, Banks and Real Estate remain the laggards. In terms of individual movers, Monday M&A action from Sanofi (+0.2%) sees the company eking mild gains as it is to acquire Principia Biopharma (PRNB) in an all-cash deal valued at approximately USD 3.4bln. The deal will further strengthen core R&D areas of autoimmune and allergic diseases, Sanofi expects to complete the purchase in Q4 2020. Under the deal, outstanding Principa shares will be purchased for USD 100/shr (vs. Friday’s USD 90.74/shr close), and thus the Co. trades over 10% higher in the pre-market. Elsewhere, Deutsche Lufthansa (-2.0%) conforms to the overall underperformance in the travel sector, albeit the group reached a deal with UFO union on cost cutting measures, but talks have been broken off with the Verdi union on ground personnel.

Top European News

- U.K. Exam Crisis Grows as Johnson Faces More Chaos This Week

- Europe’s Fading Rebound Turns Recovery From V-Shape to Bird Wing

- Europe Travel Shares Fall Again Amid Further Virus Setbacks

In FX, a real Monday summer lull and lacklustre trade in the currency markets, with the DXY going nowhere fast or far from the 93.000 pivot that has been keeping the index and Greenback in general tethered for a while. The US fiscal impasse continues and even the eagerly awaited showdown with China to assess progress towards the Phase 1 trade pact was postponed for another day, so the weekend has passed by without any real meaningful event. Moreover, today’s agenda is hardly promising in terms of potential catalysts to prompt some price action, as the European calendar is bare beyond weekly ECB QE tallies and the US docket only comprises NY Fed manufacturing and NAHB surveys. Back to the DXY, 93.124-92.887 covers the range and the base is just shy of last week’s low as a reference point.

- CAD/NOK – Marginal G10 outperformers, and perhaps deriving some traction from firmer crude prices, while the former awaits the BoC’s Q2 Senior Loan Officer Survey and latter acknowledges a significantly narrower trade deficit in the run up to this week’s Norges Bank policy meeting. Usd/Cad is straddling 1.3250 and Eur/Nok is still eyeing the psychological 10.5000 level after recent probes below, but no sustained break.

- JPY/AUD/GBP/CHF/EUR – All narrowly mixed against the Buck, as the Yen rotates around 106.50 in wake of weak GDP and ip data, the Aussie spans 0.7175, Pound flits either side of 1.3100, Franc hovers just above 0.9100 and 1.0750 vs the Euro as Eur/Usd trades around 1.1850. Note, another hefty Swiss bank sight deposits has not hindered the Chf, but did result in some selling pressure last week.

- NZD – The Kiwi is still lagging and underperforming on NZ’s COVID-19 resurgence that has forced the Government to extend mortgage deferrals by another 6 months to the end of Q1 next year and a new Nzd 510 mn salary subsidy for 470k jobs. Nzd/Usd is towards the bottom end of 0.6523-53 parameters and Aud/Nzd has extended post-RNBZ gains sharply to over 1.1000 before paring back a bit.

- EM – No adverse reaction to the aforementioned US-Sino trade deal meeting delay, as the PBoC set a firm Cny midpoint fix overnight and added more 7-day liquidity alongside medium term funds, but the Try has depreciated yet again amidst more Turkish trouble in Syria and the Med, not to mention a wider budget shortfall. Usd/Try has been above 7.3950 irrespective of the CBRT’s longer term repo auction.

In commodities, WTI and Brent front month futures have waned off overnight highs since European players entered the fray, again with little to report in terms of fresh fundamentals. That being said, source reports late Friday noted that China will significantly increase imports of US oil – an area China has been lagging in under the Phase 1 deal. On the OPEC front, the JMMC will reportedly be meeting on Wednesday. Although no major surprises are expected, focus will likely fall on any commentary surrounding the oil market outlook, whilst credence will also be given to the compliance of the OPEC+ stragglers and whether they are over-complying as promised. Turning to the US, Friday’s Baker Hughes rig count saw active oil rigs continuing to decrease (-4), but analysts are skeptical that US producers will be able to sustain current production levels given the slump in drilling activity. “Although US producers should be able to bring back some production, even with the limited drilling activity. The Industry is still sitting on a large amount of drilled but uncompleted wells (DUCs), and so can complete these wells in an attempt to sustain production levels” ING writes. Elsewhere, spot gold and silver continue grinding higher, initially due to a weaker USD, but thereafter the preciously metals found mild support at USD 1950/oz and USD 26.60/oz respectively. Precious metal traders this week will be eyeing the FOMC Minutes, US-Sino events, COVID-19 developments, and US stimulus bill updates. Meanwhile, Dalian iron ore prices continued to edge higher, marking a third straight session of gains amid an upbeat demand prospects for steel-making, but traders are also keep an eye on the supply side of the equation. Nickel prices meanwhile were supported by tighter supply from a key supplier – the Philippines.

DB's Craig Nicol concludes the overnight wrap

Two weeks left to play in August and given the calendar for this week there’s every chance that they live up to their billing as the last couple of weeks of the summer lull. Hope for any fiscal breakthrough in the US may have to wait for now with the Democratic and Republican nominating conventions taking place over the next couple of weeks. As our economists noted in their weekly over the weekend however, this presents a problem for the 28.3 million Americans who were receiving some form of unemployment insurance as of the last week in July and who ostensibly (if they had not found a job) had their monthly income fall by over 60% in August. It is also an issue for monetary policymakers who have consistently emphasized the need for further fiscal support to aid the recovery.

To that end, the FOMC minutes from the July 29 meeting should be one of the more interesting events this week – especially if there are signs of a potential average inflation target being discussed - with the other being the various surveys ending with the flash August PMIs on Friday. This should give investors one of the first indications of how the global economy has fared moving into the month, so it’ll be interesting to see if the recent positive momentum in most of the PMIs is sustained. For reference in the July PMIs, with the exception of Japan, all of the other countries (Australia, France, Germany, Euro Area, UK and US) had PMIs above the 50-mark that separates expansion from contraction.

So we’ll see if that helps the S&P 500 complete the final half a percent or so needed to take it to new all-time highs. The other talking point has the bear-steepening in rates which for Treasuries saw 2s10s jump to 56bps, steepening 13bps on the week. A reminder that our global rates strategists’ think there could be more to come and target 0.85% on the 10y Treasury (about 15bps above this morning’s level). See their full note here.

In terms of the weekend just gone, the most notable thing to report is what hasn’t happened with the scheduled meeting between officials from the US and China over progress of the Phase 1 trade deal being postponed. President Trump did however officially order TikiTok’s parent to sell its US assets. Despite that, China stocks have surged this morning with the Shanghai Comp up +2.27% and CSI 300 +2.44%. The Hang Seng has also risen +1.28%. This follows the PBoC injecting CNY 700bn of 1yr funding via the medium-term lending facility. Other markets are lower this morning however – the Nikkei down -0.92% and ASX -0.66%. Elsewhere, yields on 10yr USTs are down -1.4bps and futures on the S&P 500 are up +0.28%. WTI crude oil prices are also trading up +0.81%.

As for the latest on the virus, new cases in the US grew by +0.8% over the past 24 hours vs. 0.9% at the same point last week. Meanwhile, New Zealand delayed its national elections by 4 weeks over the concerns around the recent virus outbreak and South Korea reported 197 cases in the past 24 hours after warning over the weekend of a fresh wave, most of them linked to an outbreak at a church. Elsewhere, Italy and Spain told nightclubs to close, while France’s public health agency warned that all of the country’s Covid-19 indicators are trending upward.

Finally, to recap last week’s moves, risk assets ended the week higher on the whole, in spite of the continued stalemate on a new US stimulus package, with the S&P 500 advancing +0.64% (-0.02% Friday) to close within half a per cent of its all-time high back in February. Volatility also continued to subside, with the VIX index coming down a further -0.16pts to 22.05, its lowest level in nearly 6 months. Elsewhere, equity indices also advanced in Europe, with the STOXX 600 up +1.24% (-1.20% Friday), and the DAX up +1.79% (-0.71% Friday), though sentiment in Europe was rather dampened on Friday by new quarantine rules on French travellers imposed by the UK, as well as continued rises in cases across the continent.

With investors moving into risk assets, safe havens suffered through the week, with yields on 10yr Treasuries rising +14.5bps (-1.1bps Friday) to 0.709%, and gold down -4.44% (-0.44% Friday) in its largest weekly decline since March. Over in foreign exchange markets, the dollar index fell a further -0.36% (-0.26% Friday), while the traditional safe haven Japanese yen weakened by -0.63% (+0.31% Friday) against the US dollar.

The moves on Friday came against the backdrop of some fairly mediocre US data releases. Firstly, retail sales in July rose by a less-than-expected +1.2% (vs. 2.1% expected), though the June reading was revised up by nine-tenths of a per cent to +8.4%. Meanwhile the University of Michigan’s preliminary consumer sentiment indicator for August showed that sentiment was still weak, with the reading rising to just 72.8 (vs. 72.5 in July), and well below the 101.0 back in February. And finally, industrial production was up +3.0%, in line with expectations.

https://ift.tt/2Q60wwJ

from ZeroHedge News https://ift.tt/2Q60wwJ

via IFTTT

0 comments

Post a Comment