Luongo: Is This The End Of COMEX Paper Gold? Tyler Durden Sun, 08/16/2020 - 09:15

Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

There’s been a lot of speculation in the Gold community about what’s happening in the market this year. 2020 has been wracked with unprecedented gyrations in the gold market.

It’s also seen gold finally breach the $2000 level and, this week after a nasty correction, is still holding onto most of its recent gains.

This rally in gold and the persistent supply tightness which has kept gold futures in backwardation for most of the year are indicators that something has fundamentally shifted in the gold market.

And now, the question on a lot of people’s minds is whether we’ll see the end of the fiction of the paper gold market as epitomized by the futures market on the COMEX.

Alistair Macleod’s recent article detailed the gyrations of the gold futures market explains why he felt the so-called bullion banks who work with the central banks to keep gold control have, in fact, lost control.

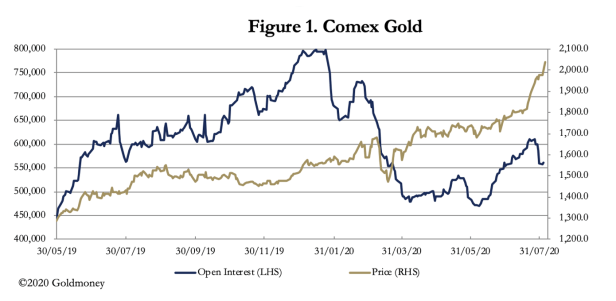

His detailed the use of open interest on the COMEX to push and pull the price of gold and how the market changed after March 23rd when the futures premiums blew out to a high of $70 over the cash price in the forex markets.

Using mass liquidation to crater the price of gold and force thinly-margined, weak longs off their positions is a classic COMEX raid on the gold and silver markets.

And if you look closely at this chart you’ll see a few moments where dramatic drops in open interest didn’t result in big price drops. So, either longs ponied up the cash to stay in their positions or the buying into those ‘raids’ so intense that attempt failed to break the psychology of the gold market.

This is especially true at the end of July, where the attempts to crash the price saw the backwardation premium contract sharply to force longs into unprofitable positions just before the delivery period opened up to try and get them to settle up in cash rather than stand for delivery.

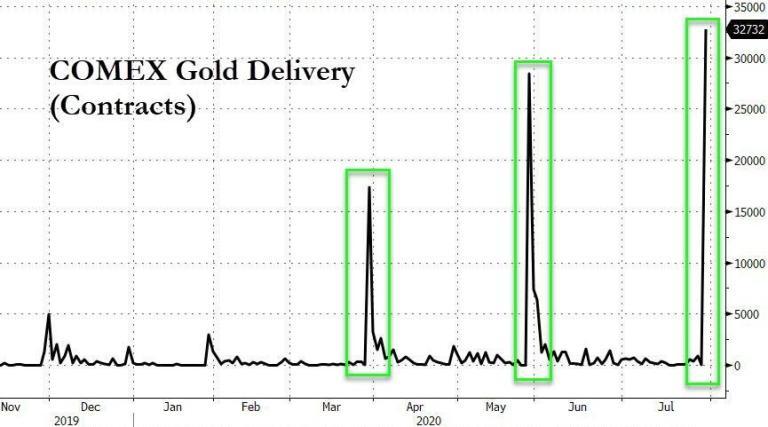

Zerohedge has been all over this story of record gold deliveries to the COMEX in recent months.

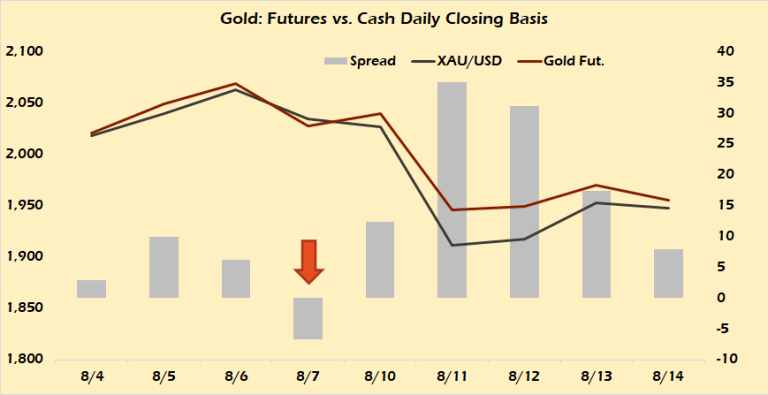

An important change in the global gold market occurred on March 23, 2020. On that day the price of gold futures in New York started drifting higher than the price for spot gold in London. Ever since, the spread has persisted, though it continuously widens and narrows. The reason for this disturbance in the market can be read in my previous article “What Caused the New York vs. London Gold Price Spread and Why it Persists.”

For years folks have talked about that ultimate dramatic moment where the COMEX stands naked in front of the gold community unable to source the physical metal and defaulting on its obligations.

We saw the opposite version of that in oil earlier this year when the May contract closed at $-40.57 per barrel because there was no place to send the oil the contracts represented.

There was so much open interest which needed to settle that the speculators couldn’t resolve the positions without paying through the nose to find a place to put the oil they’d just bought.

And a lot of people feel the same thing will happen in gold in reverse. In this scenario there won’t be enough gold to deliver to those who want the metal. Normally, gold futures are settled in cash.

It’s not a producer/consumer hedging platform. It’s a currency hedging/speculator platform.

But in 2020 it’s now a source of physical gold supply for someone and the COMEX isn’t happy about it at all.

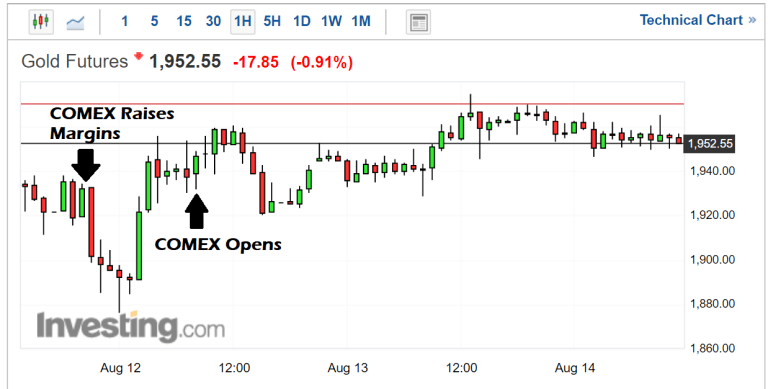

The latest raid on gold began on Friday and continued through Tuesday. When all was said and done more than $200 got knocked off the price, peak to trough.

It should have been enough to dampen gold bull enthusiasm given the strength of the rally off the March low. And during the worst of the raid gold moved back into contango.

But once the raid was over and a new low established gold moved right back into backwardation and with that an explosion off the low and a move right back to challenge $2000 again on Thursday.

What’s even more impressive is that the COMEX, after Monday’s follow-through beat down, did what it always does to protect itself, it raised margin requirements on both gold and silver to force even more liquidations from now exposed and under-water longs.

But it didn’t work!

There was weakness in the overnight Asian markets but once Europe opened the price rebounded and by the time the COMEX opened gold was trading at a higher price than the previous close.

What’s important here isn’t that gold may be moving into a longer-term correction, which is highly likely and a bit overdue, it is that dramatic washouts in price are having little effect on bullish sentiment.

The bulls know that the old market structure is breaking down. They know that London is being drained of gold supply through persistent backwardation, creating arbitrage opportunities while investors are rightfully nervous about the future.

Someone is standing for hundreds of tonnes of delivery in gold while pushing the price higher against the wishes of the exchange.

Here’s a question for you…. who would that be?

Regardless of that, the current scenario can only last for so long.

If there’s one thing I’ve come to accept after over two decades of watching markets it is that the House always wins. The exchanges will always move to protect themselves in the event of a run on their business.

And in the case of the COMEX I fully expect the current gold futures contract to go the way of the U.S. dollar, decoupled completely from physical redemption.

Some folks seem to think this will drive the price to zero. It might, but only after driving the price to infinity.

The more likely scenario is that there won’t be any gold available at any price. Once that occurs, then the value of the contract could vaporize.

What the COMEX doesn’t want to admit to the market is that its gold futures contract isn’t a real futures market but rather a speculation/hedging platform as I said earlier.

The fiction of a gold-settled futures contract keeps the fiction that supply and demand for gold are in balance at these prices. But are they really? If so then gold wouldn’t be hoarded the way it is. Gresham’s Law would reverse and gold would move into the market at a much higher clearing price.

In a regime where central bank credibility is under fire as well as complete political dysfunction in both D.C. and Brussels, the desire to keep gold from making headlines is key to extending that credibility through the crisis period.

As a last resort, then, when cornered by bulls, things have become truly crazy and the exchange cannot make good on its ability to deliver physical gold the COMEX will go to a fully cash-settled contract and that will be that.

And it will happen long before the market goes ‘ask-less.’ The COMEX will step in, in my opinion, before the end of the year to make this critical shift.

Because I think they are fighting people with deeper pockets than they’ve ever fought before.

Will that destroy the COMEX’s credibility? Yes. Will it end the market? No. There is a reason why the COMEX can write hundreds of contracts against the amount of gold in its vaults, because there is demand for a cash-settled ‘paper’ gold futures contract.

That demand will not go away just because some users of the platform are cock-blocked from taking physical delivery. The COMEX gold futures contract will just morph into a highly-liquid contract-for-difference (CFD) and the world will move on.

But it will upset the structure of the gold market in general. It will free the gold market from the fiction of the COMEX gold delivery system and, for the first time in ages, allow real price discovery unburdened by fears over physical delivery forcing ridiculous positioning by bullion banks back-stopped by the Fed’s Magic Money Tree.

That, to me, is what is so very important about what is happening now. Because that begs the question, cui bono?

Who benefits from breaking the price control system of the fake, paper gold market?

Once you sort through the answer to that, China and Russia, then what’s been happening in gold and silver should make a whole lot more sense.

And why gold seems to have decoupled not only from the COMEX but gyrations in the U.S. dollar.

* * *

Join my Patreon if you like gold. Install the Brave Browser if you hate Google’s control over information flow.

https://ift.tt/30YYcxW

from ZeroHedge News https://ift.tt/30YYcxW

via IFTTT

0 comments

Post a Comment