Here's Why the New COVID Relief Program Will Turn The Working Class Into Serfs...

Authored by Chris Macintosh via InternationalMan.com,

“This work was strictly voluntary, but any animal that absented himself from it would have his rations reduced by half.”

George Orwell, Animal Farm

Everything is now political.

ESG, climate change, racism, gender, vaccines. Ask yourself why is it that all of these things are non-negotiable? Why can’t they be discussed? Why is there no room for dissent, questioning, and discourse?

Something is amiss. Think about it.

The pointy shoes at the IMF tell us that the pandemic will cost the world $28 trillion by 2025, which means it’ll be much, much more.

The truth is the pandemic isn’t the cause. The lockdowns, however, are.

Understanding what exactly this “pandemic” is, is really critical to understanding everything taking place globally and in financial markets both now and in the future.

This virus is statistically as dangerous to the population as a bad flu. “No, not possible, Chris. Look at the response by governments. Surely that’s disproportionate.” Yes, it is, but there is a reason.

To understand the answer to this more fully we need to go back to 2008 and then walk forward tracking the unfolding events.

Following the housing crash and subsequent banking crisis QE was brought in as the tool to “fix” what could have and should have been fixed by letting the banks fail and putting on trial and jailing Wall Street bankers as well as regulatory agencies who were all willfully and knowingly involved in a massive fraud.

The economy has been hanging by a thread ever since.

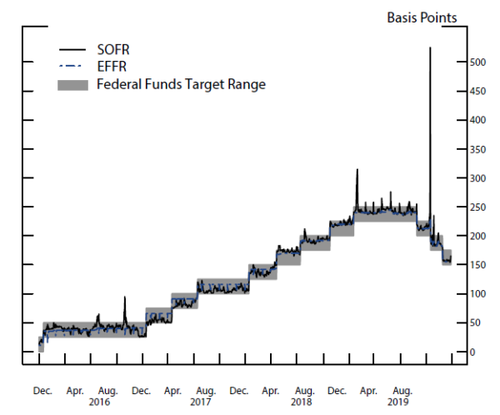

Then in 2019 the money market seized up with the overnight lending rate shooting up, causing the pointy shoes at the Fed (and the ECB in coordination with the BOE, too) to step in to “fix” it.

They printed upwards of 100 million smackaroos PER NIGHT.

Bankers should have been screaming… but they’re not. Why?

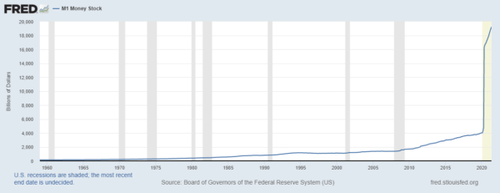

Since the beginning of 2020 the major central banks around the world have expanded the money supply by anywhere from 30% to… how do I even say this without my throat catching? Better yet a visual to display the situation.

The central banks would have struggled to do this without drawing attention to their scandalous behaviour if it weren’t for the scapegoat of Covid. “This is unprecedented,” they tell us. “We have to do something,” they say.

To convince the public of the absolute necessity for the tyranny now imposed, they have used every lying trick in the book, and when found out and revealed quickly and mercilessly acted to ensure the truth is “canceled”.

Breach of community guidelines. No mention made of what this community is or what the guidelines are. The level of distraction availed by the Covid fraud is breathtaking and has allowed for the most egregious transfer of wealth in history.

This money has been printed not to provide “covid relief” as is being sold to a gullible public but to bail out the banks in a more palatable fashion.

If direct bailouts were enacted, the outrage would have likely been of far greater magnitude than the 1% protests that followed the 2008 debacle. Instead, they chose to funnel the capital directly to the consumer.

Make no mistake about it though, without this we’d be in a full-blown banking crisis. This is why we don’t have banks failing and the fat cats on Wall Street chewing their fingernails.

Less than 3% of money supply is in physical format. The balance is all debt-based money. Money is brought into circulation by the creation of debt. This debt burden has grown to uncontrollable eye watering levels. It will collapse and was in the process of doing so back in 2008. It was about to do so again in 2019 when the money market seized up.

The desperate need to hold this ball of wax together was why in 2014, bank bailouts not being enough, they enacted laws to allow bank bail-ins. Meaning that they can (and will when necessary) seize customer deposits in order to bail out the bankers.

That it is legalized theft won’t matter. As is always the case the average Joe has no idea about any of this and gleefully plonks his hard-earned wages in the bank believing that he is a customer and that the bank is there to serve him. Customers of Cypriot banks thought the same thing right up until they received a shocking jolt of reality back in 2013.

One thing to remember is that you can’t have a collapse like this without taking the currency down with it. Never happened before in history and it isn’t going to happen this time around either.

The coming problem is this. We have a truly monstrous increase in money supply, and if we open the global economy back up, we’re going to then get an increase in velocity. I.N.F.L.A.T.I.O.N.

While the money conjured up and given to the banks in 2008 led to an explosion in “growth assets,” the money now printed has been fed to the general populace (who then don’t default on their debts to the bankers).

It solves two problems for the pointy shoes. Firstly, it ensures the bankers don’t go bankrupt. And secondly, it turns a working class into a slave class.

You see, when you work for a living and vote for your government, they are reliant on you. But when you don’t work for a living and are reliant on your government then you are a slave to them. The roles are completely reversed.

To sum it up

We have entered a period of time where ideologies are driving literally everything.

Ideas and opinions are becoming weaponized.

What is important to understand is that this absolutely is and will drive capital flows more than ever.

This will impact economies and sectors.

This is the fourth turning, and it will run until it collapses or implodes on itself.

* * *

The Fed has already pumped enormous distortions into the economy and inflated an “everything bubble.” The next round of money printing is likely to bring the situation to a breaking point. If you want to navigate the complicated economic and political situation that is unfolding, then you need to see this newly released video from Doug Casey and his team. In it, Doug reveals what you need to know, and how these dangerous times could impact your wealth. Click here to watch it now.

https://ift.tt/3BUsmD8

from ZeroHedge News https://ift.tt/3BUsmD8

via IFTTT

0 comments

Post a Comment