Ags Join Commodity Melt-Up As Wheat, Cotton Soar

Global food prices continue to move higher with no end in sight. Wheat prices tagged a new multi-year high; cotton, coffee, corn, and soybean oil are also surging as concerns about persistent food inflation mount.

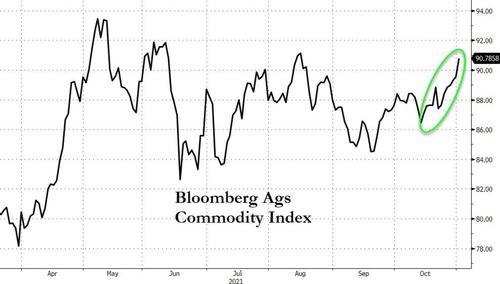

The Bloomberg Agriculture index is moving higher.

On Monday, the most-active wheat futures rose more than 3% to $7.97 a bushel on the Chicago Board of Trade, hitting 8.5-year highs. Prices have gained more than 11% since mid-October.

European wheat prices are nearing all-time highs.

COMMODITY INFLATION: Add European milling wheat to your inflation watch. Front-month European wheat prices (Matif) about to hit an all-time high, currently just a couple of euros below the peak set in 2008 | #OATT pic.twitter.com/HjfWMyE1Y2

— Javier Blas (@JavierBlas) November 1, 2021

A combination of factors is driving wheat prices higher. First, global demand is robust, and second, supplies are tightening worldwide. Demand is increasing when supplies are shrinking due to poor weather during harvest in top export countries. That helped catapult prices higher in recent weeks. Then Saudi Arabia booked a monster purchase of the cereal grain. Leading importer Egypt also returned to the market Monday after making a large purchase last week.

Pressuring prices higher are farmers faced with a whole host of inflationary woes, from soaring fuel, fertilizer, labor, and machinery costs to adverse weather conditions that may result in fewer plantings in 2022.

Then there are adverse weather conditions:

"The Russian Ministry of Agriculture had said that farmers would drill 19.5 million hectares this autumn, but prolonged dry weather has resulted in delays," U.K.-based trader Frontier Agriculture said late Friday. "Ukraine is also suffering from low soil moisture, raising concerns for the country's winter drilling potential.

Wheat prices may remain elevated in 2022 and pressure food inflation higher. The UN's Food and Agriculture Organization recently showed global food prices are fresh decade highs.

Last week, palm oil, the world's most consumed vegetable oil, surged to a new record high, which seems like an ominous sign for emerging market economies where soaring food prices will stress households and result in what SocGen's Albert Edwards has said since December: soaring food prices will destabilize vulnerable countries. And add soaring energy costs to the mix and we suspect Biden's approval rating may head even lower.

https://ift.tt/3EB39On

from ZeroHedge News https://ift.tt/3EB39On

via IFTTT

0 comments

Post a Comment