In Low Key Move, Singapore’s Central Bank Adds 26 Tonnes To Its Gold Reserves

Submitted by Ronan Manly, BullionStar.com

It has just come to light that Singapore’s central bank, the Monetary Authority of Singapore (MAS), added 26.35 tonnes of gold to its official monetary gold reserves over a 2 month period between May and June this year, in the process boosting its strategic gold holdings by 20% to a claimed 153.76 tonnes.

This addition to the monetary gold holdings of the Monetary Authority of Singapore was first pointed out by the World Gold Council’s Krishan Gopaul in a 25 November tweet, following an update to Singapore’s gold holdings appearing in the IMF’s International Financial Statistics (IFS) database, a source which World Gold Council uses to keep track of central bank and sovereign gold holdings.

Here’s something interesting in the latest IMF stats: The Monetary Authority of Singapore added 26t of #gold to its reserves over May and June 2021. This is its first gold purchase since at least 2000, and another instance of a developed market CB buying (along with Ireland). pic.twitter.com/UeHmAbxRt9

— Krishan Gopaul (@KrishanGopaul) November 25, 2021

May and June: 26.35 tonnes added

While it’s unclear why changes to Singapore’s monetary gold holdings from May and June only made it on to the IFS database in recent days, looking more closely, the Monetary Authority of Singapore did ‘reflect’ the May and June gold purchases at the end of July and August, respectively, via updates to the MAS’ monthly “International Reserves and Foreign Currency Liquidity” report, but did not announce or mention the additions specifically.

Before looking at how this substantial gold purchase by Singapore went unnoticed, here are the raw numbers from the MAS site itself. Up until the end of April 2021, Singapore’s central bank (MAS) had been reporting total gold holdings of 4,096,439 fine troy ounces, or 127.42 tonnes, a figure which had not changed since at least 2002 (which is as far back as World Gold Council records go).

During May 2021, MAS reports that it added 527,201 ozs (16.4 tonnes) of gold, taking it’s gold holdings as of end of May to 4,623,640 ozs (143.81 tonnes).

During June 2021, MAS reports that it added a further 319,801 ozs (9.95 tonnes) of gold, which increased MAS’ gold holdings as of end of June to 4,943,441 ozs (153.76 tonnes).

This means that over the two months May and June 2021 inclusive, MAS purchased 847,002 fine troy ounces of gold (26.35 tonnes), and in doing so increased it’s gold holdings by 20.67%, and at the same time rising from 30th to 28th place in the world gold holding rankings.\

Quietly and Discreetly

Each month, the World Gold Council (WGC) updates it’s World Official Gold Holdings spreadsheet (xls) in which it ranks sovereign gold holders largest to smallest based on how many tonnes of monetary gold each country holds. Looking at the latest version of this report (November), it lists Singapore in 30th position with 127.4 tonnes ‘as of August 2021’, and this spreadsheet has not yet been updated (at time of writing) to reflect the 26 tonnes of gold purchased by Singapore in May and June.

The WGC ranking methodology states that: “This table was updated in November 2021 and reports data available at that time. Data are taken from the International Monetary Fund's International Financial Statistics (IFS), November 2021 edition, and other sources where applicable. IFS data are two months in arrears, so holdings are as of September 2021 for most countries, August 2021 or earlier for late reporters”.

IMF IFS data will only get updated if and when an individual country informs the IMF of a change to that country’s gold holdings. It appears then that the World Gold Council’s data for Singapore’s gold holdings is based exclusively on the IMF IFS data, and that this IFS data has for some reason only in recent days been updated to reflect Singapore’s gold purchases, which means that for some reason Singapore has only very recently informed the IMF of it’s May-June gold buying.

For verification, I ran a data query in the IMF IFS database for search criteria Singapore, for each month of 2021, with the data indicator of “International Reserves and Liquidity, Reserves, Official Reserve Assets, Gold (Including Gold Deposits and, If Appropriate, Gold Swapped), Volume in Millions of Fine Troy Ounces, Fine Troy Ounces”.

This data query output the following:

From the IFS data, you can see that Singapore’s (MAS) gold holdings remained unchanged at 4.1 million ozs until the end of April 2021, then increased to 4.62 mn ozs at the end of May, and then increased again to 4.94 mn ozs at the end of June, after which MAS gold reserves remained unchanged.

MAS Monthly International Reserves report

However, knowing now that MAS purchased gold during May and June, I went back and checked on the actual MAS monthly ‘International Reserves and Foreign Currency Liquidity’ reports on the MA website.

The MAS ‘International Reserves and Foreign Currency Liquidity ‘ report for April 2021, which was published on 30 June 2021, shows the Singaporean central bank reporting a total of 4,096,439 fine troy ounces (or 127.42 tonnes). See Item 4 “Gold (including gold deposits and, if appropriate, gold swapped)”.

The same report for May 2021, which was published on 30 July 2021, then shows that the volume of gold held by MAS at the end of May was 4,623,640 fine troy ounces, which was 16.4 tonnes more than at the end of April.

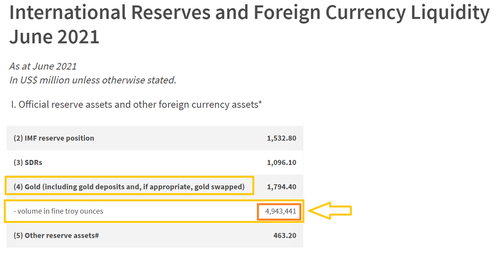

The report for June 2021, published on 31 August 2021, shows that as of end of June MAS held 4,943,441 fine troy ounces of gold, a 9.95 tonne increase over May, and a combined May-June increase of 26.35 tonnes.

Just for completeness, the report for July 2021, published on 30 September, shows that gold holdings then remained constant at 4,943,441 ozs, i.e. there were no further gold purchases beyond June.

Despite the two-month lag in reporting, these reports show that the Monetary Authority of Singapore (MAS) did report increases in gold holdings on 30 July and again on 31 August, but for whatever reason, no one noticed, or else those who noticed it did not publicise it. There is a slight chance that MAS has recently altered it’s “International Reserves” reports since May to retrospectively show these gold purchases, but it would seem quite absurd to do so, even in the secretive world of central bank gold reporting.

Besides, an Internet Archive of the preliminary MAS “International Reserves” report for end of August (published end of September) and archived on the Wayback Machine on 6 October, shows that even then (at the end of September) MAS was, on it’s website, reporting it’s latest gold holdings of 4,943,441 ozs.

The Secretive World of Central Bank Gold

So overall, it seems to be a case of no one noticing the updated gold holdings data in the MAS monthly “International Reserves” reports since the end of July, and at the same time, the Monetary Authority of Singapore (MAS) not highlighting it’s gold purchases to either the gold market or the financial press, i.e. there was no press release, no other form of announcement, nor even any comment on either the MAS website or from central bank officials. In contrast, central banks, such as Poland, have made many public statements about their gold buying, and even signal their gold buying in advance.

For a central bank which actively publishes reams of publications and reports on all sorts of topics related to Singapore’s financial sector and markets and it’s international financial position, this omission about Singapore’s sizeable gold purchases could be considered quite strange, but then again, given that we are dealing with the secretive world of gold and central banks, maybe it’s not so strange.

In addition, MAS is famous for it’s obsession with maintaining and controlling the exchange rate of the Singaporean dollar (versus a basket of currencies), so perhaps MAS prefers not to draw attention to the amount of gold in it’s international reserves as this might encourage FX markets to view the gold purchase as a move that strengthens Singapore’s reserve position and hence could put upward pressure on it’s exchange rate.

From Washington to Switzerland

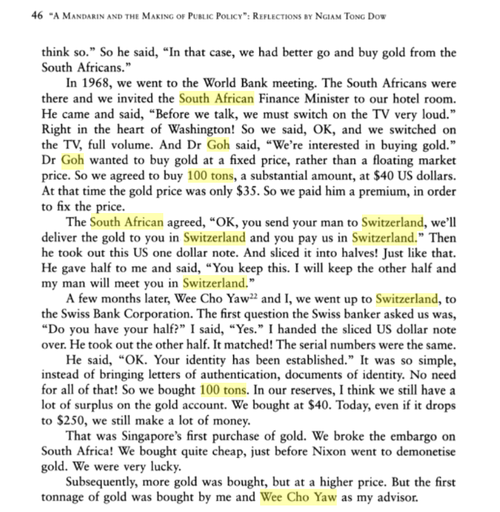

In 1968, Singapore’s finance minister Dr Goh Keng Swee and senior adviser Ngiam Tong Dow were responsible for securing Singapore’s first gold reserves when they negotiated with South Africa’s finance minister Nicolaas Diederichts to purchase 100 tonnes of gold from the South Africans at $40 per ounce while attending a World Bank meeting in Washington D.C.

Realising that the Bretton Woods system would soon collapse, and on advice from Ngiam Tong Dow, Dr Goh decided “In that case, we had better go and buy gold from the South Africans.”

Given that there was an embargo on South Africa, intriguing the gold deal was conducted in Dr Goh’s hotel room in Washington D.C. and they turned up the TV to full volume to counter possible listening devices. According to Ngiam Tong Dow, when Diederichts agreed, he said “OK, you send your man to Switzerland, we’ll deliver the gold to you in Switzerland, and you pay us in Switzerland.” Diederichts then took out a $1 bill, ripped in in two halves, kept one half, and gave the other half to Ngiam Tong Dow saying ‘You keep this. I will keep the other half, and my man will meet you in Switzerland.” And just like that, 100 tonnes of gold changed hands. It may sound like a James Bond storyline, but this story is actually factual.

A few months later the deal was finalised when Ngiam Tong Dow and Singaporean banker Wee Cho Yaw flew into Switzerland and went to the offices of the Swiss Bank Corporation (SBC) where they met the Swiss banker representing the South Africans. Upon handing him the one half of the dollar bill, and seeing that the serial numbers matched, the Swiss banker said “OK, your identity has been established”. And the rest, as they say, is history.

Sometime subsequent to 1968 (but before 2002) Singapore added to its gold reserves to bring them up to the 127.4 tonnes level, and now yet again, Singapore has added another 26.35 tonnes during May and June 2021.

While the negotiation of this latest gold purchase may not have been as intriguing and James Bond-esque as Singapore’s 1968 gold purchase, in the world of central bank gold markets anything is possible, and we could well imagine MAS officials in exotic Swiss locations or Washington DC hotels.

But like their 1968 compatriots who were quiet and discreet in their negotiations, so yet again Singapore’s central bankers have added a sizeable tonnage to Singapore’s monetary gold reserves, so discreetly, that no one, until now, even noticed. And that's the way the secretive central bankers like it.

Yet with this gold purchase, Singapore's central bankers are now signaling that after years on the sidelines, they feel compelled at this time to come back to the gold market as buyers. While yet not covered by mainstream financial media, this is a major move by one of the world’s most savvy and discreet central banks.

This article was originally published on the BullionStar website under the same title "In low key move, Singapore’s central bank adds 26 tonnes to its gold reserves".

https://ift.tt/3p6wIRU

from ZeroHedge News https://ift.tt/3p6wIRU

via IFTTT

0 comments

Post a Comment