FOMC Preview: "We'll Put $5 In The Atlanta Fed's Swear Jar"

By Philip Marey, senior US strategist at Rabobank

Tapering during a slowdown

-

Although the economy has slowed down in the second half of the year, the FOMC is expected to announce the start of tapering at the November meeting. The Fed is likely to stress accumulated progress in the labor market and the transitory nature of supply side bottlenecks.

-

The FOMC is expected to announce a fixed monthly taper schedule that would reduce net asset purchases by $10 billion Treasuries and $5 billion agency MBS.

-

During the press conference Powell is likely to stress again that the end of tapering does not automatically mean the start of hiking. And that the high inflation readings are transitory.

Introduction

The US economy appears to have shifted to a slower pace of growth in the second half of the year as the impact of the fiscal stimulus measures is fading, the Delta variant of the coronavirus continues to spread, and inflation has risen to 5.4% due to supply constraints. Nevertheless, the FOMC is expected to make a formal announcement of the start of tapering on Wednesday. Clearly, inconvenient timing, but the Fed is likely to stress accumulated progress in the labor market and the transitory nature of supply side bottlenecks.

Second half slowdown

We learned this week that GDP growth slowed down to only 2.0% in Q3, from 6.7% in Q2 and 6.3% in Q1. The impact of the COVID relief packages launched under the Trump and Biden administrations is fading, while we are still waiting for the Democrats to agree on a large (but shrinking) health, education and child care bill, and their approval of the bipartisan Senate bill on infrastructure. Meanwhile, the Delta variant continues to spread as vaccination rates have found an insufficient plateau. This is delaying the much-awaited return of labor supply that was supposed to start in September, as we discussed in Labor shortages: temporary or permanent? Consequently, employment growth slowed down to 194K in September, from 366K in August and 1091K in July. What’s more, global supply chains are in disarray and CPI inflation rose to 5.4% in September (year-on-year). Today, the PCE deflator, the Fed’s preferred measure of inflation, rose to 4.4% in September (year-on-year), from 4.2% in August. This is more than double the Fed’s 2.0% inflation target.

This is also having a negative impact on personal consumer spending, which slowed down to 1.6% in Q3, from 12.0% in Q2 and 11.4% in Q1. In fact, the Atlanta Fed’s GDPNowcast actually put GDP growth in Q3 at 0.2% on October 27, the day before the official release by the BEA. This would have put the US economy close to stagnation. Although the BEA’s official estimate was 2.0%, we should see the FOMC statement acknowledge this slowdown in the growth of economic activity and employment.

An inconvenient time to taper

In the FOMC’s ideal world, they would step up the pace of asset purchases, instead of slowing them down, in case of an economic slowdown. However, in that world, inflation does not rise when the economy slows down either. Monetary policy is not very adequate if the adverse shock to the economy comes from the supply side. After all, monetary policy is aimed at influencing the demand side of the economy.

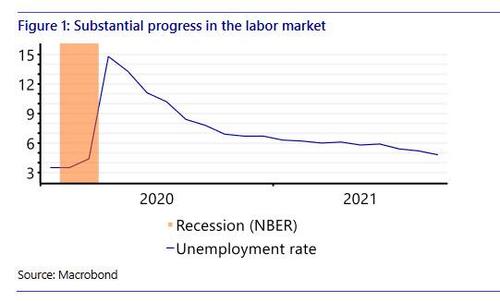

However, tapering is not tightening and there has been progress in the labor market since last year. The FOMC can point to the decline in the official unemployment rate to 4.8% in September, from 6.7% in December 2020, as proof of substantial progress in the labor market (Figure 1). What’s more, inflation has been rampant for half a year now. Perhaps transitory, but enough catching up in terms of average inflation targeting for now. In fact, the minutes of the September meeting showed that most participants remarked that the standard of "substantial further progress" had been met with regard to the Committee's price-stability goal or that it was likely to be met soon. So the Fed can still make the case for the start of tapering. Let’s just hope the economy is not going to slide back further during the winter months.

Speeches and interviews with FOMC participants have confirmed that tapering is near. At the press conference on September 22 Powell stressed that the decision to start tapering was about accumulated progress in the labor market and that in his opinion the test was all but met. The FOMC speakers since that second disappointing Employment Report confirmed this interpretation. Fed Vice Chairman Clarida said that a gradual tapering of asset purchases that concludes around the middle of next year may soon be warranted. What’s more, according to the Minutes a number of participants indicated that they believed the test of “substantial further progress” toward maximum employment had already been met at the time of the September meeting. Finally, last week, Powell said he thinks it’s time to taper. So it is highly likely that the FOMC will announce tapering at the November meeting.

A fixed monthly taper schedule

According to the minutes of the September 21-22 meeting of the FOMC, the Fed staff presented an illustrative path of tapering that was designed to be simple to communicate and entailed a gradual reduction in net asset purchases that would end around the middle of next year. Participants generally commented that the illustrative path provided a straightforward and appropriate template that policymakers might follow. Participants also noted that the Committee could adjust the pace of tapering if economic developments were to differ substantially from what they expected.

In contrast to 2014, the FOMC is considering a taper schedule that involves a fixed monthly reduction in asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency MBS. Participants noted that if a decision to begin tapering occurred at the next meeting (November 2-3), the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December. Taking this together, the mid-November start would mean that $70 billion Treasuries and $35 billion will be purchased between mid-November and mid-December, followed by a monthly reduction by $10 billion Treasuries and $5 billion agency MBS, ending the net asset purchases by mid-June next year. Analogously, a mid-December start of the process would imply a mid-July end. Such a monthly schedule would be set in advance, because the FOMC only meets about every six weeks. For example, there is no meeting after mid-December and before mid-January.

This stands in contrast to the previous tapering process, carried out in 2014. Back then, the changes in the pace of monthly purchases only changed after FOMC meetings. With a fixed monthly schedule this taper process will be less flexible than last time, but the FOMC will still be able to change the schedule at any FOMC meeting if desired.

Conclusion

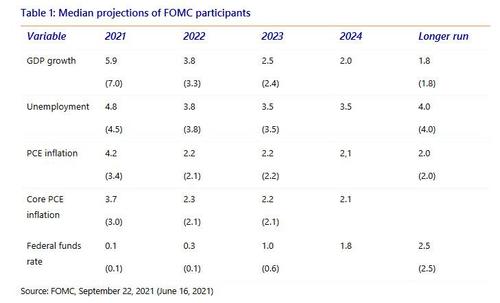

The FOMC meeting on November 2-3 is expected to conclude with a formal announcement of the start of tapering. There will be no update of the economic and rate projections (Table 1). During the press conference Powell is likely to stress again that the end of tapering does not automatically mean the start of hiking. And that the high inflation readings are transitory. We’ll put $5 in the Atlanta Fed’s swear jar.

https://ift.tt/3EUW6Az

from ZeroHedge News https://ift.tt/3EUW6Az

via IFTTT

0 comments

Post a Comment