How Central Banks Unleashed A Devastating 6-Sigma VaR Shock

As we discussed over the weekend, in the last week front-end curves have experienced unprecedented volatility and even wilder P&L swings.

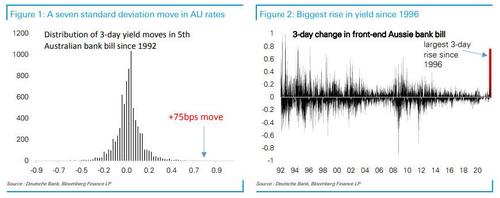

As DB's FX strategist George Saravelos summarizes in a note "It's a VaR shock now", in Australia alone, we have added 75bps of hikes over the next twelve months in just three days. At the same time, the Canadian curve added nearly two upfront hikes following the latest BoC meeting. At the same time back-end government bond yields have moved lower in an unprecedented twist flattening of the curve.

As Saravelos first discussed back in May, and repeated against more recently last week, "the general flattening of curves is backed up by the very latecycle dynamics of the global economy plus our pessimistic view on global r*." But what is happening now runs beyond macro and as the DB strategist writes, confirming what we said last week, "it is a plain and simple Value at Risk (VaR) shock driven by positioning and the inability to appropriately calibrate central bank reaction functions in such an uncertain environment."

To put things in context: the Aussie bank bill yield rise is the largest 3-day change since 1996 and represents a 6 standard deviation move. In Canada, it is the largest move since 2009 and a 4 standard deviation move.

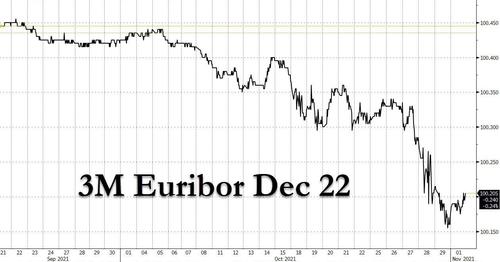

This, as Saravelos writes, is the closest we can get to a distressed Treasury market and as the next chart shows Europe appears set to join the chaos as rate hike odds represented by 3M Euribor Dec 22s tumbled after last week's dismal ECB press conference in which Lagarde failed to push back against market expectations for tightening, indicating the market is now also expecting higher rates in the eurozone, a move which suggests that the ECB - which has been adamant there will be no tightening for a long time - is also losing control of the front-end.

Commenting on this ongoing VaR shock, another DB credit strategist, Francis Yared, writes over the weekend that while it may be difficult to interpret from a macro economic perspective, if there was to a be an "original macro sin" for such moves, it would be the excessive reliance of central banks on forward guidance.

According to Yared, while forward guidance is hailed by central banks as a great monetary policy tool, "when close to the lower bound it suffers significant drawbacks. Indeed, using as an example the ECB situation as summarised in our ECB preview, there are intrinsic limitations to the forward guidance." Yared explains:

- First and foremost and as pointed out by former Fed governor, Jeremy Stein, forward guidance may end up being self defeating: "There is always a temptation for the central bank to speak in a whisper, because anything that gets said reverberates so loudly in markets. But the softer it talks, the more the market leans in to hear better and, thus, the more the whisper gets amplified. So efforts to overly manage the market volatility associated with our communications may ultimately be self-defeating. "

- Second, to be more "credible" the ECB would need to adopt a calendar based forward guidance (or equivalently as the RBA did a target for e.g. 3-year rates). However, this will imply a degree of certainty that central banks should be wary of pretending to have. It would be the equivalent of doubling up in a difficult position. It could solve the issue in the short term, but will increase the stakes when either (1) time will comes from exiting this reinforced forward guidance or (ii) facts challenge the forward guidance (cf. the RBA).

- Third, the forward guidance is ultimately based on the ability to forecast inflation. A lot has been written as to why inflation has been low in the past decades. Inflation expectations being adaptive, the conclusions have been extrapolated to the indefinite future. But little credit has been given to the fact that inflation is subject to regime shifts which can be generated by (a) monetary and/or fiscal policy shifts or (b) exogenous supply shocks. In particular, coordinated monetary and fiscal policies is the textbook way of generating inflation. Therefore, in presence of a very pro-active fiscal policy following Covid, introducing a new monetary policy framework predicated on years of low inflation is the theoretical perfect combination to create a challenging environment for forward guidance. Some credit should also be given to the uncertainty generated by the potential negative supply shock associated with addressing climate change.

- Fourth, in the case of the Fed, the forward guidance is also predicated on the ability to forecast NAIRU. A causal look at historical revisions of estimates of NAIRU highlights the degree of uncertainty associated with it. In fact, as NAIRU is derived ex-post from the combination of the observed level of unemployment and inflation, estimates will turn out to be backward looking and ignoring the regime shifts that could impact inflation. For instance, the US labor market is currently behaving as if was through full employment.

As Yared concludes, it may very well turn out that following the US mid-term elections a significant fiscal tightening will force inflation back lower. But no matter the outcome, it "should not distract from the fact that an excessive reliance on forward guidance is not the silver bullet that current central bank rhetoric suggests." To this, one can only add that if central bank guidance can not be relied upon - i.e., if central bankers are just as clueless as everyone else - then this is actually wildly bullish for risk assets and hyperinflation, as it means that when the inevitable policy error hits and both the economy and markets swoon, these same central bankers will unleash much more of the same "wealth effect" in hopes of undoing their current round of errors, which will do nothing to actually normalize a market that is beyond broken and do everything to push asset hyperinflation to never before seen highs.

This dynamic will continue indefinitely - as there is nothing preventing the Fed from creating a few more trillion or quadrillion in fiat "money" with the push of a button - and the only possibly constraint for future such catastrophic behavior is when the class inequality finally leads to mass riots and the appearance of the proverbial pitchforks in front the Marriner Eccles building.

https://ift.tt/3Bz6KdR

from ZeroHedge News https://ift.tt/3Bz6KdR

via IFTTT

0 comments

Post a Comment