Beijing Steps Up Efforts To Contain Housing Risks

By Ye Xie, Bloomberg Live commentator and an analyst

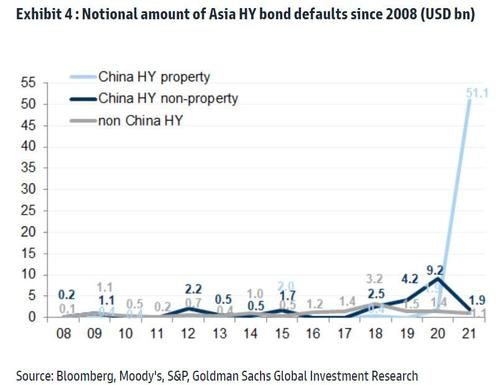

1. China lent more support to the housing market. Policy makers called on banks to boost real-estate lending in the first quarter and eased a key debt restriction for developers. It’s part of the broader policy shift to prioritize economic stability this year. While the credit market remains fragile, property stocks rallied to the highest since July (for more on how one can trade the growing policy divergence between the US and China see here).

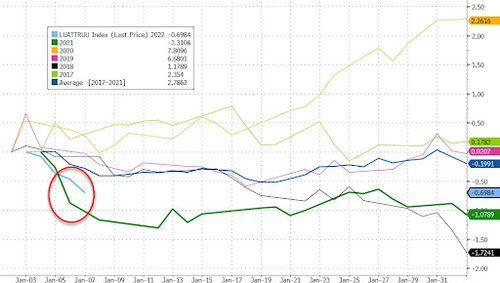

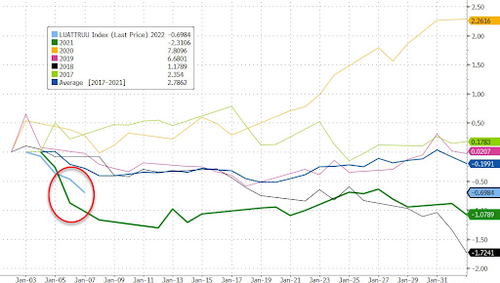

2. China’s easing stands in contrast with the U.S., where the Fed embarked on one of the most-hawkish turns in recent memory. U.S. Treasuries had the worst start to a year in decades as Fed minutes suggested the central bank may unwind its balance sheet soon after raising rates.

Friday’s payroll report showed the unemployment rate dipped below 4%, cementing expectations for the first rate hike in March. This week’s inflation report may add to the vulnerability of the bond market. The policy divergence between the U.S. and China drove their yield differential to the narrowest since 2019.

3. Beijing’s strict Covid strategy adds downside risk to the economy. As one of the world’s last “Covid Zero” holdouts, China has enacted strict measures to curb the spread of the virus, including locking down some 13 million residents in Xi’an. Travel has already taken a knock, with air passenger trips during the Jan. 1-3 long weekend down 27% from a year ago, state broadcaster CCTV reported.

https://ift.tt/33gKydk

from ZeroHedge News https://ift.tt/33gKydk

via IFTTT

0 comments

Post a Comment