Rabobank: 2021 Showed The Fed Has No Clue...

By Philip Marey, senior US strategist at Rabobank

Summary

- The Fed has made a remarkable pivot around the turn of the year, dropping the ‘transitory’ narrative and squeaking like born-again hawks.

- Recent testimony, speeches and interviews have made it clear that the FOMC is gung ho and ready to start hiking in March. Unless we see a setback in the real economy, we expect the Fed to hike each quarter this year.

- Balance sheet normalization is also likely to come soon. In fact, we expect May to be the first live meeting.

Introduction

In this first FOMC Preview of the year, we take a look back at the Fed’s misguided transitory stance of 2021, the remarkable pivot to inflation fighting around the turn of the year, our expectations for Fed policy in 2022, and we address the upcoming meeting of the FOMC on January 25-26.

Waking up from a transitory dream

In April 2021 inflation jumped to 4.2% from 2.6% (CPI, year-on-year), but it took until November before the Fed realized it should do something about it. While price stability is part of the dual mandate given by Congress, the Fed decided in August 2020 to interpret this through a flexible average inflation targeting (FAIT) strategy. Based on the 2018-2019 experience of low unemployment without accelerating inflation, the Fed decided that pre-emptive action against inflation was no longer warranted and that it could afford to let inflation overshoot its target in order to compensate for recent undershoots. A textbook example of fighting the last war and losing the next. In June 2021, in Is the Fed going to be blindsided by inflation? we warned against ignoring the changes that were taking place in the economy. However, based on FAIT, the Fed decided to get behind the curve and repeatedly claimed that inflation was ‘transitory.’ As inflation exploded, this mantra became so ridiculous that Atlanta Fed President Bostic introduced a swear jar, collecting one dollar each time the word was used. Finally, during the course of November, Powell realized that it was time to drop the word altogether.

Powell’s pivot was overwhelmingly supported by the other FOMC participants and if you would only look at the 2022 news flow, you would think this is a hawkish monetary policy committee. However, the data tell a different story. Last week, we learned that inflation had climbed to 7.0% in December (CPI, year-on-year), the highest level since 1982. At the same time, unemployment has fallen to 3.9%, not far from the pre-COVID level of 3.5%, and already below the FOMC’s estimate of longer run unemployment of 4.0%. In theory, this state of the economy should be accompanied by tight monetary policy. But where is the Fed’s main monetary policy tool? At its lower bound, with a target range of 0.00-0.25% for the federal funds rate. And surely, this is no time for quantitative easing? Well… the Fed is still expanding its balance sheet and will continue to do so until March! The Fed is so far behind the curve they can’t see the curve anymore.

Now that the FOMC has woken up from its ‘transitory’ dream, they find themselves in a reality where they have a lot of catching up to do. Hence the acceleration of the tapering process at the December meeting in order to prepare for the start of the hiking cycle. The December dot plot showed that the median FOMC participant expects three hikes of 25 bps each in 2022.

The timing of the Fed’s conversion cannot be seen in isolation from the political reality that the Fed is facing. Yes, Powell has given us three data points that he claims to have changed his mind, but it is no coincidence that this conversion came just in time for his renomination by President Biden and his confirmation hearing by the Senate. Imagine what would have happened if Powell had gone before the Senate Banking Committee in September 2021 style, responding to each question about inflation that it is just a transitory thing? In reality, he made his pivot just in time. This also means that the Fed has political cover, or perhaps we should say a political obligation, to hike this year.

The Fed in 2022

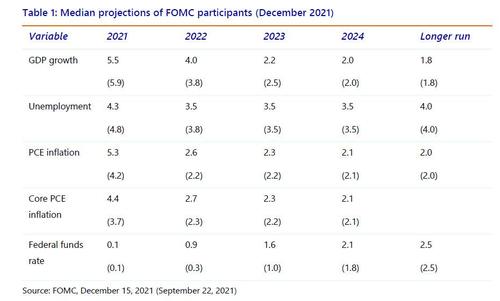

In December, the median FOMC participant anticipated 3 rate hikes of 25 bps each in 2022, based on the assumption that PCE inflation will fall back to 2.6% in the final quarter of this year (see Table 1). In his confirmation hearing, Powell attributed current inflation largely to supply chain disruptions, but he expects them to have eased by the end of 2022. Meanwhile, he said that labor supply issues could cause future inflation. Therefore, if supply chain disruptions have not eased by the end of 2022 or labor supply causes more inflation than expected, the FOMC may have to hike more than 3 times in 2022.

The joint probability of both supply chain disruptions to have faded in the final quarter of 2022 and labor supply issues to have been resolved is not very high in our view, see for example our report Labor shortages: temporary or permanent? from last summer. Consequently, we expect one or both of these risk factors to cause inflation to remain more persistent than the FOMC now expects, and therefore we expect them to hike more often than they now anticipate. Before the Senate, Powell said that the Fed would have to be humble (= they have little confidence in their own forecasts) and nimble. He said that if they saw inflation persisting higher than expected, the FOMC would raise rates more than currently anticipated. So we shift our forecast to 4 rate hikes this year, from 2 earlier, based on the hawkish shift shown by Powell and his fellow FOMC participants in recent weeks. Since March seems a live meeting, we put our forecasts for Fed rate hikes at the meetings with projection updates: March, June, September and December.

Balance sheet normalization is also likely to come soon. In fact, we expect May to be the first live meeting. The minutes of the December meeting reported on the first discussion of balance sheet normalization. The FOMC expected the start of balance sheet reduction to come sooner and faster than last time. During his confirmation hearing Powell said that 2-3-4 meetings might be needed to discuss this topic. This means that the Fed could announce balance sheet reduction at the May meeting.

Another rude awakening ahead

So the turn of the year has seen a pivot by the FOMC from FAITful doves to born-again hawks. Are they already too late, are they going to hike too fast, or will they be able to bring down inflation to target without interrupting the economic recovery? We all hope for the last, but getting a hiking cycle right has always been a difficult task for the Fed. And this one is even more difficult than previous iterations. First of all, the neutral policy rate has fallen over time, but it is unclear where it exactly is now. So there is very little room for manoeuvre, while the boundary is unclear. If the Fed ventures too far into restrictive territory too fast, then it risks causing a recession. In contrast, if the Fed remains behind the curve, inflation could spiral out of control and warrant an acceleration of rate hikes that surely delivers a recession. What’s more, the 2021 response to inflation shows that the Fed has no clue about forecasting inflation. So a central bank that does not understand inflation is going to bring it back to target, without accident? Sounds like another dream from which only a rude awakening is possible.

Confidence interval

In fact, the confidence interval around our point forecast of 4 Fed rate hikes of 25 bps each is exceptionally large this year. If inflation gets out of control, the Fed may have to hike more than 4 times and could even consider rate hikes of 50 bps instead of the 25 bps in our baseline scenario. In contrast, if PCE inflation falls back to 2.6% by the final quarter of 2022 as projected by the FOMC, they are likely to find 3 hikes sufficient and refrain from a December hike. Moreover, we can also think of scenarios where inflation falls back further, or scenarios with significant setbacks in the real economy, that could bring an early halt to the Fed’s hiking cycle. If scenario analysis has added value to baseline forecasting, this is the year! The key risk factor is the inflation outlook. Unfortunately, the economic literature offers very little guidance on inflation modeling in the current circumstances.

The Fed in January

The next meeting of the FOMC takes place on January 25-26. There will be no update of economic projections, only a formal statement and a press conference by Powell. Since tapering continues until March, there will also be no rate hike in January. Powell will likely repeat his hawkish remarks of recent weeks and try to convince the markets, the public, and the politicians, that the Fed is now serious about inflation fighting.

At the two day meeting, balance sheet normalization is likely to be a key topic again, with staff presentations about possible scenarios and a debate in the Committee. As Powell said at his confirmation hearing, they may need 2-3-4 meetings to discuss balance sheet normalization before getting into action. This implies that May could be the first live meeting for balance sheet normalization. At the post-meeting press conference on January 26, Powell may shed some light on the balance sheet normalization discussion. The minutes – to be released on February 16 – may give us more details on this debate.

The Beige Book, published on January 12, noted that economic activity expanded at a modest pace in the final weeks of 2021, and continued to be restrained by ongoing supply chain disruptions and labor shortages. Job openings were up, but overall payroll growth was constrained by persistent labor shortages. Tightness in labor markets drove robust wage growth. There was also solid growth in prices charged to customers, but price increases had decelerated a bit. Transportation bottlenecks had stabilized in recent weeks, though procurement costs remained elevated. If we contrast the Beige Book with the FOMC statement of the December meeting than it seems that the phrases “indicators of economic activity and employment have continued to strengthen” and “job gains have been solid in recent months” are due for a rewrite.

Conclusion

Last summer, we expressed our fear that the Fed would be blindsided by inflation. However, we had no idea how long it would take for the FOMC to see the light. Keep in mind that at the time we wrote our special the FOMC still expected to keep rates unchanged until 2024! Then, at the December meeting, the Fed created the option to start hiking in March, by accelerating the pace of tapering. What we have heard in recent weeks from Powell and his fellow FOMC participants has convinced us that they have become serious about inflation fighting. In fact, they seem eager to show it through action. Therefore, we have put 4 Fed rate hikes of 25 bps each in our outlook for 2022.

https://ift.tt/3nFzu0s

from ZeroHedge News https://ift.tt/3nFzu0s

via IFTTT

0 comments

Post a Comment