"In 10 Years Half Of All Financial Transactions Will Touch Ethereum" - Iconic Crypto Fund Responds To JPMorgan's Ethereum Hit Piece

Perhaps having grown tired of bashing bitcoin which had become one of his main pastimes for the past two years, JPMorgan quant (and rising in-house expert cryptoskeptic) Nick Panigirtzoglou shifted his attention to ethereum last week, and at the risk of infuriating his (very wealthy) web 3.0 clients, used his latest Flows and Liquidity report to slam the second biggest cryptocurrency by warning that it has "been losing market share in the DeFi space at a rapid pace over the past year."

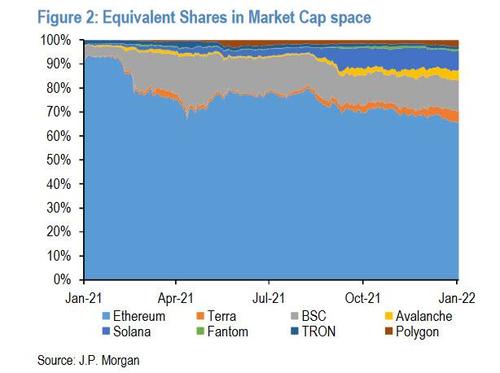

And while he admits that the pace has (clearly) slowed in the second half of the year (as the chart below so vividly demonstrates), he then boldly predicts that "the share of ethereum in DeFi will likely drop further before Sharding is implemented in 2023" although it is very much unclear how he reaches this conclusion, and then proceeds to note that "the relative valuation of ethereum vs. its competitors has been echoing its declining DeFi share", because correlation in this case is clearly causation.

There is more in the full note (available to pro subs in the usual place) but you get the gist; and here is the one chart that he used to guide his whole narrative and goalseeked conclusion which may have been among the factors that hammered the price of ETH in the past week, sending it 40% below its all time high.

Not everyone was impressed by this painfully superficial "analysis" however, and on Sunday, Joey Krug, co-CIO at digital-asset investment firm Pantera Capital, tore apart JPM's hitpiece, telling Bloomberg that an explosion in the growth of crypto networks vying to take market share from Ethereum is unlikely to threaten the dominance of the world’s most used blockchain, and what will happen instead is that ETH dominance will only grow in the coming years.

“If you roll the clock forward 10 to 20 years, a very sizable percent, maybe even north of 50%, of the world’s financial transactions in some way, shape or form will touch Ethereum,” Krug said in an interview, an outcome which all web 3.0 fanatics would find delightful.

To be sure, Krug is also talking his book, which is of course to be expected - he admitted that Ether is among Pantera Capital’s top three positions across funds. That said, unlike so many fly-by-night "asset managers" who have taken to crypto in recent months and years hoping to piggyback on the success of the cryptocurrency, Pantera is one of the earliest digital-asset investment firms and ranks in the top five of crypto-focused funds with $5.8 billion in assets.

Krug was responding not just to JPM but to all critics of Ethereum (who tend to also be big bitcoin fans... big frustrated bitcoin cans since that particular crypto is flat over the past year) say it has expensive fees and slow transaction speeds as traffic crowds the network. Add-ons, known as layer-2 networks, have emerged as fixes but can be complex to use, or have other disadvantages. Of course, all of that will change with Ethereum 2.0 and Sharding, both of which are coming soon.

There is another reason why bitcoin supporters do not like ETH much: it had a breakthrough year, hitting a record high while soaring almost 400%, smashing the performance of bitcoin. That came on top of a gain of almost 500% the prior year, and has rekindled speculation that it could one day surpass Bitcoin, which currently has about double the market value of Ether, an advantage that is rapidly shrinking.

While various ETH-killers had an even better year in 2021 with Solana and PolkaDot surging 7,000% and 150% respectively, that has to do with their far lower price a year ago. Meanwhile, Krug, an early DeFi developer, believes competitors will eventually rely on Ethereum as a base, assuming that the blockchain successfully switches to proof-of-stake, a transition which is expected to take place in Q2 of this year, and which should catalyze a major spike in the price.

“There’s too many trade-offs other chains are making that Ethereum is not making on the decentralization side that are pretty important,” Krug said, noting security concerns. “I don’t know if they’re best suited to be the new global financial settlement layer.”

Pantera is headed by Dan Morehead, a veteran Bitcoin investor, who was an executive at Julian Robertson’s Tiger Management earlier in his career.

Some have a more laid back view of the increasingly cutthroat competition in the crypto space: Grayscale Investments’ David Grider, head of research, says “all boats can be lifted” in the sector. Several competitors performed strongly in the second half of 2021, Grider said. Grayscale Investments LLC offers clients a Solana investment fund. It is also exploring products related to other rivals.

“I don’t think it’s this winner-take-all type of market,” Grider says. “Ethereum has this lead-of-a-network effect. It has this large community, but other ones have emerged that fill different market voids.”

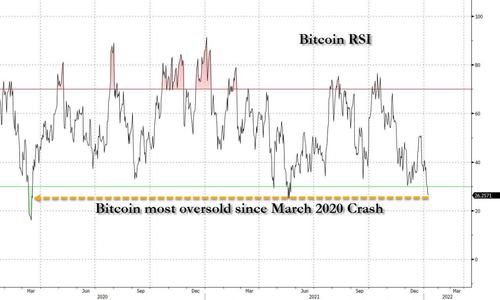

Of course, a far bigger concerns for both Ethereum and Bitcoin fans is when will the selling associated with the Fed's infamous hawkish turn relent. As we noted yesterday, a furious bout of selling on Saturday which sent bitcoin just above $40,000 and Ethereum to precisely $3,000.01, both down more than 40% from their November all time highs, made Bitcoin be the most oversold since the March 2020 crash, surpassing even the furious liquidations observed during the May 2021 crash.

It remains to be seen what will catalyze the relentless BTFD bid that lifted the crypto space from every single previous crash in its brief history, although our money is on the realization that the more the Fed tightens and hikes rates in the coming months, the more it will have to ease, cut rates, do more QE, NIRP, etc in the months that follow once it send stocks into a catastrophic tailspin.

https://ift.tt/3I4XqCv

from ZeroHedge News https://ift.tt/3I4XqCv

via IFTTT

0 comments

Post a Comment