Here Come The Tech Giant Earnings: What Matters And What To Expect

Just as we previewed last night (see "Here Comes The Next Leg Higher: CTAs Momentum Flips Bullish With Buybacks Restarting In 4 Days"), US equities soared Tuesday, sending the S&P 500 Index and Nasdaq 100 Index toward the highest close in a month.

And while the Fed is now getting added pressure from politicians to pivot, a move that would send stocks explosively higher (even if it cements that the Fed's new inflation target is 3 or 4%), the fate of the rally - if only for the next few days is in the hands of the mega tech companies reporting after the close today and through the end of the week. Microsoft and Alphabet are the market generals kicking-off big tech earnings season Tuesday after the closing bell. Meta Platforms, which is expected to report earnings Wednesday, rose as much as 4.5%, shrugging off a global outage on its WhatsApp messaging service, even as broker KeyBanc joined Bank of America in cutting its price targets on the stock, as well as on Alphabet, citing skepticism of revenue growth amid mounting concerns of a downturn in 2023.

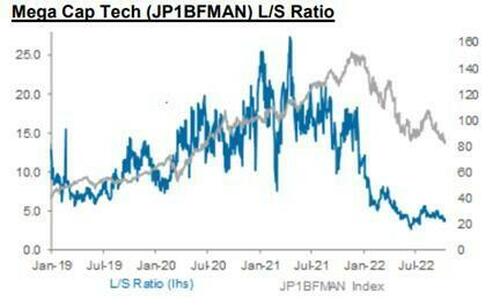

Some more details: the JPM Mega Cap Tech index (JP1BFMAN, includes NFLX, GOOGL, AAPL, AMZN, MSFT, NVDA and META) has collapsed 40% YTD. This sustained sentiment decline is evident in JPM's Prime data too: the bank's latest Positioning Intel note (available to pro subscribers) shows that the L/S ratio in Mega Cap Tech is at the 2nd %-ile since 2018 (see chart).

Finally, courtesy of JPM's Jack Atherton, Tech Sector Specialist, here are some buyside expectations of what to expect from big tech earnings.

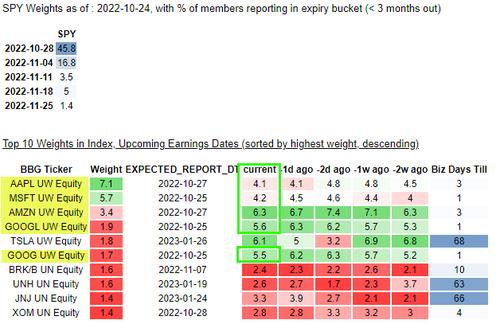

- GOOGL (10/25): Still well owned by LOs but we’ve seen fast money shorts given downgrade risk and some as a pair with META. Buyside looking 3Q advertising ~$55b (some 3P checks have come in below that), with Search reported +LSD% y/y, YouTube +MSD%, Cloud >30% (Q2 +36%). Consensus at 27.7% OPM and investors will be looking for an update on cost save initiatives given GOOGL has been slower to react than others in general. Q2 buyback was $15.2b & investors looking for something similar for Q3. Stock -31% YTD; Implied move 6%.

- MSFT (10/25 amc): Stock definitely remains well owned but we’ve seen a lot of derisking amidst concerns over PC datapoints. The biggest debate I’ve had with investors has been whether mgmt reiterate the FY23 guide for double digit reported revenue growth – most assume they reiterate on a constant currency basis but remove the guide for double digit reported to reflect ongoing FX and PC pressure. On Azure, just beating consensus/guide of a ~3%pt q/q decel (FQ4 +46% cc) should be good enough (FQ4 +40%). Stock -30% YTD; Implied move 4%.

- META (10/26): I surprisingly continue to hear the buy thesis on this one from HFs and it stacks up as one of the best held names across our HF Prime Data. The 2 most important data points investors are waiting for are, 1) Q4 revenue guidance (buyside looking for down 3-10% reported), and 2) 2023 expense outlook (buyside ~$90b low-end vs current ’22 guide $85-88b). For Q3, buyside expecting revenue +1-3% FXN, -5% reported. Expect a lot of focus recent cost cutting initiatives. Stock -60% YTD; Implied move 11%.

- AMZN (10/27 after the close): Probably the most unanimously well held name across HFs and LOs. Buyside looking for Q3 revenue $128-129B, EBIT $4B+ (guide $125-130b, $0-3.5b); Q4 guidance of $157-158b, EBIT ~$6B (both high-end). AWS likely more important than previous quarters given a higher representation in the SOTP, macro backdrop and recent competitive headlines (ORCL chest beating, Coinbase signing with GCP) – bulls hoping for a 3-handle on revenue growth (Q2 +33%). Prime Day weakness was an easy excuse for last week’s underperformance but I don’t think investors were too worried. Stock -32% YTD; Implied move 7%.

- AAPL (10/27): Concerns are high from investors, as Apple’s share price has managed to outperform both the broader technology stocks as well as the S&P 500 index year to date, despite a consumer spending pullback across various product segments, including smartphones, which has been expected since the start of the year. As we look closer at the impact of the iPhone 14 product cycle, which has reflected lackluster demand in base models but strong demand in high-end and legacy models, as well as variations in year-over-year compares coming through one extra week of shipping the iPhone 14 series in Sep-Q (F4Q) and the 14-week Dec-Q (F1Q), we believe the resilient fundamentals are unlikely to change in the near term. As outlined in our updated forecast in a separate report this morning (see here), we are updating our Apple estimates and now expect both F4Q (Sep-Q) and Dec-Q (F1Q) revenues to meet sell-side consensus and likely exceed more bearish buy-side expectations.

Finally, as Nomura's Charlie McElligott writes, while the equities flows remain tilted towards upside (1. Long Gamma stabilization yet with still Negative $Delta = Put bleed catalyst, 2. Call Skew remaining “Bid” on “Crash-UP” fear-grab 3. post EPS Corp “Buyback” resumption, 4. Vol Control re-allocation buying next 2w to 1m, 5. CTA Trend covering remaining “overhead”), the nearest micro catalyst will be MegaCap Tech / Growth Earnings this week (MSFT, GOOGL, AMZN, AAPL) which as shown below, may experience big “Gamma-y” implied moves (highlight box = earnings implied % move)

https://ift.tt/NpcjGJK

from ZeroHedge News https://ift.tt/NpcjGJK

via IFTTT

0 comments

Post a Comment