Peak Shipping Season A Bust Due To Reversal In 'Bullwhip-Effect'

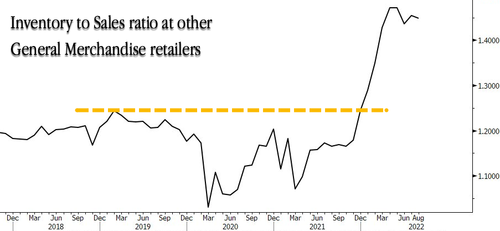

We predicted in May that an inventory glut, i.e., the reverse bullwhip effect, would cool the booming freight market. It's now peak shipping season -- retailers cancel overseas orders as freight companies reduce freight capacity ahead of the busiest shopping season of the year: Black Friday through Christmas.

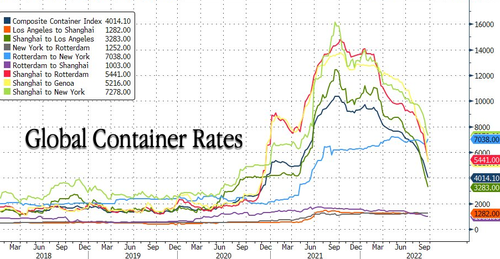

Trans-Pacific shipping rates are cratering. Since last year's peak, the Shanghai-Los Angeles freight rate for 40-foot shipping containers has plunged 73%.

Weeks ago, we pointed out that October cancellations for vessels on the world's busiest shipping lanes (between China and US West Coast) are in a sharp decline. WSJ said the pullback in ordering from overseas has resulted in carriers reducing capacity on "concerns a deeper downturn is coming."

"The growth in US import volume has run out of steam, especially for cargo from Asia.

"Recent cuts in carrier shipping capacity reflect falling demand for merchandise from well-stocked retailers, even as consumers continue to spend," said Ben Hackett, founder of Hackett Associates and the author of the Global Port Tracker report issued by the National Retail Federation.

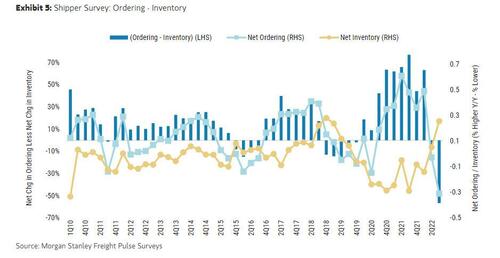

Remember, Morgan Stanley Shipper Survey showed ordering by 100 corporations reached the lowest point in the survey's 12-year history. Ordering levels are down 40% year over year. Net inventory levels are also unusually high.

Wonder why?

"The NRF report is one of several measures showing shipping volumes slowing sharply from August to September, signaling waning demand rippling through supply chains even as retailers are lining up goods for the traditional sales season," WSJ said.

An accelerating slowdown in imports means an even more significant decline is ahead, according to Descartes Datamyne, a data analysis supply-chain software company.

Descartes Datamyne's recent report said September container imports, measured in 20-foot-equivalent units, fell 11% YoY and declined 12.4% from August. A slump in shipping activity is highly unusual for peak shipping season. They said imports of electronics, furniture, and toys for major US retailers from China plunged 18.3% from August to September.

Import slowdown has already led to a decline in rail and trucking traffic:

The slowdown in imports is already hitting rail volumes. Average weekly loads carried in intermodal operations, a combined truck-rail service favored by retailers, fell 4.8% year-over-year in September, according to the Association of American Railroads. The volume was also 5.4% below August levels. --WSJ

FTR Transportation Intelligence published a report Monday that shows Truckstop.com's spot-market rate for available loads for truckers on the West Coast plunged to the lowest level since May 2020. The report added demand in the Southeast "fell sharply after recent strength."

Another website that shows trucking spot rates, DAT Solutions LLC, reveals similar downward trends, showing average spot rates for truckload vans dropped from August to September for the first time since 2015.

And remember, in mid-September, FedEx CEO Raj Subramaniam warned about declining worldwide cargo volumes and mounting macroeconomic headwinds that may indicate the global economy is on the brink of a recession.

Freight winter is here thanks to high inventory as consumer behaviors changed from buying computers, televisions, and Pelotons to now spending on services, such as restaurants...

The silver lining is supply chain stress is rapid easing, as explained by Liz Ann Sonders, the chief investment strategist at Charles Schwab:

Supply chain stress essentially back to pre-pandemic level (black line is average) ; commodities & used car prices helping lead on way down

— Liz Ann Sonders (@LizAnnSonders) October 19, 2022

@DataArbor @Conferenceboard @federalreserve @ISM @NFIB @UMich pic.twitter.com/5UZsrvuDwt

Goldman Sachs' Supply Chain Congestion Scale is back to "4," indicating bottlenecks are easing.

This could be good news that inflation is moderating.

https://ift.tt/SLeChl9

from ZeroHedge News https://ift.tt/SLeChl9

via IFTTT

0 comments

Post a Comment