Beware Of Driving Through The Rear-View Mirror

By Simon White, Bloomberg Markets Live reporter and analyst

Optically strong US growth data does not take 2023 rate cuts off the agenda.

My colleague, Ed Harrison, reckons the Fed rate cuts in 2023 are likely off the table.

In the words of Samuel L. Jackson in Pulp Fiction: “Allow me to retort.”

The first release of 4Q22 GDP just came out, ahead of expectations, at 2.9%.

The problem with a lot of economic data is it is lagging and frequently revised.

GDP is one of the more lagging economic series. But if we look at what is leading lately, the figures point to significant growth deterioration over the next six to nine months. This is plenty of time for the Fed to stop hiking and begin cutting before the year is out.

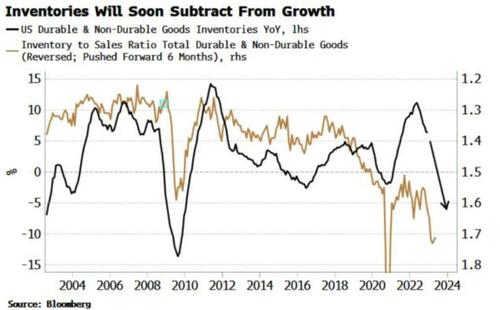

The largest percentage-point contribution to fourth-quarter GDP was the change in private inventories. This is one of the most volatile GDP components. On top of that it lags inventory-to-sales ratios, which have risen sharply. Inventories are likely to be strongly negatively contributing to GDP growth by the second or third quarter.

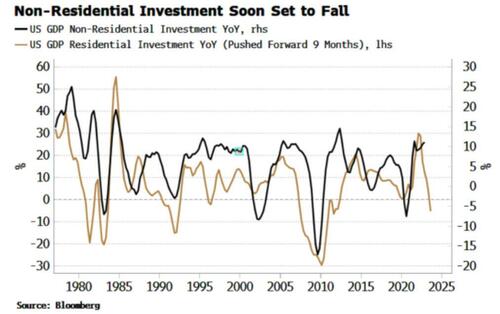

Within GDP, non-residential investment has so far held up well, while residential investment has collapsed with the effect of higher rates. But non-residential investment almost always goes the way of residential investment within the next six to nine months.

Private consumption in 4Q22 came in softer than expected and should continue to weaken as the year goes on. With investment falling too, GDP overall will be in a much weaker state before year-end.

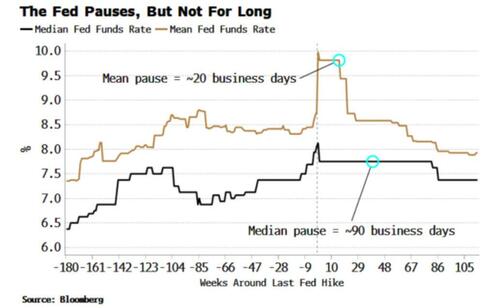

Further, the Fed doesn’t hang around for too long once it does its last hike.

Going back to 1971, in mean terms there’s only about one month between the last hike and the first cut, and in median terms, it’s a bit over four months.

It’s far from inconceivable that lagging data such as GDP and employment are deteriorating enough by the summer to lead the Fed to cut rates by October.

This is not much different from the market outlook, which has the first full 25 bps cut priced by the November meeting.

There is good risk-reward for betting there will be an earlier cut, as data could worsen more quickly than the above analysis would suppose.

Moreover current data could be revised lower, as so often happens in downturns.

Rate expectations are little changed since the GDP release, so perhaps the market isn’t paying too much attention to what’s happening behind it...

https://ift.tt/lV4P8UT

from ZeroHedge News https://ift.tt/lV4P8UT

via IFTTT

0 comments

Post a Comment