Fully Priced-In: Even Goldman Expects Sharp Contraction In Profit Margins In 2023

There has been a bizarre episode of cognitive dissonance developing within Goldman's trading desk and research departments over the past three months: as readers may recall, some time in late September, just as stocks slumped near their 2022 lows for the second time, Goldman's chief equity strategist David Kostin - who had heretofore been one of the staunchest equity bulls - slashed his market outlook and his S&P price target, which he now sees closing unchanged from its Friday level, or right at 4,000. That's right, Goldman clients can now take a 11 and a half month vacation, spare themselves the emotional rollercoaster that is to follow, and come back for the last day of trading in 2023 when Goldman expects stocks to be... unchanged.

Of course, when Goldman started turning bearish some three months ago (which just happened to coincide with that other permabull Marko Kolanovic also turning bearish), we said that that was the bottom and so far, some 400 S&P points higher, our cynicism has been proven correct.

Kolanovic turned bearish. Bottom https://t.co/bXVFOHDoRS

— zerohedge (@zerohedge) September 30, 2022

But as so often happens, with Goldman so bearishly positioned at a time when the Fed is hinting that a rate hike pause is imminent and the market is expecting at least 50bps of rate cuts in the second half, last week saw the first tentative signs that Goldman's strategists and economists are starting to turn bullish again, which means that the countdown to a material upgrade in Goldman's year-end price target (to, say, 4,500) has begun.

Indeed, in the past week, two top Goldman strategists, Jan Hatzius and Dominic Wilson highlighted the "improving investing landscape" in two notes this week: “Mostly Better News” (available to pro subs here) and “A Bit More Room to Grow” (also available to pro subs), pointing out that after the latest payrolls and CPI data, "markets are now pricing in the soft landing for the US economy that we forecast; Europe no longer appears to headed towards a recession either (Goldman also raised its GDP growth forecast into positive territory earlier this week in "10 Questions for 2023" and no longer expects a European recession)" and Goldman even saw upside to its China growth forecast which now anticipates a 4Q23/4Q22 GDP growth pace of over 7%.

But, as Goldman strategist Chris Hussey notes in his Friday weekly recap, "just like in Legoland, this 'Everything is awesome!' environment may still be riddled with risks that our strategists and analysts also highlight this week from macro to micro."

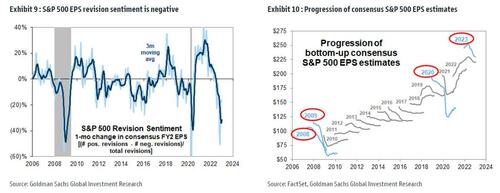

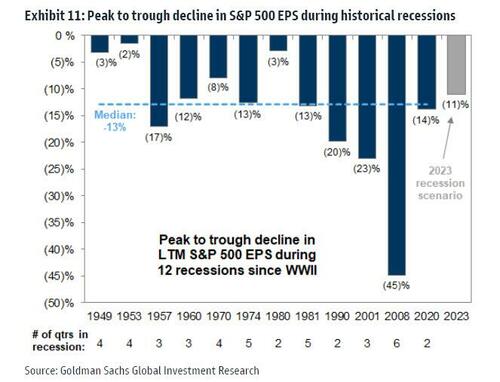

One such risk was brought up by none other than David Kostin, who remains one of the bearish holdouts withing Goldman (not for long) and continues to sound a cautious tone in a fresh note this week, urging the bank's clients to "buy protection" in his note “strategies for soft and hard landings.” According to Kostin, the biggest red flag: downward earnings revisions have been extreme and have only looked like this in past recessions (2000 and 2008).

As such, Kostin is hesitant to look through this dependable market indicator and believe prudent portfolio managers should at least consider the implications if a hard landing transpires.

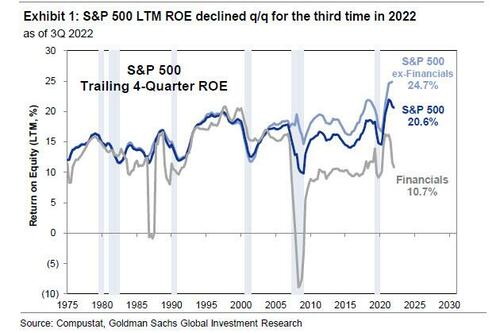

Over the weekend, Kostin continued this game of good cop (Hatzius, Wilson) vs bad cop (Kostin), writing in his latest weekly Kickstart note (available to pro subs here) that "negative consensus earnings revisions and analyst expectations for a lackluster 4Q 2022 earnings season continue the trend of weakening corporate profitability in recent quarters." Additionally, the S&P's trailing 4-quarter return on equity declined by 29 bp to 20.6% in 3Q 2022 driven by a contraction in margins: as Kostin calculates, "at a sector level 7 of 11 S&P 500 sectors experienced declining ROE, with Info Tech suffering the largest drop and Energy expanding the most." Looking ahead, Kostin warns that an upwards inflection in S&P 500 ROE will be difficult to achieve in 2023, "as headwinds from a higher cost of capital and higher taxes will place further strain on profitability."

Of course, this is all taking place as Q4 earnings season kicked off in earnest on Friday with large banks reporting mixed results, and with consensus expecting the aggregate S&P 500 index to post -1% EPS growth in 4Q 2022 vs. 4Q 2021 and decline by 5% excluding the Energy sector. As shown in the charts above, earnings revisions have recently been very negative, adding to many investors’ concerns about a potential recession on the horizon.

What does all of this mean for corporate profitability? Clearly, nothing good: according to Kostin, the increasingly negative consensus earnings revisions and current analyst expectations for a lackluster 4Q 2022 earnings season continue the trend of weakening corporate profitability in recent quarters. To wit, S&P 500 trailing 4-quarter return on equity declined by 29 bp to 20.6% in 3Q 2022. The decline in ROE represented the third consecutive quarterly decline following the metric’s all time high of 22% in 4Q 2021 (despite the recent declines the latest figure still ranks in the 99th percentile of S&P 500 ROE going back to 1975, meaning there is a lot more downside from here).

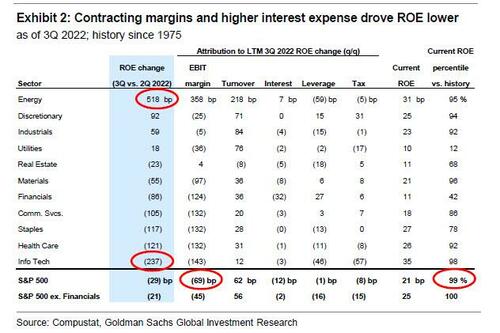

The Goldman strategist finds that contraction in profit margins was the main reason for the ROE decline last quarter: "We use a five-factor DuPont decomposition to analyze the drivers of ROE.Falling EBIT margins drove 69 bp of ROE contraction (Exhibit 2). Margins had already begun to decline in both 1Q and 2Q 2022 after a full year of expansion in 2021, and the trend continued in 3Q 2022. Index-level LTM EBIT margins contracted q/q by 48 bp in 3Q (vs. -90 bp in 2Q and -47 bp in 1Q). Slightly higher interest and tax expenses also weighed on ROE during 3Q (contributing -20 bp total). These headwinds were offset by higher asset turnover, which contributed +62 bp to ROE."

Financial jargon aside, while most sectors saw ROEs fall last quarter, they also enjoy profitability well above historical averages. 7 of 11 S&P 500 sectors experienced declining ROE, with Info Tech suffering the largest drop (-237 bp) and Energy expanding the most (+518 bp). The increase in Energy ROE was driven by margin expansion, contrasting with contracting margins in every other sector except for Real Estate. In addition to Energy, Consumer Discretionary, Industrials, and Utilities saw slight ROE gains. Despite lackluster ROE growth over the past three quarters, 9 of 11 sectors’ levels of ROE still stand above their historical sector averages, and 6 have ROEs currently in the top decile vs. their sector’s history.

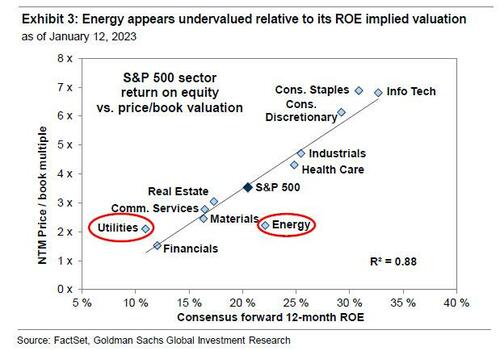

Ironically, while to some this may mean that Energy - which was the blowout outperforming segment in 2022 - is overvalued, the reality is just the opposite, and with most sector P/B valuations currently well-ordered based on ROE, Energy and Utilities remain outliers. Energy remains below the P/B implied by its expected ROE while Utilities’ valuation appears stretched. In the case of Energy, the lackluster valuation is likely due to consensus expectations for -15% EPS growth in 2023 (after +161% growth in 2022) and lower long-term growth expectations relative to other sectors. Meanwhile, utilities valuations have benefitted in part due to the attractiveness of the sector’s defensive attributes amid heightened recession concerns.

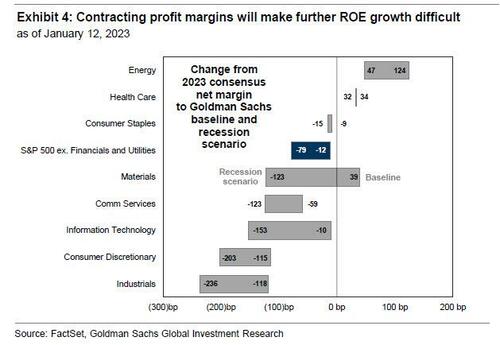

Looking ahead, the bearish Goldman strategist concedes that "an upwards inflection in S&P 500 ROE will be difficult to achieve in 2023" and he expects margins for most sectors to contract while also expecting further cut in current consensus EPS estimates to bring them closer to Goldman's baseline and recession scenarios (which is odd since Goldman chief economist Jan Hatzius is adamant that a recession will not happen, but that's all part of Goldman's "good cop, bad cop" CYA routine). As other ROE headwinds, Kostin lists taxes, leverage, and borrow costs.

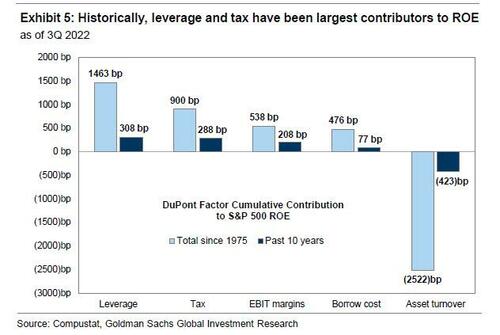

Taking a closer look at margin hurdles, Goldman notes that historically, higher leverage and lower taxes have been the largest contributors to ROE. Indeed, since 1975, declining interest rates and corporate tax rates have been the strongest tailwinds to corporate profitability. Declining interest rates have allowed firms to utilize higher leverage to bolster equity holder returns, resulting in a cumulative contribution of +1463 bp to ROE while lower borrow costs have contributed +476 bp to ROE over the period. Similarly, declining corporate tax rates have contributed +900 bp. On the other hand, lower asset turnover has been the largest detractor from ROE, shaving off -2522 bp over time.

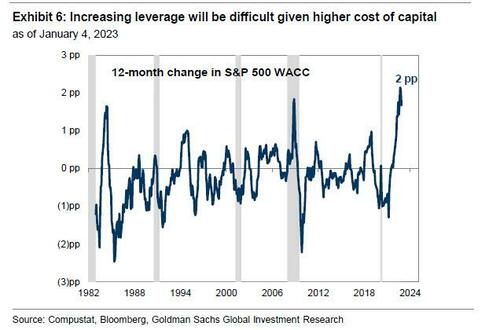

Here, Kostin warns that "near-term improvements to ROE from higher leverage will be unlikely given higher cost of capital", i.e. the Fed's tightening. The weighted average cost of capital (WACC) for US firms has spiked by 200 bp to 6%, the highest level in a decade and the largest 12-month rise in 40 years, or since the Volcker Fed.

Goldman expects the WACC in 2023 will remain near the current level (which of course, is as good as tell as any that Powell will very soon be slashing rates). The direct consequence of a higher WACC is costlier leverage, which will ultimately disincentivize firms from boosting ROE through this channel in 2023. As an aside, despite higher WACC, borrow costs will be less of a dramatic headwind, as most S&P 500 debt is fixed rate with long maturities. 75% of S&P 500 debt is fixed, and only 24% of total debt is expected to mature between 2023 and 2025.

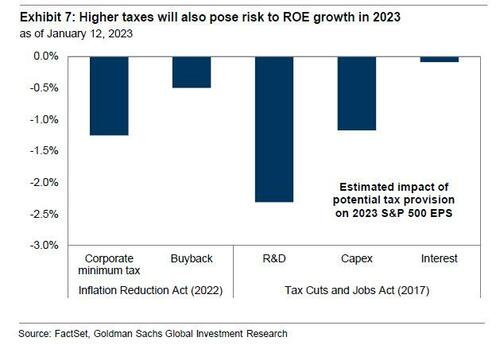

Finally, Goldman warns that higher taxes in 2023 will also be a headwind for ROE expansion. While new corporate taxes from the Inflation Reduction Act (IRA) should reduce S&P 500 EPS by less than 2% in 2023, the direction of the change in tax expense will now weigh on ROE instead of supporting it.

According to the Goldman strategist, This impact should be pronounced for sectors with low effective tax rates such as Info Tech and Health Care which will face a larger impact from minimum tax provisions. Sunsetting provisions from the 2017 Tax Cuts and Jobs Act and the new 1% excise tax on buybacks introduced in the IRA will place additional tax-related strain on ROE.

Of course, none of what Kostin claims above is incorrect (he goes on to note that in a challenging environment for ROE growth, stocks that were expected to grow ROE outperformed the S&P 500 by 10 pp in 2022 and then pitches Goldman's ROE growth basket which contains 50 stocks with the highest consensus-expected ROE growth during the next 12 months, the full list available to pro subs) but what we find most notable is that now that even Goldman fully embraces the core pillar of the 2023 bear case (as laid out by Michael Wilson some 6 months ago), the reality is that while sellside analysts may be slow to trim their optimistic outlooks, most on Wall Street have applied their own personal discounts to consensus, and more importantly, the margin contraction and EPS shrinkage narratives are both fully priced in by now, and only a full-blown recession can lead to further downward repricings. In other words, now that a sharp slide in inflation is the base case, the longer the Biden Dept of Labor ignores reality and pretends that job growth is there, the higher stocks will rise.

More in the full Goldman note available to pro subs.

https://ift.tt/cKq6hVO

from ZeroHedge News https://ift.tt/cKq6hVO

via IFTTT

0 comments

Post a Comment