Bond Bloodbath Triggers Biggest Stock Puke Of Year

The 'one-way-trade' of January is rapidly unwinding in February with stocks finally getting the joke today and accelerating their catch-down...

Source: Bloomberg

Better than expected PMIs didn't help as the 'no landing' narrative is now driving the market's reality ever more hawkish with expectations for the Terminal Rate now above 5.35%, and barely any rate-cuts priced in at all for 2023...

Source: Bloomberg

The NYSE TICK Index (Upticks vs Downticks) was extreme today - one of the most extreme days we have seen in a long while - with barely any positive trends at all as selling was practically non-stop from the open...

Source: Bloomberg

Small Caps were the days biggest loser, followed by Nasdaq

The S&P broke below 4,000 and the algos battled to keep it there...

...testing down towards its 200DMA...

The Dow dropped into the red for the year...

Source: Bloomberg

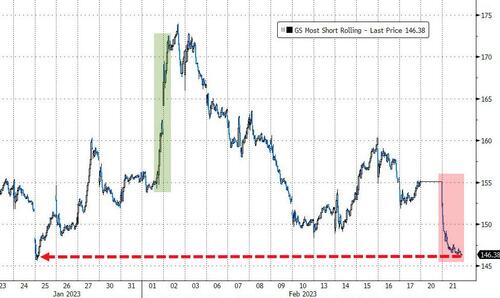

'Most Shorted' Stocks were clubbed like a baby seal today - the biggest single-day decline since June 2022...

Source: Bloomberg

Unprofitable tech stocks tumbled to their lowest since Jan 26th (16% off its early Feb highs)...

Source: Bloomberg

VIX topped 23 today - the highest level of the year

As Goldman's Chris Hussey noted, back in the fall, the concern was that too-high rates are going to induce a US recession. But today, the concern has been flipped on its head: too strong growth is going to keep rates high. Rates may be on a round trip to 4%, but they are traveling on a very different road than the one they were on the last time we saw 4% 10-year yields.

Treasury yields were higher across the board with the belly underperforming...

Source: Bloomberg

The 10Y yield surged higher today - after yesterday's holiday - to its highest since Nov 10th (CPI), inching ever closer to 4.00%...

Source: Bloomberg

The 2Y yields traded all the way up to the November highs (the 2y auction today had the highest yield since July 2007)...

Source: Bloomberg

...actually closing at fresh new cycle highs back to 2007...

Source: Bloomberg

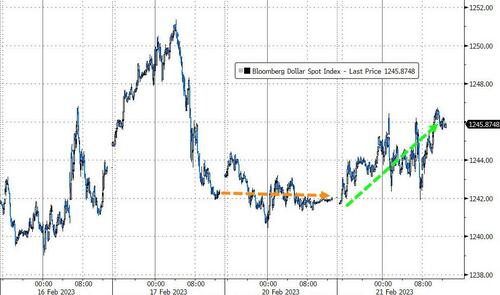

The Dollar inched higher today after being relatively flat yesterday...

Source: Bloomberg

Bitcoin has traded largely sideways with some volatile moments the last week or so, unable to break and hold above $25,000...

Source: Bloomberg

Gold ended the day modestly lower...

Oil prices also slipped with WTI finding support at $76...

And NatGas (HH) just keeps on plunging, trading down to within a few pennies of a 1 handle today - the lowest since Sept 2020...

Source: Bloomberg

For some context, US Nattie is trading at a $41 discount to WTI Crude (the 'cheapest' oil-barrel-equivalent since 2012)...

Source: Bloomberg

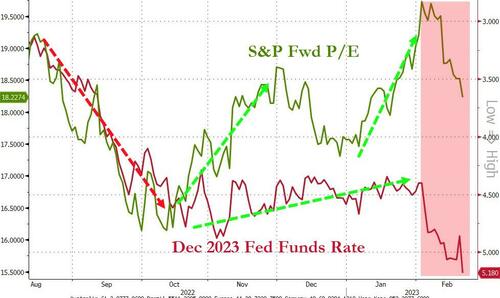

Finally, with the death of the 'Fed pivot' narrative, the market's expectation for terminal Fed rate is soaring (above 5.35%) while US macro keeps surprising to the upside...

Source: Bloomberg

...and the year-end Fed Funds rate expectations smashed back above 5.00%...

Source: Bloomberg

That's a lot of 'turns' in valuation before reality reasserts itself in stocks.

https://ift.tt/UJv0uXK

from ZeroHedge News https://ift.tt/UJv0uXK

via IFTTT

0 comments

Post a Comment