Stocks Soar As Big-Banks' Depo-Reacharound Rescues Regionals; Bonds Dumped

On the 15th anniversary of JPMorgan's distressed buyout of Bear Stearns, uncertainty around the US and Europe banks sector remains elevated but markets today are signaling at least an incremental level of comfort as stocks rise and bonds fall a tad (pushing up yields).

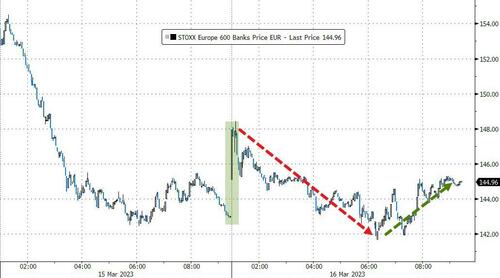

European markets started off exuberantly, opening positively after the SNB bailout of CS; but from the start, selling pressure took EU banking stocks red and credit risk to new cycle highs...

Source: Bloomberg

EU banking stocks ended with very marginal gains, despite the bailout...

Source: Bloomberg

That then reversed on chatter from US about a bailout plan for small/regional banks. FRC started the day off deep in the red with talk of a $25 bn shortfall and capital raise plans being discussed. That morphed into a bailout by the big banks - injecting their own cash as deposits in FRC.

Basically, the big banks are recirculating all of the deposits they get from small banks back into small banks... and for now that was enough to lift FRC into the green, but surprisingly, it didn't explode higher...

Bear in mind that regional banks are still down dramatically from pre-SVB levels...

Source: Bloomberg

All the US Majors were ramped into the green to day with Nasdaq leading and The Dow lagging...

The S&P 500 rallied back above its 100- and 200-DMAs...

When the S&P broke above its 200DMA, 0DTE traders pushed heavily on negative delta, but the market kept going...

Nasdaq 'VIX' remain dramatically decoupled from S&P 'VIX'...

However, amid all this 'good' news, Commercial Real Estate stocks continued to be sold...

Source: Bloomberg

After the ECB 'surprised' with a 50bps hike (exp was around 28bps - so a small prob of 50bps, large prob of 25bps), US rate-hike odds also rose, with next week's March FOMC now expected to hike 25bps (market pricing in 20bps of hikes)...

Source: Bloomberg

Treasuries were dumped today as safe-haven flows unwound with yet another day of utterly crazy size yield swings across the curve (2Y +30bps, 30Y +5bps). Amid all the chaos, the 30Y is basically unch on the week while 2Y yields are down 45bps...

Source: Bloomberg

2Y yields moved back above 4.00% today...

Source: Bloomberg

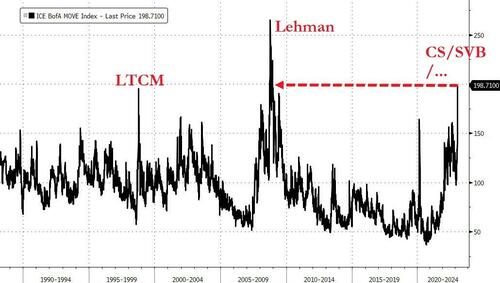

Given the swings, it is no surprise that MOVE (Bond vol) has literally exploded...

Source: Bloomberg

Fed expectations shifted hawkishly today (banking crisis 'solved')...

Source: Bloomberg

...but overall, expectations for The Fed's rate moves from here remain on the dovish side with 1-2 more hikes only before 3 cuts before year-end...

Source: Bloomberg

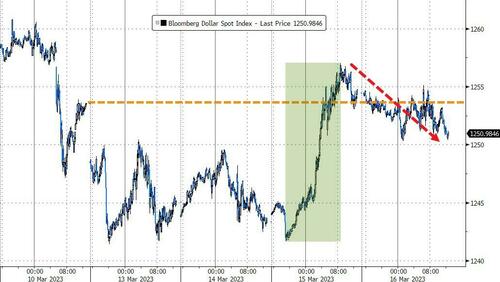

The dollar limped weaker today, back in the red for the week...

Source: Bloomberg

Bitcoin rallied back above $25,000 today...

Source: Bloomberg

Gold was down modestly on the day, still holding well above $1900...

Oil prices were volatile again but after the deposit-reacharound plan, WTI bounced from a $65 handle, back above $68...

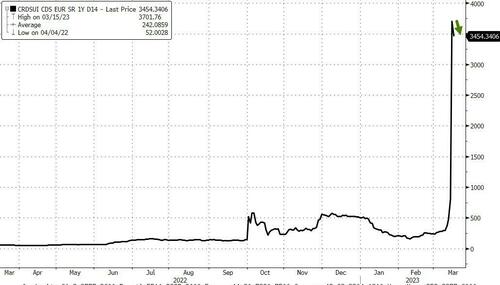

Finally, we note that Credit Suisse counterparty risk was only very marginally improved today...

Source: Bloomberg

...suggesting the market's pros ain't buying that this is even close to over.

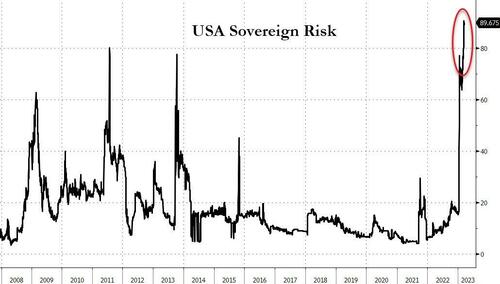

And systemic risk is just as clear across the pond as USA sovereign risk reached a new record high...

Source: Bloomberg

Yes, we have the debt ceiling overhang, but this feels like more.

https://ift.tt/kpXYoCF

from ZeroHedge News https://ift.tt/kpXYoCF

via IFTTT

0 comments

Post a Comment