SVB's Loans To 'Insiders' Exploded Ahead Of Its Collapse

By now, we've all seen the losses that SVB faced on its unhedged book of Treasuries and MBS. We've all read about the gargantuan deposit run that occurred on the eve of its demise. We've all scratched the back of our heads at the percentage (and size) of uninsured depositors that were bailed out by the Biden administration.

We have also all seen the relatively huge amount of share-selling by insiders in the month leading up to the bank's inevitable collapse.

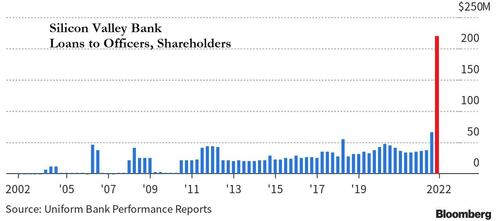

But, this next chart is a doozy...

Courtesy of Bloomberg's reporting, it appears that not only were insiders dumping their shares faster than syphilitic hooker, there were loading up on loans from the bank at a scale that makes a mockery of any regulatory oversight...

Yes, that's real.

Loans to officers, directors and principal shareholders, and their related interests, more than tripled from the third quarter last year to $219 million in the final three months of 2022 - a record dollar amount of loans going back over 20 years.

Many questions come to mind - what were the terms, who were the recipients, what was the collateral?

But, sadly, we will likely never know.

However, we do note that the banking execs may be facing a serious shortfall (like their bank): if the loans were collateralized by SVB shares for example, those shares are now worthless, leaving the loan-heavy C-suite left to come up with the cash to repay the loans (and no, these loans don't disappear with the bank's liquidation).

While there is no evidence of wrongdoing, and no personal details of the loans (names, purposes, collateral) are disclosed in the government filings, this headline dollar data is part of the regulatory oversight panel demanded to guard against banking executives getting preferential treatment.

“Our loan portfolio has a credit profile different from that of most other banking companies,” the banks aid in its 2022 annual report.

The firm added that “a significant portion of our loan portfolio is comprised of larger loans, which could increase the impact on us of any single borrower default.”

With DOJ and SEC eyes already probing the stock-sales ahead of the collapse, we can only imagine what this chart will do to stoke some more WTF-isms from Washington's elites.

https://ift.tt/fVPot7O

from ZeroHedge News https://ift.tt/fVPot7O

via IFTTT

0 comments

Post a Comment