Yields Soar, Oil Roars As Stocks Plunge In Rollercoaster Session

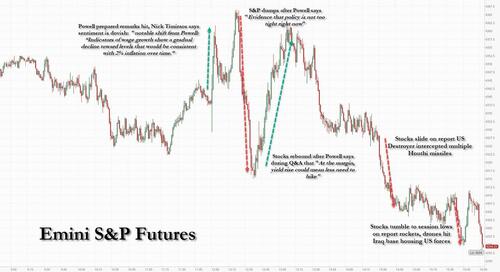

With traders already exhausted by relentless, brutal daily whipsaws, today was not the day anyone expected the rollercoaster would end, and a good thing too because it was another brutal day for those tracking every twist and turn in the S&P, which in turn was pingponged about by headlines from both the New York Economic Club where Powell was speaking and also from the middle east, where the war between Israel and Hamas threatens to erupt into a much bigger regional conflict with every passing day.

With too much going on for a blow by blow, here is a chart summary of some of the key market reversals today, starting with the Powell rollercoaster and then progressing to the latest (adverse) developments out of the Middle East.

While stocks had a bad day, 0DTE traders were even more bearish, with the Delta flow outpacing the decline in equities by a sizable margin.

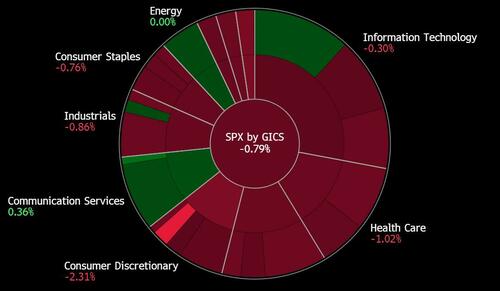

Virtually every sector was red...

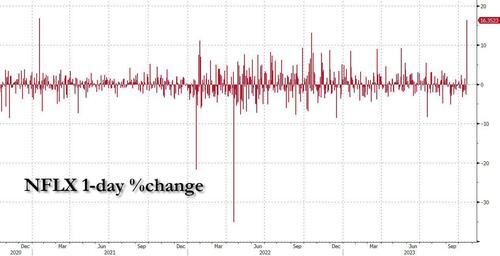

... with the only outlier being communication services which was green thanks to just one company: Netflix, which soared as much as 17%, its biggest one-day surge since Jan 2021...

... but while NFLX longs rejoiced, the same could not be said for TSLA shareholders: Elon Musk's EV company tumbled more than 10%, its worst drop since Jan 2023.

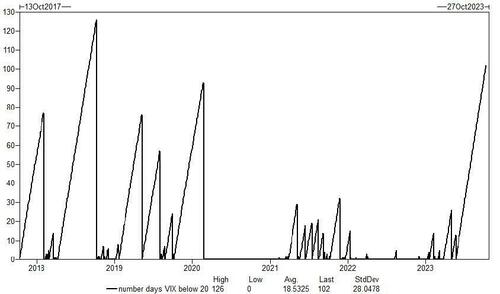

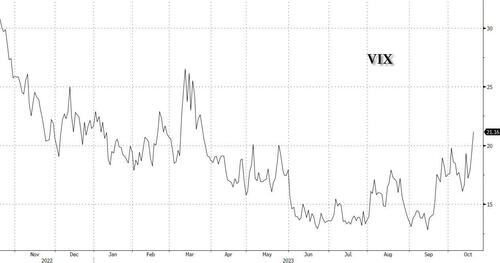

As stocks tumbled, the VIX soared, and after 105 consecutive days of closing below 20, the longest streak since 2019...

... the VIX index finally closed above 20 - in fact above 21 - breaking the streak on day 106.

But believe it or not, the swings in the S&P, which weren't even that wild with the S&P barely dipping more than 1%, were not the day's main event: that would be the combination of soaring yields, which saw the 10Y rise as high as 4.992% and the 30Y touch 5.10%, levels which Morgan Stanley and Goldman both said earlier were buy triggers...

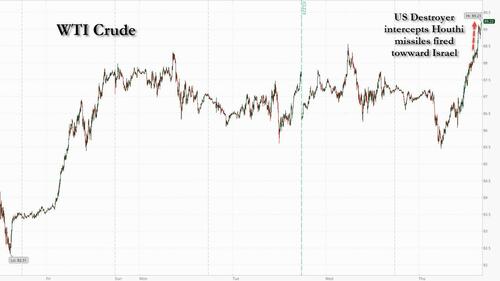

... as well as the surge in oil, which exploded $4 from session lows, and sent WTI above $89 and Brent above $93.

That said, oil wasn't the only flight to safety. Capital flows into gold also extended, sending the precious metal to $1974, the highest price since July, and up $150 in just two weeks...

... while digital gold also saw continued buying which sent bitcoin to $28,775 the highest since August, and on pace to rise back above $30K in days if not hours.

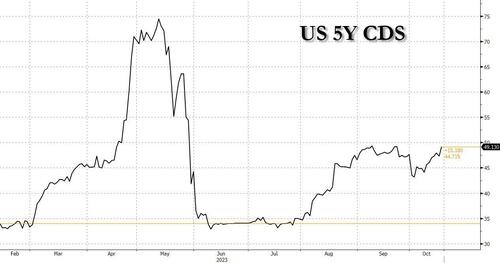

Finally, while investor focus has been targeting the middle east as the new geopolitical hot spot, keep an eye on the US, where 5Yr CDS just hit the highest level since May when the US financial system was again on the edge of collapse and had to be bailed out with the Fed's BTFP facility.

https://ift.tt/CM6Vki1

from ZeroHedge News https://ift.tt/CM6Vki1

via IFTTT

0 comments

Post a Comment