Stocks Soar Amid Hopes Regional Bank Crisis Will Lead To Early Rate Cut, More Fed Easing

Another rollercoaster day for stocks.

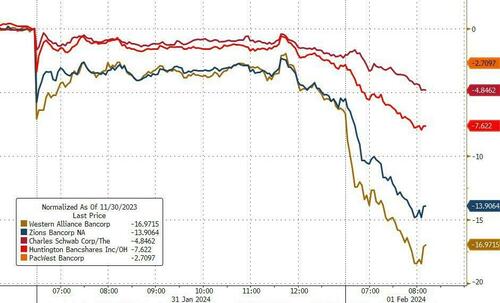

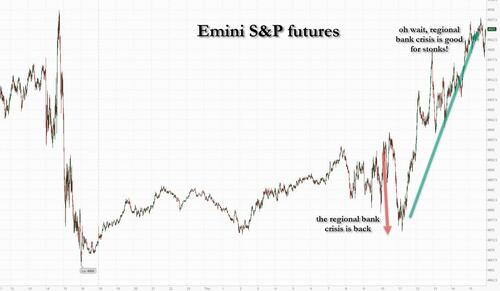

Following on the biggest drop for the S&P since September thanks to Powell unleashing Hawk Hogan during his presser, stocks - which had managed to regain about a third of the drop overnight - started the day off on the back foot, dropping to session lows early in the session as the regional banks crisis threatened to spread out of control as multiple small banks tumbled high-single and double digits.

However, then the market quickly remembered that it was precisely the bank crisis last March that sparked a powerful Fed response (BTFP), and a violent rally, and we got the same thing today as stocks slingshot sharply higher closing 1.1% higher...

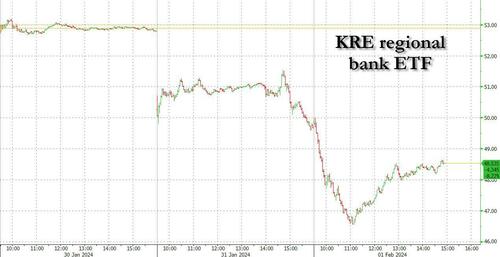

... with the meltup paradoxically also spreading to the KRE regional bank index, as the very catalyst for the meltup reversed and also rose in an example of absurd market reflexivity.

While banks have struggled, one can't say the same for tech, which has levitated since the open, and is well on its way to erasing all the losses during Wednesday's drubbing...

... although a lot will depend on what AMZN, AAPL and META report after the close.

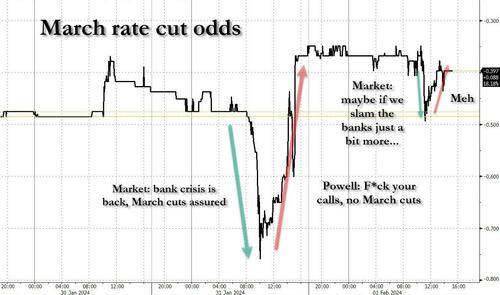

Until then, however, everyone is enjoying today's relief rally (relief from what exactly?) and even though we have seen a veritable rollercoaster in March rate cut odds in the past 48 hours...

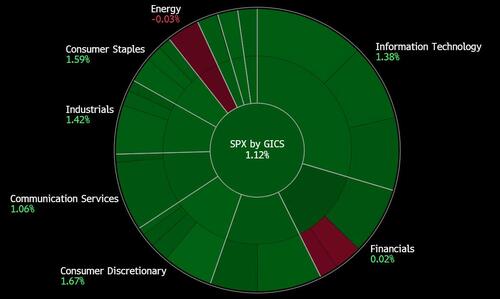

... all sectors green except energy...

... which was hammered by various fake news reports out of Al Jazeera that an Israel-Hamas ceasefire is imminent (it isn't), which was enough for CTAs to resume shorting on overdrive, and sending oil sharply lower...

... and even though Al Jazeera deleted the original report, the shorting CTAs were still too powerful and ended up pressing shorts all day to send WTI down almost $3 for the day.

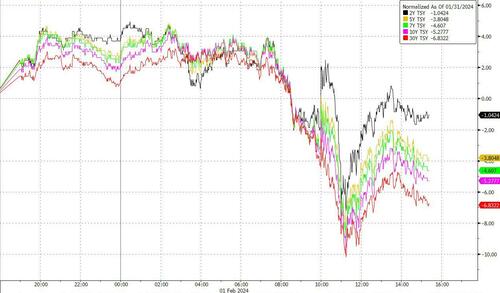

Elsewhere, as stocks rose, yields tumbled, with the 10Y plunging as low as 3.815% before reversing modestly, with the move focusing on the long-end...

... while the dollar reversed an earlier attempt to move higher after a very strong ISM report, which the market quickly ignored as attention shifted to the nascent round two of the banking crisis and the inevitable rate cuts...

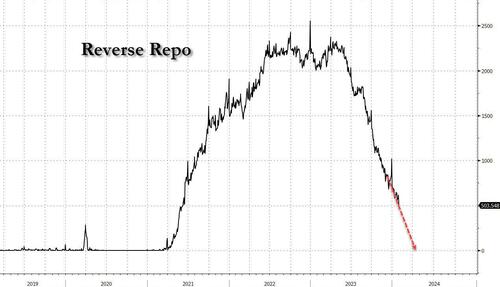

... as well as the sharp drop in the Fed's reverse repo which assures that tapering of the Fed's QT is fast approaching...

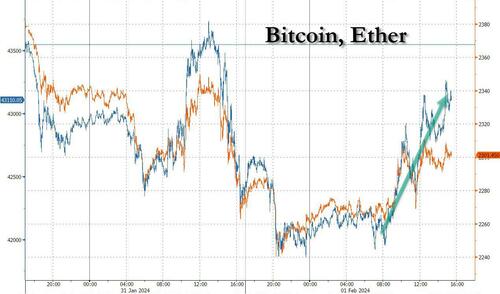

... which may explain why both gold and bitcoin closed the day near session highs as attention turns to today's mega earnings and tomorrow's jobs report, at which point we start everything from square one.

https://ift.tt/pRJWOEC

from ZeroHedge News https://ift.tt/pRJWOEC

via IFTTT

0 comments

Post a Comment