Warren Buffett Controls 3% Of Treasury Bill Market, More Than "International Organizations, Stablecoin Issuers ..."

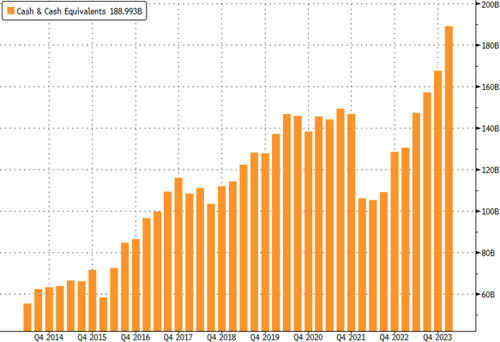

Berkshire Hathaway has struggled to find sizable deals in recent quarters, leaving Warren Buffett sitting on a mountain of cash and cash equivalents. According to JPMorgan analysts, Buffett now wields control over a staggering 3% of the entire US Treasury Bill market.

At Berkshire's annual meeting in May, Buffett told the audience, "It's a fair assumption" that its cash pile would exceed $200 billion at the end of this quarter amid the dearth of big-ticket deals due to very few opportunities.

Buffet's growing cash and or cash equivalents stockpiles intrigued fixed-income analysts at JPM, including a team led by Teresa Ho, who wrote in a recent note to clients that Berkshire Hathaway keeps excess cash primarily invested in T-bills.

"Over the years, their T-bill position has grown so large that, as of March-end, it owned $158bn in T-bills, comprising 3% of the market," Ho said.

She continued, "Berkshire Hathaway currently holds more T-bills than international organizations, stablecoin issuers, offshore MMFs, or LGIPs."

Berkshire Hathaway's current cash position is about 17.5%, which is in line with its long-term average when measured against the firm's total assets. Since 1997, the firm has kept cash on its balance sheet at an average of 13%.

Current figures from Bloomberg show Berkshire's cash and cash equivalents total $188 billion.

"We'd love to spend it, but we won't spend unless we think there's really something that has very little risk and can make us a lot of money," Buffett said at last month's annual meeting.

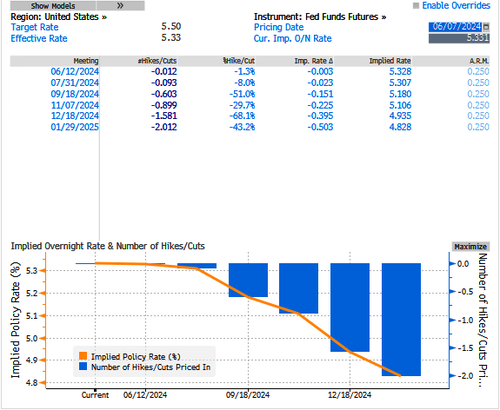

Buffett and his companies are cautious about finding deals as the high-for-longer interest rate environment unfolds, especially after Friday's screaming hot payrolls data forced Citi to shift its first rate cut forecast from July to September.

*CITI CHANGES FIRST FED RATE-CUT FORECAST TO SEPTEMBER FROM JULY

— zerohedge (@zerohedge) June 7, 2024

These things have become a total joke. Changing your "forecast" every month has zero value to anyone

Fed swaps are only pricing in 1.58 cuts through the end of the year.

The absence of deals will only mean Berkshire's giant cash and cash equivalents pile will continue growing until valuations become more attractive.

https://ift.tt/ZW35pQ2

from ZeroHedge News https://ift.tt/ZW35pQ2

via IFTTT

0 comments

Post a Comment