"Short Dollar" Is Now The World's Most Consensus Trade... So It's Time To Go Long Tyler Durden Sun, 08/16/2020 - 21:03

It's official: as of this past week, the number of futures contracts amid the speculator community that were net short the DXY (via other FX pairs) was tied for the highest on record going back to the late 1990s.

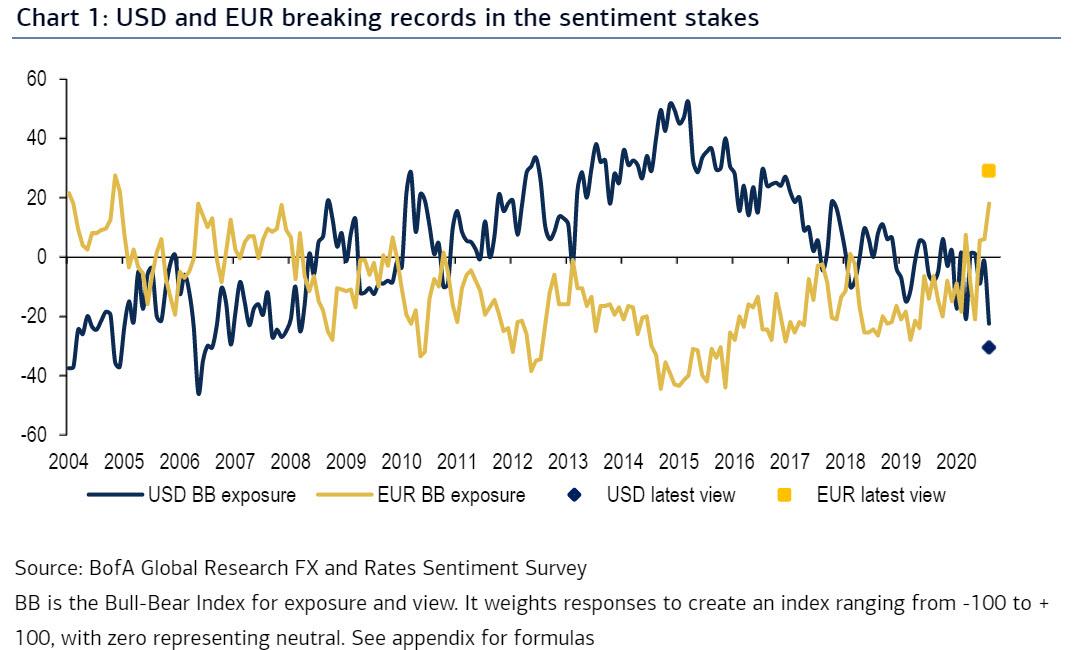

But one doesn't need to look at the weekly CFTC data to know that the currency, which until just three months ago was exploding to record highs, has become the worst most popular short: according to Bank of America "short USD" has extended its lead as the most popular trade in 2020 according to the bank's latest FX and Rates sentiment survey.

However, as discussed previously, the surge in dollar shorts is not so much a secular bet on the dollar decline as a bullish view on its two key pairs, the Euro and the Yen.

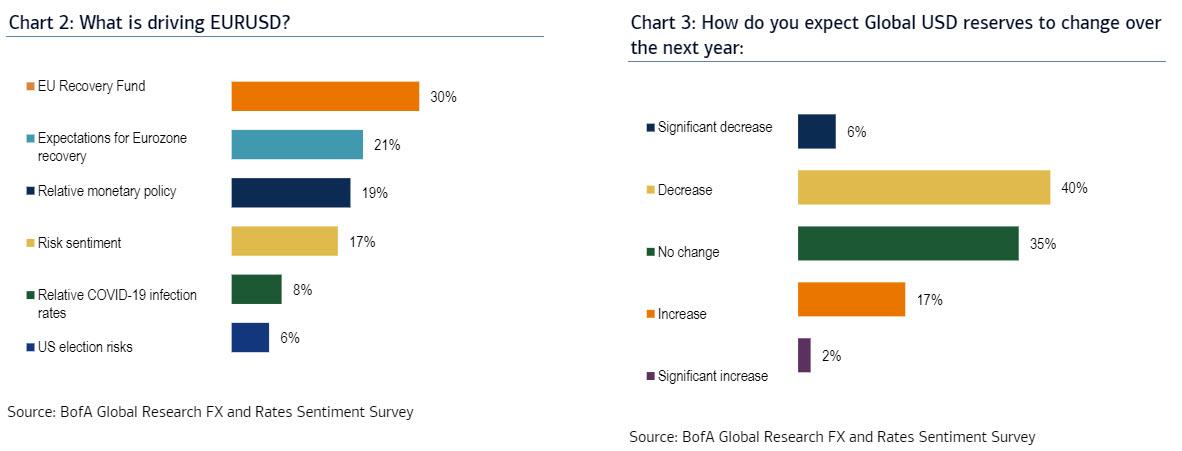

As per the BofA survey, the EU Recovery Fund seems to be the main driver of positivity on EUR (Chart 2), with almost a third of investors telling the bank in June they considered it a game changer, while USD bearishness can at least partly be explained by expectations of some erosion of the hegemony of USD as a reserve currency.

Still, as BofA notes, in the current backdrop, risks - both known and unknown - abound and could be a threat to seemingly stretched positions. It is worth bearing in mind however that if the more structural nature of investor views play out - 'game changing' recovery fund, changes in reserve and portfolio flows - current positioning could be less of a constraint as benchmarks themselves adjust.

Of course, after last month's dramatic move, what happens next may seem largely moot.As a reminder, in July, the trade-weighted Dollar saw the largest monthly decline in two and half years, with DXY seeing the steepest drop in a decade.

And, in a world where momentum other trend-following investors have had a dismal year, any trade that has as much continuity as the dollar drop was sure to attract the momentum chasers, and sure enough as Goldman's Karen Fishman writes on Friday, the DXY move has "renewed focus on momentum-based investors (e.g., Commodity Trading Advisors or CTAs, also known as pattern-chasing robots) and their potential participation in the Dollar sell-off."

Some background from the Goldman strategist:

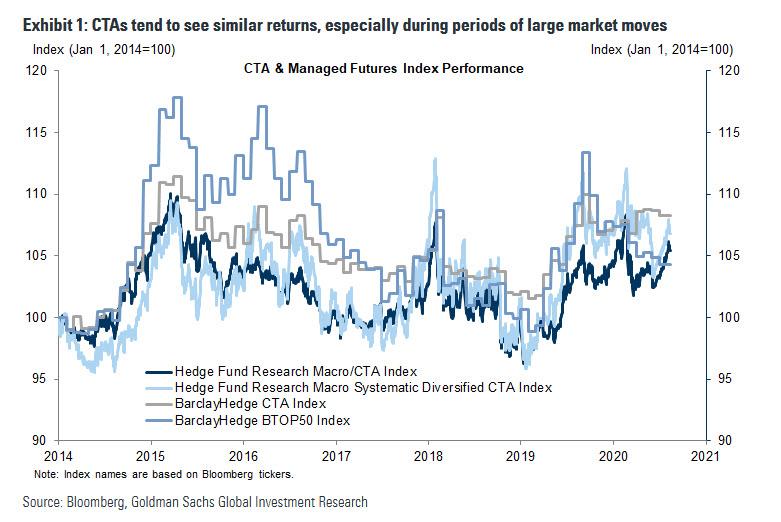

Momentum-based trading systems have been popular for decades, given their low correlation with traditional benchmark returns and, therefore, their potential for generating alpha. The strategies tend to have common components, including set rules for entering and exiting positions. Although there are a variety of methods employed to produce a trade signal, many rely on simple moving averages—such that a buy (sell) is triggered if spot moves above (falls below) a specified moving average. Other popular methods include “crossover strategies,” where a trader goes long (short) if a faster-moving average exceeds (breaks below) a slower-moving average, and “breakouts,” where a trader buys (sells) an asset if spot surpasses (undershoots) the prior high (low) over a certain time horizon. For example, the “Turtle Experiment” of 1983 relied primarily on a breakout-based system, according to Faith (2013). Despite the different methodologies, CTAs tend to see similar returns, especially during periods of large market moves (Exhibit 1). In fact, according to Clenow (2013), most of the variation in returns between funds comes from factors such as asset composition, risk level, and position size, rather than the specific trade signal.

So what does Goldman conclude based on inferred CTA positioning? As the bank explains, it finds "a fairly clear message to short the Dollar against G10 currencies, with slightly more mixed signals for high-beta EM crosses" and adds that "even though CTAs are probably already short Dollars, we see scope for further weakness as (i) fresh shorts could be triggered soon and (ii) longer-term investors start to participate as well, particularly in the Euro and other European assets."

Furthermore, Goldman also claims that the typical August illiquidity could provide further impetus for trend-following strategies, which argue for holding on to Dollar shorts (primarily versus G10 currencies) and adding AUD/NZD longs.

Bottom line: with everyone - literally - on Wall Street now short the dollar, as observed by either CFTC net specs or various sellside surveys, and with Goldman resorting to "inferring" the future of the DXY based on recent momentum (something which even 5 year old Robin Hood trading veterans can do on their own), the only possible real conclusion is that there is virtually nobody else left who can add to dollar shorts, which means that absent some unexpected socio-economic disaster in the US, the only possible move for the dollar at this point is higher.

https://ift.tt/3h5rTmB

from ZeroHedge News https://ift.tt/3h5rTmB

via IFTTT

0 comments

Post a Comment