Three Things We Learned Last Week Tyler Durden Sun, 08/16/2020 - 21:30

By Ye Xie, Bloomberg macro commentator

Three things we learned last week:

1. Bond bulls’ faith is being challenged by data and vaccine hopes.

Yields on 10-year Treasuries rose above 70 bps for the first time in more than a month, and gold suffered one of the biggest single-day slumps of the past two decades. While heavy bond supply contributed to the selloff in Treasuries, it also appears to be a repricing of the global economy to the upside following better-than-expected economic and inflation data.

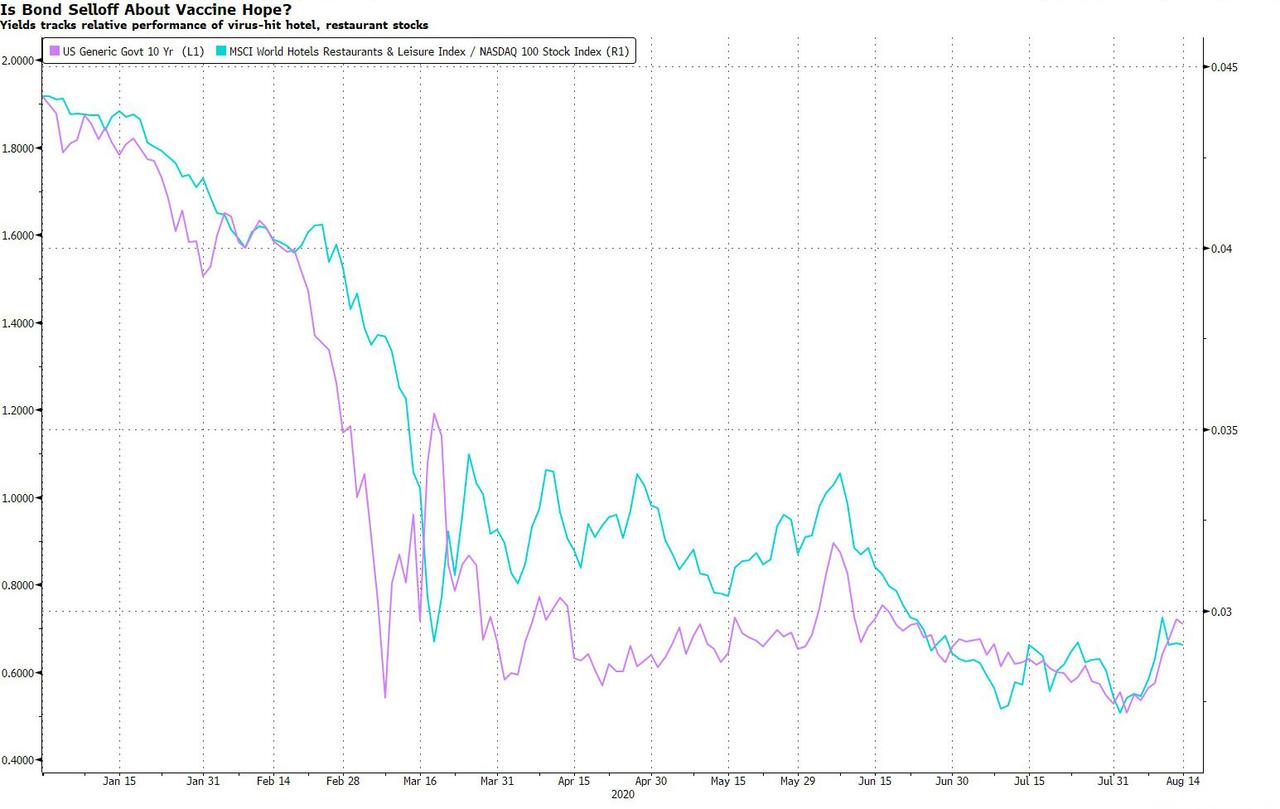

The bond yield is also tracking the relative performance of Covid-hit stocks, suggesting optimism toward a vaccine. This is a chart comparing bond yields with the ratio between the MSCI World Hotels Restaurants & Leisure Index and the Nasdaq 100 Index.

So far the yield increase has had a limited impact on risky assets. The assumption is that the Fed needs to cap yields to help the economy heal. But what if there’s a vaccine available in the next three months? How much of a yield increase will the Fed tolerate? The minutes of the central bank’s July policy meeting will be released Aug. 19 and may shed some light on the discussion about forward guidance. In any case, everyone’s favorite the 5y30 curve steepener trade is working again.

2. China’s uneven recovery slows with the PBOC staying put.

Data last week showed weaker-than-expected industrial production, retail sales, and credit growth, suggesting China’s economic recovery is losing some momentum. The PBOC is expected to keep the one-year prime loan rate steady this week, maintaining its neutral stance. Expect a range-bound bond market. BTW, the central bank’s balance sheet data apparently show it hasn’t secretly bought government bonds, as some speculated.

3. IPOs of Chinese companies in the U.S. are booming even amid scrutiny.

Despite the crackdown on TikTok and WeChat, Chinese companies haven’t abandoned the U.S. capital markets for fund-raising. Housing transaction firm KE Holdings surged 87% on its debut, marking the biggest first-day pop on record among mega Chinese IPOs in the U.S. Eleven Chinese companies, including KE, Li Auto and Kingsoft Cloud, raised at least $100 million in IPOs this year. The IPOs total about $5.7 billion, already double the amount for all of 2019.

Meanwhile, the scrutiny toward Chinese companies continues to increase. On Friday, streaming company Iqiyi tumbled after disclosing that the SEC is investigating and seeking documents cited by short sellers.

https://ift.tt/3fZXBjP

from ZeroHedge News https://ift.tt/3fZXBjP

via IFTTT

0 comments

Post a Comment